Stocks and Treasuries are trading around the flatline as investors await news on today’s monetary policy meeting. Meanwhile, crude oil is weaker, the dollar is higher, and gold and silver are up a bit.

Today it’s all about the Federal Reserve. We’ll get a 2 p.m. Eastern announcement from the Fed, followed by a press conference from Chairman Jay Powell shortly thereafter. No one expects policymakers to cut rates from their current 5.25% - 5.5% range at THIS gathering. But investors will be scrutinizing any hints or projections about the future direction of policy, including whether cuts are likely at upcoming meetings in Q2 or Q3.

The Boeing Co. (BA) has been under fire for several mistakes lately, including the fuselage failure of a 737 Max 9 aircraft that could’ve been a disaster. Now, Wall Street is getting an idea about what regulatory scrutiny, alleged manufacturing mistakes, and slower jetliner output is going to cost the company.

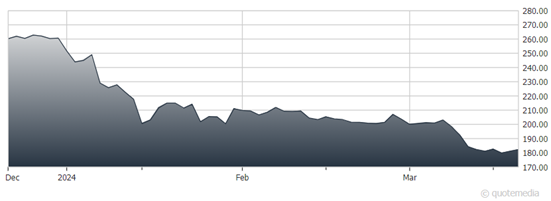

The Boeing Co. (BA)

Chief Financial Officer Brian West said the airline manufacturer will bleed $4 billion to $4.5 billion in cash in the first quarter, while margins will be deeply negative for a while. The stock is already down 27% year-to-date, and will likely remain under pressure for some time.

It appears profit pressures are even reaching the top end of the retail market, with the Gucci brand’s owner Kering warning of lackluster Q1 sales. The French company’s shares plunged 14%, on track for the worst one-day decline ever. Foreign-based, but US-traded, luxury goods sellers like LVMH Moet Hennessy Lousi Vuitton (LVMUY) and Hermes International (HESAY) will be under scrutiny as investors try to discern whether weakness in Asia-Pacific sales are a company-specific or industry-wide problem.