I’ve stated for several months that the markets will stay volatile until the Fed stops increasing interest rates. In the meantime, our quarterly rebalancing lets us take advantage of the individual price swings between our different stocks. I am adding HF Sinclair Corporation (DINO) using 3% of the current cash balance, writes Tim Plaehn, editor of Monthly Dividend Multiplier.

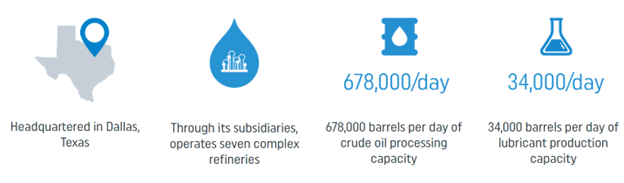

HollyFrontier Corp and Sinclair merged exactly one year ago, and this company now operates as one of the most efficient and profitable downstream energy stocks.

HF Sinclair owns and operates seven refineries located in Kansas, Oklahoma, New Mexico, Utah, Washington, and Wyoming and markets its refined products principally in the Southwest U.S. and Rocky Mountains, extending into the Pacific Northwest and in other neighboring Plains states. HF Sinclair also produces base oils and other specialized lubricants in the U.S., Canada, and Netherlands and exports products to more than 80 countries.

In addition, HF Sinclair owns a 47% limited partner interest and a non-economic general partner interest in Holly Energy Partners, LP (HEP), a master limited partnership that provides petroleum product and crude oil transportation, terminal, storage and throughput services to the petroleum industry, including HF Sinclair.

HF Sinclair reported a hugely profitable 2022. The company reported adjusted net income of $3.015 billion, or $14.73 per share. Adjusted EBITDA came in at $4.734 billion. For reference, the stock recently traded for around $52, giving it a $10.5 billion market cap.

Last year’s profits came due to a tremendous crack spread, which is the gross profit per barrel of crude oil when refined into fuels. The 2022 fourth quarter produced a refinery margin of $23.47 per barrel, which is more in line with recent years (minus 2020). The company reported a net income of $2.97 per share for the quarter.

HF Sinclair targets a 50% payout ratio of net income as a return of cash to shareholders as dividends and share buybacks. Last year, it returned $1.63 billion, including $1.4 billion in share repurchases.

In February, Sinclair increased its dividend by 12.5%, to $0.45 per share. The recent yield was about 3.5%.

I am not a big fan of share buybacks. But if HF Sinclair uses them to grow net income per share and, most importantly, its dividend rate, we will be happy with our investment in DINO.

Recommended Action: Buy DINO.