The SPDR S&P Bank ETF (KBE) tracks an equal-weighted index of U.S. banking stocks and generally will invest at least 80% of its total assets in such financial services companies, explains Jim Woods, editor of The Deep Woods — and a participant in The Interactive MoneyShow Virtual Expo from May 11-13. Register for free here.

The index represents the bank segment of the S&P Total Market Index and comprises the following sub-industries: Asset Management & Custody Banks, Diversified Banks, Regional Banks, Other Diversified Financial Services and Thrifts & Mortgage Finance.

The index is also equally weighted at each quarterly rebalancing, which puts giant banks on equal footing with smaller ones (at rebalance at least) and increases the emphasis on smaller firms overall than a market-cap-weighted fund.

KBE fills a niche market by providing exposure to a broad selection of banks in an equal-weighted manner. The ETF has amassed an impressive $4 billion in assets under management. With a 0.35% expense ratio, the fund is relatively inexpensive to hold in relation to other ETFs.

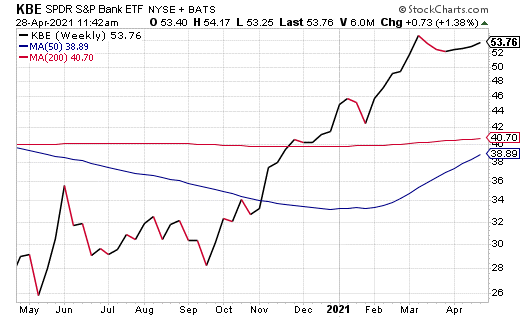

The fund trades around $53-54 and has an attractive 2.23% distribution yield. As the chart above shows, KBE’s share price has grown a whopping 80% over the trailing 12-month period to beat its index’s 21.99% return during the same time. The fund also is up 21.91% so far this year, compared to a gain of 7% for its index.

The top three holdings in the fund, and their percentage of KBE’s assets, are MGIC Investment Corp., 1.65%; Essent Group Ltd., 1.64%; and Wells Fargo & Co., 1.61%. The fund holds a total of 96 equities.

With strong fundamentals and a seasoned management team, this fund is poised to continue growing higher. However, I do urge all interested investors to exercise their own due diligence in deciding whether this fund fits their own individual portfolio goals.