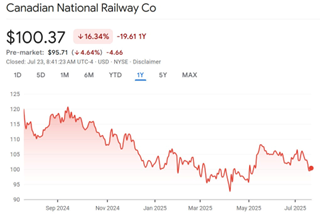

Shares of Canadian National Railway Co. (CNI) fell after the railway operator cut its profit growth forecast for the third year in a row. CN Rail now sees profit growing in the mid-to-high-single-digit range, down from 10-15%. The company is blaming tariff headwinds and a stronger Canadian dollar, writes Amber Kanwar, host of the In the Money with Amber Kanwar podcast.

It wasn’t a good day to be a shareholder as many analysts said the stock is destined for purgatory after the results. Not only has volume growth been lackluster, but recent M&A chatter is likely to leave CN Rail on the outside looking in.

(Editor’s Note: Amber will be speaking at the 2025 MoneyShow Toronto, scheduled for Sept. 12-13. Click HERE to register.)

Many analysts are having a hard time finding a catalyst. I’ve counted at least three downgrades basically because of that.

“We see few reasons for the stock to move meaningfully higher in the short-to-midterm,” wrote National Bank’s Cameron Doerksen in his downgrade yesterday morning. “With US railroad merger speculation growing, we expect investor interest in the sector to be more focused on the US peer group with funds potentially flowing out of CN as a result.”

This is threatening to become the next Pfizer Inc. (PFE) in my portfolio (lured in by value). There are others hanging on like me. “We maintain our Buy rating, because we find it hard to downgrade CN when it trades at such a wide discount vs. the peers and just ~5% above its 52-week low,” wrote TD’s Cherilyn Radbourne.