The S&P 500 Index (^SPX) recorded a price decline in its final month of 2025. Meanwhile, midterm election years (MTEYs) have the reputation of being quite challenging due to the uncertainty surrounding the upcoming November Congressional elections, observes Sam Stovall, chief investment strategist at CFRA Research.

The December decline came as a slight surprise to market participants, since the S&P 500 recorded the highest monthly frequency of price increases in December since WWII. This end-of-year performance may reignite investors’ tendency to forecast recency, concluding that what happened in December may carry over into the first quarter of 2026.

More often than not, however, it doesn’t typically work that way. Indeed, since 1990, whenever any of the sectors or sub-industries outperformed the S&P 500 in December, fewer than 50% continued to outpace the benchmark in Q1 of the following year.

What about midterms and markets? During “Wave” years when the Executive and Legislative branches were controlled by the same party, the elections resulted in a loss of four seats in the Senate and 33 seats in the House of Representatives, frequently diluting or shifting the control of Congress.

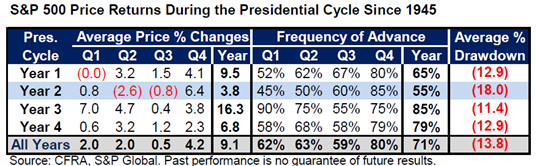

As a result of this uncertainty, the S&P 500 in MTEYs since WWII recorded a paltry 3.8% annual price increase – and rose in price only 55% of the time. That compares with an average gain of nearly 11%, and a 76% frequency of advance, for the other three years in the cycle.

What’s more, the second and third quarters recorded the only consecutive average declines in the 16-quarter Presidential Cycle. Finally, the S&P 500 endured an average intra-year drawdown of 18% during MTEYs, which was more than five percentage points higher than the average for the other three years in the cycle.

After the election, history reminds us (but does not guarantee) that with the uncertainty lifted, the S&P 500 recorded uninterrupted advances. From Oct. 31 of MTEYs through Oct. 31 of the following year, the S&P 500 gained an average of 16% – and rose in price 100% of the time.