Regency Centers Corp. (REG) is an owner, operator, and developer of shopping centers located in suburban areas with strong demographics. Major markets are in geographic areas located in states throughout the Northeast, Mid-Atlantic, Southeast, and the Midwest, highlights Martin Fridson, editor of Forbes/Fridson Income Securities Investor.

The company’s portfolio includes high-quality properties with best-in-class local merchants, anchored by many top national retailers. Over 80% of REG’s centers are grocery-anchored and in suburban neighborhood areas, with tenants that include national supermarket chains such as Kroger, Albertsons, Safeway, and Publix.

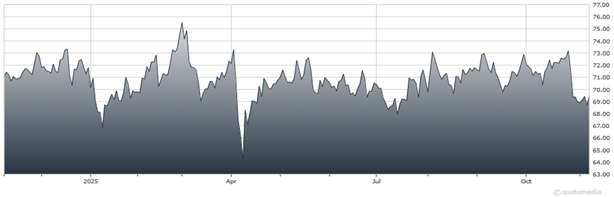

Regency Centers Corp. (REG)

The company operates with a tenant pool that has annual rent steps of roughly 2%, contributing 130-140 basis points of same-store net operating income growth. Strong credit ratings (A3/A-) are supported by low leverage and excellent liquidity. Occupancy rates remain solid, ending 2Q 2025 at 96.5%. REG operated 483 shopping centers at quarter-end, with retail space of more than 61 million square feet.

The company reported solid 2Q 2025 earnings, with adjusted funds from operations (AFFO) of $212.1 million, up 8.1% year-over-year to $1.16 per share, surpassing analysts’ $1.12 estimates. Total revenue of $380.9 million topped estimates of $357.3 million.

Quarterly results reflected healthy leasing activity and a 7.4% quarterly increase in same property net operating income. REG’s common shares are suitable for low-risk, tax-deferred portfolios. Dividends are taxed as ordinary income. REG recently yielded 4.4%.

Recommended Action: Buy REG.

Subscribe to Forbes/Fridson Income Securities Investor here…