Extra Space Storage (EXR) — a holding in our model Income Portfolio — owns only self-storage facilities. At the end of last year, its portfolio consisted of nearly 2,000 properties comprising roughly 150 million square feet throughout the U.S., notes Jim Pearce, chief investment strategist for Investing Daily's flagship newsletter, Personal Finance.

You may not think of self-storage property as being a lucrative form of real estate investment given its inherently frugal nature, but it is one of the few types of commercial property that has benefited from the coronavirus pandemic.

Businesses are downsizing as workers stay home, using self-storage as a means of holding onto valuable property while shedding costly office space. At the same time, displaced workers are cutting costs by reducing living space and putting their valuables in self-storage while they transition to smaller living quarters.

The combined impact for EXR was a 38.4% jump in net income per diluted share during the fourth quarter of 2020 versus the prior year. The company’s full-year results were equally impressive. Net income per diluted share increased 14.5% in 2020, resulting in an 8.2% gain in core Funds From Operations (FFO) to $5.28.

That’s important since FFO is what dictates the potential size of a REIT’s dividend payment. As a result, the board approved an 11.1% increase in the quarterly cash dividend to $1.00 per share.

At this point, it is fair to ask if EXR has become overvalued. If the pandemic is the reason for its recent success, will EXR fade as vaccines gradually allow the economy to fully reopen over the remainder of this year?

I don’t think so. Self-storage is a “sticky” business. Once someone puts something in storage, it usually sits there until it has somewhere else to go. And right now and for the foreseeable future, self-storage is the least expensive option for storing property off-grounds.

Meanwhile, the REIT is taking advantage of its strong financial position to acquire new properties and improve existing facilities so it can increase rents.

There is plenty of room for expansion. Approximately 70% of the nation’s inventory of self-storage space is independently owned. About two-thirds of those properties are institutional quality and could be quickly assimilated into a REIT’s portfolio.

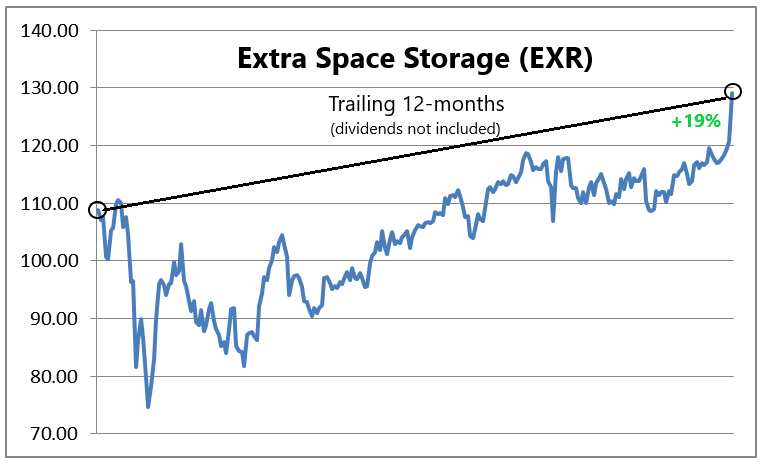

Over the past five years, Extra Space has raised its quarterly cash dividend by more than 60% while its share price has increased by a similar amount. At a share price of $130, the forward annual dividend yield for EXR works out to 3.3%.

The company is guiding for FFO of $5.85 to $6.05 this year. That’s an increase of more than 10% over last year’s result which should result in a similar-sized jump in its dividend payment. I am raising the buy limit on Extra Space Storage to $140.