New platforms, lower barriers, and new products make it easier for regular folks to speculate. One long-term beneficiary will be CBOE Global Markets Inc. (CBOE), observes Bill Patalon, chief stock picker at Stock Picker’s Corner.

The explosion of online gambling is making it easier for folks to see sports betting and securities speculation as kinda the same thing — a dangerous view I’ve labeled as the “DraftKings Mindset.” Plus, we have a record bull market in stocks and an uninterrupted economic expansion.

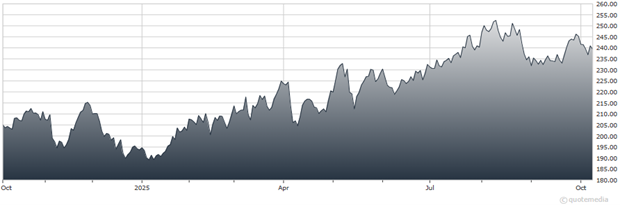

CBOE Global Markets Inc. (CBOE)

That will eventually end. But for now, CBOE should benefit. It’s the inventor of the “Fear Gauge,” known to investment pros as the VIX. Emotions and markets share one strong tendency — they both run in cycles. Think fear → panic → calm → complacency.

Today, zero-day options trading has exploded. 0DTE options — contracts that expire the same day — have become the speculative instrument of choice. They now account for as much as 65% of all S&P 500 options volume — a record. Retail traders account for 50% to 60% of 0DTE volume, according to CBOE.

That said, the VIX spiked to 45 before the historic two-day stock market wipeout of early April. It’s been as high as 60 in the last 52 weeks. Now it’s back down to around 16, near its 52-week low of 12.70, reached in early December.

While trouble continues to bubble on the peripheries, retail investors are complacently speculating. And if volatility spikes, so will options trading — and so will the VIX. Own CBOE now and also profit when this happens — because it (eventually) will. For certain.

Recommended Action: Buy CBOE.