Joe Duarte sees weakness in stock indices due to overbought conditions, but due to the Fed’s ZIRP, any correction should be seen as a buying opportunity.

The long-term trend for stocks remains up, but shares could experience a short-term correction, which, if it materializes may be worse in the technology sector than other areas of the market. On the bright side, if there is a correction and recent history repeats itself, unless the Federal Reserve stops its forever money infusion into the banking sector, investors will once again be given the opportunity, at some point, to buy stocks on the proverbial dip.

If the action in the stock market over the last few days is any sign of what lies ahead, we are clearly in the Dog Days of August where prices consolidate and investors who focus solely on the stock indexes can run into a wall of frustration. Fortunately, because the Federal Reserve continues to put money into the banking system, the odds of a lasting meltdown, although never out of the question, seem well below average, a fact that offers the opportunity to find winners if you are willing to put in the work.

Still, because of the potential for falling volumes as traders finally take some time off, the algos are likely to switch their tactics to the short side while lowering the bid and ask spread on a regular basis and causing all kinds of problems in the short term.

In a Tricky Market Look for Relative Strength

After the market bottomed in March 2020 active investors have had an excellent opportunity to make money as stocks have rebounded aggressively. However, as market valuations have expanded and the uncertainty over the Coronavirus pandemic, the election and other economic factors start to exert their influence, the likelihood of a sideways market or a full blown correction is likely to increase. Of course, in a market run by trading algos and heavily influenced by Fed liquidity there are no guarantees as to which way things may shake out or how long any pullback may last.

That said, by deploying common sense and sound trading principles, we can still find stocks worth owning during a consolidation. Moreover, if this turns out to be a meaningful top, well placed sell stops should protect the bulk of recent profits.

So, in order to prepare for any occasion here are some important steps to take:

- Take at least partial profits on positions which have gained 20% or more

- Expand your research focus beyond your comfort zone

- Stick with strong sectors and stocks

- Trade in small lots (think E-micros instead of E-minis)

- Look closely at lagging sectors for potential turnaround candidates

- Adjust sell stops to prevent losses beyond 5%

By following these three steps you will increase the odds of finding potential winners and protecting your recent gains. And here is an example of how to go about it.

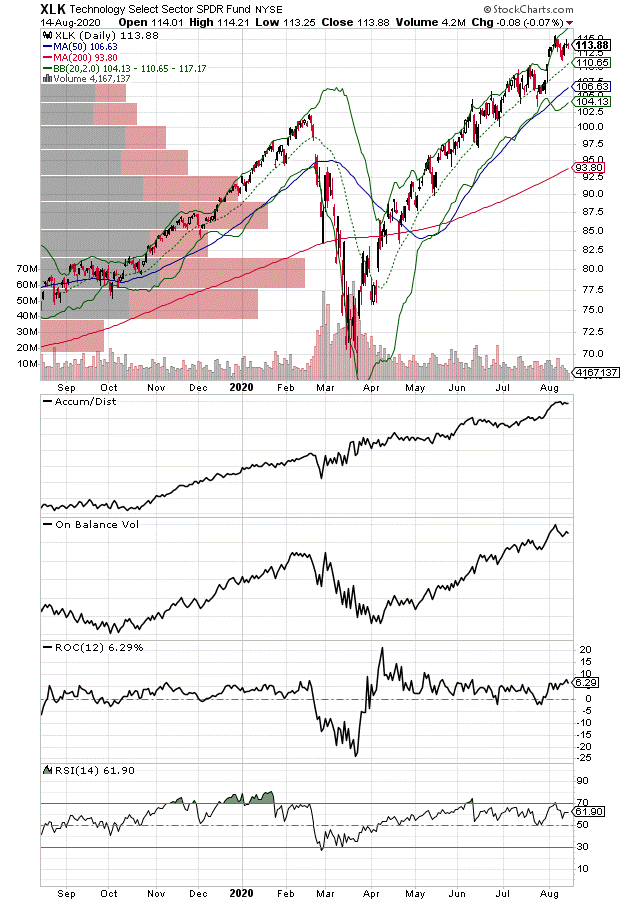

Consider the broad Technology Select Sector SPDR Fund (XLK), a market leader until recently, which has been struggling of late as investors start to look beyond the work at home dynamic and effects of Covid-19 (see chart below). XLK may improve as a result of the Fed’s actions and the politics of the moment. If I’m right, this heady advance could well slow or even reverse.

So, when looking to expand your analysis horizons, you have two choices: You can look for sectors which are displaying exceptional strength, or you can look at sectors which are laggards and seem poised to turn up. Because many stocks in strong sectors can be overextended, I focus on areas of the market which have been consolidating and which look set to breakout to the upside.

Such a sector may be the large pharmaceutical stocks as represented by the VanEck Vectors Pharmaceutical ETF (PPH); and here is why. Many large drug companies are involved in Covid-19 vaccines. And although this is important work, Covid-19 vaccines are not likely to be huge money makers for these companies beyond the grants and other funds, which they have received from government contracts. Indeed, as investors have recognized this fact these stocks have rolled over.

Look for our posts over the next two days as we dig into examples of opportunities in big pharma including PPH and Merck & Co. (MRK).

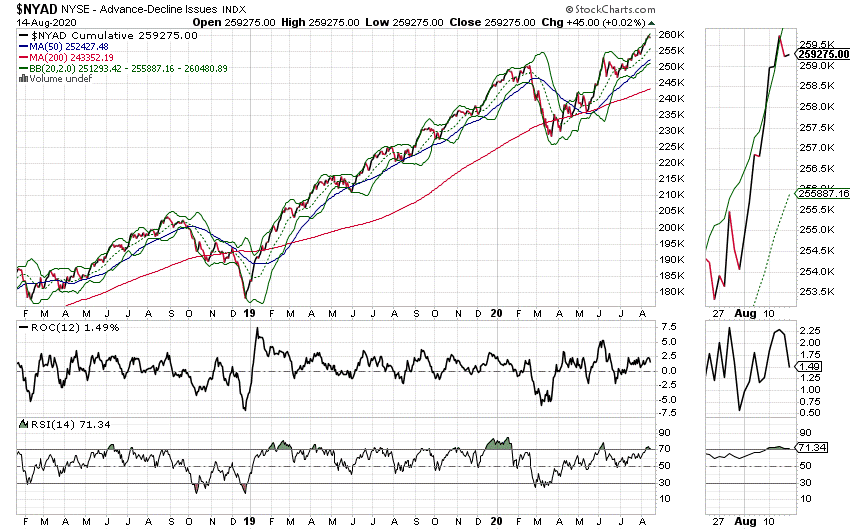

NYAD Makes New High, but is Overbought

The New York Stock Exchange Advance Decline line (NYAD) made a new high last week keeping the uptrend for the market in place (see chart below). At the same time, the indicator has now reached overbought territory for the first time since June 2020, having crossed above 70 on relative strength index (RSI). That means that the odds of a sideways period or even a pullback to the 20- or 50-day moving average are on the rise.

However, even though the pullback, if it materializes could be a bit unnerving as the algos exaggerate every move in the market, unless NYAD breaks decisively below the 50-day moving average and the RSI 50 area simultaneously, triggering a Duarte 50-50 sell signal, the uptrend should remain intact.

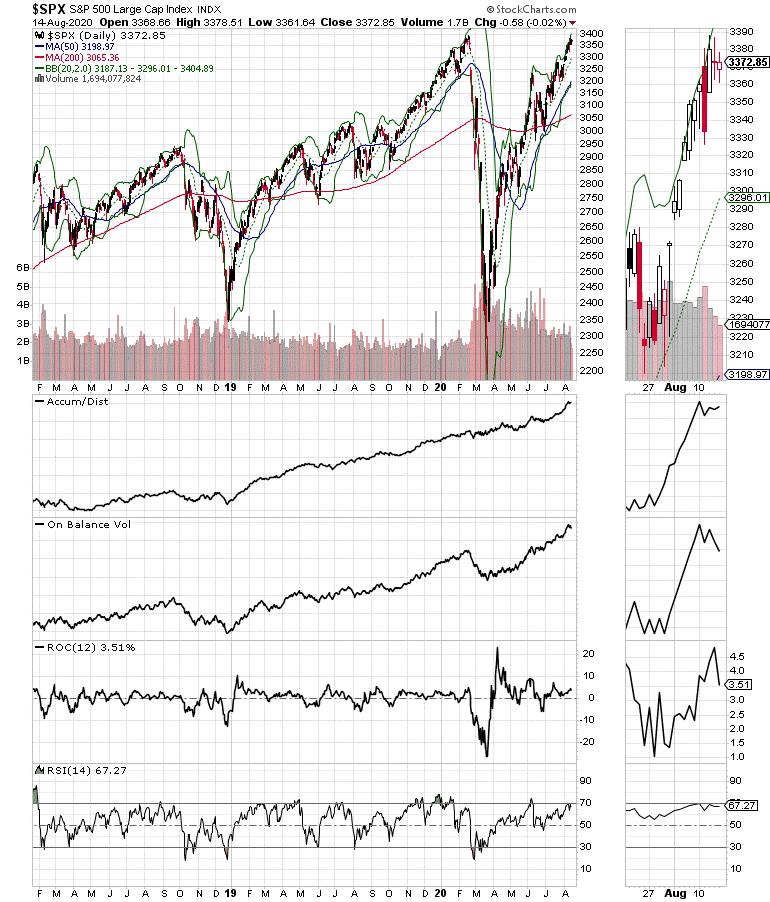

The S&P 500 (SPX) seems to have made a double top, at least for now (see chart below). Thus, as with NYAD a move toward the 20-day moving average will be the first likely outcome, with a break below the 50-day average and the 3200 area suggesting that a move to the 200-day average could materialize.

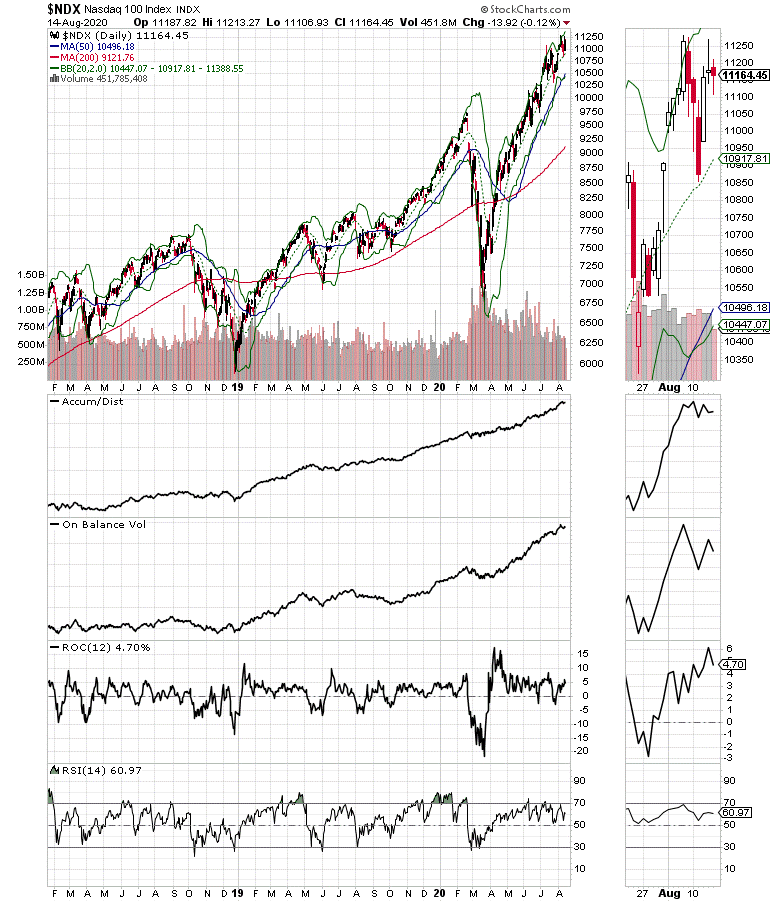

The Nasdaq 100 index (NDX) has also formed a double top, which means that it too is likely to move lower in the short term (see chart below). Key support will be at 10,500. A break below that, though could take us down to the 9,000 area, which would likely be a fairly unpleasant development even if the index finds support at its 200-day moving average.

Stick with Strength and Protect Your Gains

If there is a correction as the indicators suggest, the best way to survive it is to focus on strength. That means that if stocks you own stop working it’s probably a good time to lighten up or exit completely. On the other hand, corrections are excellent times to look for bargains. Either way the focus should be on stocks that outperform the broad market.

Finally, consider that since the 2009 March bottom in stocks, thanks to the Fed’s zero interest rate policy, the robot traders have bought every single meaningful dip in the market just as sentiment had reached its darkest point. In fact, the only two factors that have triggered meaningful declines since 2009 have been higher interest rates and more recently, the Coronavirus pandemic.

What that means is that if we get another decline and nothing else changes, until proven otherwise, get ready to buy the dip.

I own shares in MRK and recently recommended the stock to subscribers of Joe Duarte in the Money Options.com.

Joe Duarte is a former money manager, an active trader and a widely recognized independent stock market analyst since 1987. He is author of eight investment books, including the best-selling Trading Options for Dummies. For a FREE trial to Joe Duarte in the Money Options.com, click here.