Three bullish things are happening for gold, suggests Brien Lundin, editor of Gold Newsletter — and a participant in the Money, Metals & Mining Virtual Expo, streaming live on December 6-7. Register here for free.

Fed policies over the years have destroyed the historic relationships among financial assets. Bonds do not trend higher when stocks trend lower, or vice versa. Gold does not rise in response to higher inflation, but rather falls.

This is because every market is priced on a daily, even hourly, basis by hot-money traders and their computers, and they’re setting those prices according to a very simple formula: If the data or rhetoric is indicating easier money from the Fed (or in the current case, a pause), then buy everything. And if the indicators are pointing toward hawkishness, then sell everything.

Thus, all the previously inversely- or un-correlated assets have become positively correlated, because they’re all driven by central bank policy.

So ignore every other factor or fundamental — everything now depends upon what Powell & Co. do with their rate-hike campaign.

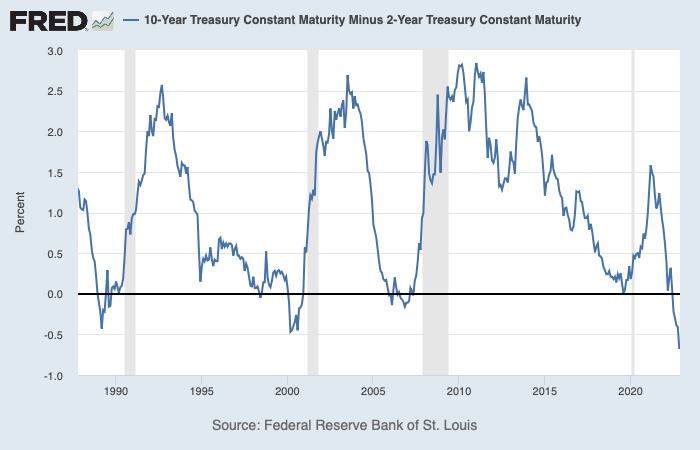

This begs the question of what happens next, with the Fed seemingly unconcerned about the damage it will wreak. Well, we’re going to find out soon, as this chart strongly indicates:

The 10-Year/2-Year Treasury yield is not only inverted, it’s inverted to the greatest extent seen in 40 years. Notice those gray bars following every other significant inversion over that time frame?

Those are recessions. So let’s stop arguing about whether we just had a recession with the two quarters of negative GDP growth, as there is little doubt that we are heading into another one. And this one should be much deeper and long-lasting.

At some point in the near future, then, Powell and his compatriots are going to have to break out their monetary mops, because there’s going to be a helluva clean up in Aisle 3.

Naturally, the upcoming pivot will be bullish for gold and silver, as well as most commodities and mining stocks. It will also be very helpful for equities in general.

In the near term, I continue to believe that the Fed is close to the end of their hiking crusade. A half-point rise in December followed by a pause to reflect seems to be the market consensus, and I tend to agree with it.

Those looking for a spark to come in the Fed’s December meeting may be disappointed, though, because the Fed seems bound and determined to quash any enthusiasm on Wall Street.

In the meantime, we continue to focus on our junior mining shares, which are generally still near long-term bottoms that represent outstanding opportunities. One in particular made important news: i-80 Gold (IAUX) has made a potentially game-changing discovery on its Ruby Hill property in Nevada.

The company announced results from four follow-up holes drilled on Ruby Hill’s Hilltop zone. The original discovery hole at Hilltop was released in late August and included 28.3 meters of 515.3 g/t silver, 28.9% lead, 10.5% zinc and 0.9 g/t gold.

The follow-up holes also hit impressive widths of world-class, polymetallic mineralization. These are fantastic intercepts. They are indicative of a style of mineralization that can often occur in clusters, like pearls on a string. If that proves to be the case here, and the grades hold up with further drilling, Hilltop could wind up hosting a multi-million-ounce, gold equivalent deposit.

With this huge upside at Hilltop adding to an already impressive collection of gold assets in Nevada, i80 Gold continues to be one of our better bets for a re-rating once we get a sustained normalization in sector valuations, and regardless as it continues to advance its exploration and development plans. It’s a buy.