About Edward

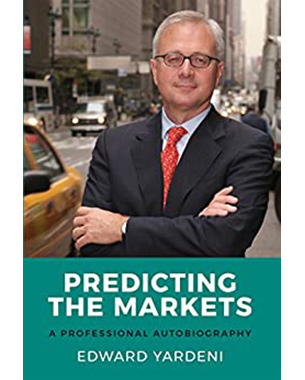

Dr. Ed Yardeni is the president of Yardeni Research, Inc., a provider of global investment strategy and asset allocation analyses and recommendations. He previously served as chief investment strategist for Oak Associates, Prudential Equity Group, and Deutsche Bank's US equities division in New York City. Dr. Yardeni taught at Columbia University's Graduate School of Business and was an economist with the Federal Reserve Bank of New York. He is frequently quoted in the financial press, including The Wall Street Journal, Financial Times, The New York Times, The Washington Post, and Barron's.

Edward's Articles

Edward's Videos

Get a sample of what our attendees experienced at our recent Miami MoneyShow Master Symposium. In this session from our Miami Symposium, Dr. Ed Yardeni discusses the similarities and differences between the current and previous decades. He will explain why he assigns a 55% probability to a productivity-led boom like the 1920s, 20% to a scenario similar to the Great Inflation of the 1970s (including a possible debt crisis and a trade war), and 25% to a meltup like the one experienced during the late 1990s. He will also discuss why economists have been too pessimistic about the US economic outlook and not cynical enough about China’s economy. The importance of the AI Digital Revolution will also be covered. Dr. Ed will explain why he remains bullish with his S&P 500 targets of 7,000 in 2025, 8,000 in 2026, and 10,000 in 2029. He will balance his optimistic outlook with a discussion of widespread concerns about US government deficits and the unsettling geopolitical environment.

Edward's Books

S&P 500 Earnings, Valuation, and the Pandemic: A Primer for Investors

The Yield Curve: What Is It Really Predicting?

Predicting the Markets: A Professional Autobiography