For investors looking to “go green,” the iShares Global Clean Energy ETF (ICLN) may be a fund worth looking into, suggests ETF expert Jim Woods, editor of Successful Investing.

The fund, which was created in 2008, tracks a market-cap-weighted index of the 30 most liquid companies involved in businesses related to clean energy.

In this fund, “clean energy” is defined as companies involved in biofuels, ethanol, geothermal, hydroelectric and solar and wind industries. Not only does this portfolio consist of companies that produce energy in such a manner, but it also includes the companies that develop the technology and equipment used in the process.

ICLN has holdings that are both domestic and international, which gives investors access to clean-energy stocks around the world.

Though this ETF may not be a core holding for most, it may be considered a savvy satellite holding, as it covers a corner of the market likely to do well during a green-energy-friendly Biden administration.

With a new administration poised to reign in 2021, alternative energy stocks are gaining traction, as the coming year may be more focused on clean and renewable energy resources versus coal and oil.

For investors seeking more targeted exposure within the clean energy sector, ICLN provides multiple options for delving more deeply into renewable energy.

ICLN has an expense ratio of 0.46% and a dividend yield of 0.69%. It has $2.59 billion in assets under management and total net assets of $1.96 billion. More impressively, the fund’s year-to-date (YTD) daily total return is 92.13%.

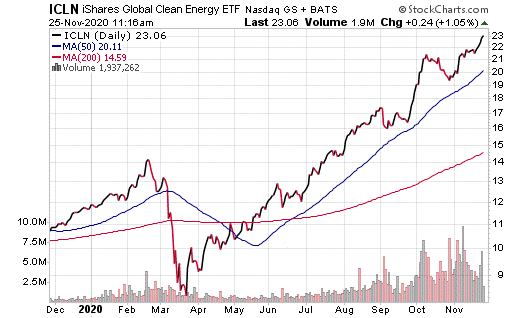

Unlike many big-name funds, ICLN has seen a gradual increase in both its 50-day and 200-day moving averages year to date. However, much like all other sectors, the fund saw a huge drop in mid-March, courtesy of COVID-19. Since that drop, it’s seen a great upward trend, surpassing its all-time high of $14.23 in February.

CLN’s holdings are primarily in three sectors: 52.33% in Utilities, 28.71% in Technology and 16.45% in Industrials. Its top five holdings include First Solar, Xinyi Solar Holdings, Orsted A/S, Contact Energy Ltd. and Meridian Energy Ltd.

With a portfolio made up of not only companies using alternative energy sources, but also the companies working to develop the technology and equipment to harness it, there is a plethora of alternative-energy stock options, both domestic and international.

In sum, the iShares Global Clean Energy ETF may be an interesting option for investors looking to expand their secondary holdings and break into the clean-energy space. However, investors should always do their due diligence to determine if an ETF is appropriate for their portfolio strategy.