One of the more straight-shooting CEOs in the banking industry is Brian Moynihan, who has steered the recovery of Bank of America (BAC) — America’s largest consumer-oriented bank — for the past several years, suggests Bryan Perry, income investing specialist and editor of Cash Machine.

For the most recent Q2 results, which were mixed, positive revenue stood out as an organic tenet to the hard work being done by Moynihan and his team.

The bank upped its reserves for any loans that might prove risky if economic conditions persist into 2023. To this point, BAC set aside $523 million, and that impacted net income, but in a manner that I think is responsible.

The big question for BAC is how long the softening of economic conditions will last in a market where inflation may or may not have peaked, the labor market is strong, consumers are cautious and the Fed is bent on bringing down inflation.

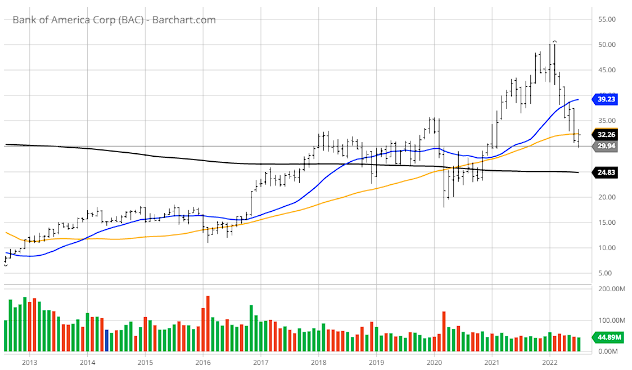

Shares of BAC have corrected by 35% year to date. Sentiment is about as bearish as I’ve seen in many years. Looking at the long-term chart, the stock has pulled back to a level that I believe will hold because the bank is now trading at 1x book value, a serious discount to its future trajectory if you believe in the American consumer.

So, what to do with this conundrum? You buy time and terms. To this point, shares of the Bank of America 7.25% Cumulative Perpetual Preferred (BAC-L) are a compelling way to harness a 6% current yield and get paid handsomely to wait out what will be a sudden train leaving the station when this market rights itself.

This is the same security that was issued to Warren Buffett's Berkshire Hathaway (BRK.B) when he and his company were asked to step in and provide stop-gap financing for certain banks in 2008.

While these shares were originally issued at $1,000 per share, they recently traded at $1,233. The all-time high set back in September 2021 was $1,500. Yes, it trades at a premium because long-term money is bullish on the bank and Brian Moynihan's ability to potentially take the common stock to $100. Today, it trades near $32.

The terms of this convertible security are very plain. Each share of BAC-L is convertible into 20 shares of BAC common stock at $50. With a 6% yield, I want us to put some risk capital into this investment-grade security.

Because it is perpetual with no maturity, the Preferred Stock is not redeemable by BAC at any time. Meanwhile, in order for this preferred to be called, the shares of BAC common stock would have to trade at $115 per share. That's not likely, but not unrealistic either.

Let’s put some of our sideline cash to work and buy into America’s #1 Main Street bank through a security that is paying 2x the yield of Treasury bonds with significant upside potential. Buy Bank of America 7.25% Cumulative Perpetual Preferred under $1,250.