The markets are trying to fight their way green after a few down days. Treasury yields, on the other hand, remain basically unchanged. Not that that’s a surprise. Here’s why, writes Keith Fitz-Gerald, editor of 5 With Fitz.

The Fed threw yet another spanner in the works Tuesday with ol’ JPow noting a “lack of further progress” on inflation this year after recent economic data shows – ta da – strength and growth.

Sigh. He says the data hasn’t given him “greater confidence.” I say he ought to have his head examined. Growth is good, not bad.

Remember what he’s trying to do and why. JPow and his bunch want you to lose your job, make and spend less, and struggle because doing so helps cool the economy according to his (failed) economic models and doctrine. So, the fact that companies are hiring, and people are going back to work and earning a living, is bad to his way of thinking.

That’s messed up. Gimme growth, great companies, and even greater people any day of the week! I say celebrate success and create the business conditions needed for more people to enjoy it – but that’s just me.

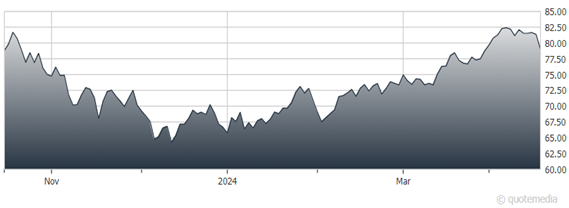

United States Oil Fund (USO)

Anyway...I’ll get off my soap box now and move on to oil. Traders appear to be discounting the Middle East conflict. Oil is back under $85.

Somebody, however, just made a “Hail Mary” bet. I caught wind of a 3,000-lot trade on June $250 call options this week for about a penny each.

It's a small lottery ticket for sure. But as noted by Charles Kennedy writing for oilprice.com, it's one that would pay off handsomely.

I’ll stick with my favorite oil company stocks, thank you very much. The United States Oil Fund (USO), which I’m asked about a lot, could be a proxy. Just don’t expect it to skyrocket.