Stocks are adding to Friday’s modest gains in the early going here, while Treasuries are a bit lower. The dollar is in focus after declining notably for the first time in a while. Gold, silver, and crude oil are rising.

On the news front...

The US dollar has been on a tear recently, rising eight straight weeks for the first time since 2005. But central banks in Japan and China pushed back forcefully against the move overnight, causing the greenback to (finally) give back some gains. The Bank of Japan hinted it would end its negative interest-rate policy, while the People’s Bank of China warned speculators to stop targeting the yuan. China’s currency recently hit a 16-year low against the buck.

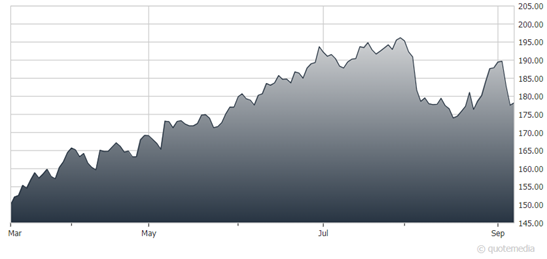

Tomorrow is the day Apple (AAPL) will release its next iteration of the iPhone...and it couldn’t come at a better time for the mega-cap tech company. It just lost almost $200 billion in market capitalization after China told government officials to stop using iPhones, raising concerns Apple could get swept up in the broader economic “Cold War” China is having with the US.

Apple (AAPL)

Still, the iPhone now commands a 50% share of the US market, up from 41% a half-decade ago. It’s increasingly popular with younger users. And India could replace China as a source of demand over time if Apple plays its cards right.

Finally, the Wall Street Journal covered Business Development Companies (BDCs) in this article today. Many of our experts have highlighted them for their generous dividend yields and the fact they are one of the few beneficiaries of Federal Reserve interest rate hikes. That’s because the loans they make to private companies often sport variable rates, which rise with each hike the Fed implements.