The media seem to be dominated more than usual by negative takes on recent events and trends. But to expect the worst outcomes and be a long-term pessimist, you must ignore a lot of history and recent positive developments – including better market performance in Japan. Among the many quality ETFs that invest there, I recommend Franklin FTSE Japan Hedged ETF (FLJH), writes Bob Carlson, editor of Retirement Watch.

It seems pessimists are receiving most of the attention, and the pessimists are persistent. Some pessimism and caution are understandable. There is always unpleasant news and trends. I don’t have to list them for you, and you’re probably tired of hearing about most of them.

Yet it is well-documented that living standards have steadily increased and life has improved in many ways even while pessimists dominated the commentary. For example, read “The Rational Optimist” by Matt Ridley.

We continue to live in an age of innovation and invention. In only the last few years, significant developments occurred in medicine and related fields that are going to benefit generations. New technology continues to roll out, increasing productivity and growth.

Franklin FTSE Japan Hedged ETF (FLJH)

Now, let’s talk about FLJH. Most US investors fixate on the US stock indexes, ignoring markets around the globe. That paid off in the recent past, but it cost people money so far in 2023. I believe it will continue to be an expensive practice.

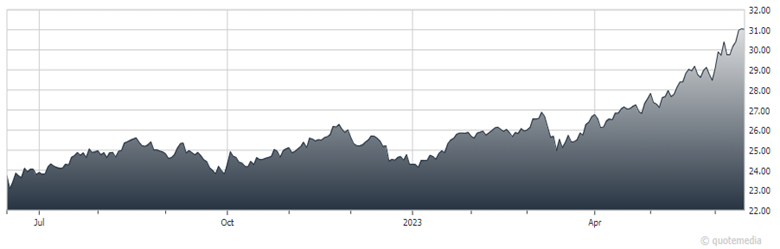

Japan’s depression and bear market that began in the late 1980s appear finally to be ending. Inflation recently topped 2%. While still below their peak of the late 1980s, Japan’s stock indexes reached 30- year highs.

The stocks sell at discounts to comparable US stocks. Japan’s policymakers say they’re committed to increasing growth. They won’t worry if the yen declines against the dollar or inflation continues to rise.

FLJH tracks the FTSE Japan index, owning primarily large and mid-size companies and buying both value and growth stocks. Top sectors in the fund recently were industrials, technology, consumer cyclical and financial services. It recently held 516 positions with 20% of the fund in the 10 largest holdings. Top holdings were Toyota, Sony, Keyence, Mitsubishi UFJ Financial and Daiichi Sankyo.

The fund hedges its portfolio against declines in the yen against the dollar, boosting US investors’ returns when the stocks rise and the yen declines. A falling yen is why the fund’s 2023 returns are higher than those of unhedged ETFs.

FLJH was recently up 7.8% in the last four weeks, 13.1% over three months, 24.1% for the year to date and 21.7% over 12 months.

Recommended Action: Buy FLJH