Addus HomeCare Corp. (ADUS) posted a strong close to fiscal 2023. In Q4, revenues grew 11.9% to $276.4 million, while EPS increased 31.9% to $1.20. Commenting on the results, Dirk Allison, Chairman and CEO, said, “We continued to benefit from robust demand for home-based care, especially for our personal care services, which accounted for 74% of our revenues,” notes Doug Gerlach, editor of SmallCap Informer.

Allison went on to add: “We were pleased with our 11.2% organic revenue growth on a same-store basis for the quarter, and our annual growth rate of 12.1% was a record for our personal care services. This impressive revenue growth reflects higher volumes, as well as continued rate support for our services.”

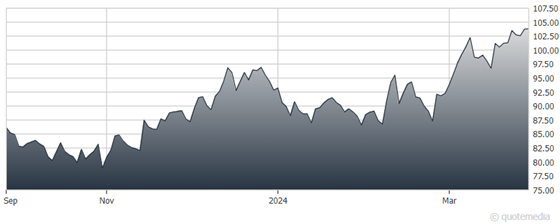

Addus HomeCare Corp. (ADUS)

Hospice services accounted for 19.8% of revenue for the fourth quarter and included the benefit of a 3.1% rate increase that was effective on Oct. 1, 2023. Hospice revenues were up 3.5% over Q4 2022 on a same-store basis, while average daily usage and length of stay also improved over Q4 last year. For the full year, Addus revenues increased 11.3% to $1.06 billion while EPS increased 34.9% to $3.83.

As of December 31, 2023, the company had cash of $64.8 million and bank debt of $126.4 million, with capacity and availability under its revolving credit facility of $470 million and $335.6 million, respectively. Net cash provided by operating activities was $30 million for the fourth quarter of 2023, and $112.2 million for the full year 2023, inclusive of a net $7.6 million in ARPA funds utilization.

The company lowered its revolver balance in the year by $8.3 million and funded all of its acquisitions in 2023 as a result of its strong cash flow. Management expects a final ruling on the Medicaid Access Proposed Rules by the end of April.

Recommended Action: Buy ADUS.