Contrarians love to talk about buying when there’s blood in the streets. But the most profitable opportunities often emerge not when the world collapses, but when investors are simply exhausted. Here’s a five-part framework to capture that edge, writes Nicholas Vardy, editor of The Global Guru.

1. Focus on Policy-Backed Tailwinds

Look for sectors benefiting from structural, legal, or regulatory momentum — grid infrastructure, domestic manufacturing, and industries dependent on high-skilled immigration.

2. Bet on AI’s Second-Order Effects

Everyone is chasing Nvidia Corp. (NVDA). Few are looking at the industries where AI quietly drives margin expansion: logistics, energy optimization, industrial automation, and compliance software.

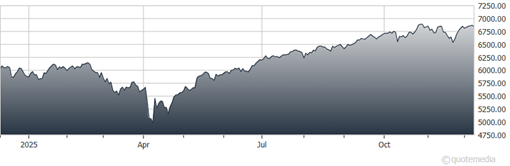

S&P 500 Index (^SPX)

3. Screen for Pricing Power Plus Underfollowed Balance Sheets

Small- and mid-caps with real pricing power and fortress balance sheets are trading below intrinsic value simply because they lack a narrative.

4. Look Where the Capital Isn’t

Capital flows drive returns. With trillions crowded into the Magnificent Seven and Treasury bills, the opportunity sits in the ignored middle — companies that benefit from any uptick in risk appetite.

5. Back Founder-Led Companies with Skin in the Game

When macro is messy, alignment matters. Founder-operators adapt faster, cut faster, and recover faster than bureaucratic mega-caps.

This isn’t Pollyanna optimism. America faces real challenges. But so does every country. And over the last 250 years, the most expensive investment mistake has been betting against the United States.

As Walter Wriston famously observed, capital goes where it’s welcome and stays where it’s well-treated. America — messy, loud, argumentative America — remains the world’s largest magnet for talent, capital, and ideas. The doom loop is loud. But opportunity rarely shouts. It whispers.

Right now, it’s whispering something important. Doom is overdone. It’s time to position for the upside