To earn the Dividend Kings moniker, an S&P 500 company must have a market capitalization of more than $3 billion and a record of raising annual dividend payout amounts for at least 50 consecutive years, explains Ned Piplovic, editor of DividendInvestor.

An analysis of historical performances indicates that public companies which pay rising dividends reward their shareholders with higher overall returns over extended periods, as well as experience lower volatility over a long-term investment horizon.

However, regardless of these back tested results, financial and investing professionals stand in disagreement regarding whether dividend distributions contribute at all to the company’s overall long-term total returns.

Long-term distribution of rising dividend income generates a steady cash flow for investors and the rising dividend compensates – and hopefully exceeds – any inflationary effects over long-time horizons.

More than just providing a steady dividend income, long-term rising dividend payouts usually indicate a well-managed company that generates sufficient earnings to cover its increasing dividend distributions and sustainable dividend payout ratios.

Any of the current Dividend Kings are potentially good investment choices for generating dividend income over extended periods.

However, while some companies decide their dividend distribution amounts based on their quarterly results as they go along, some of these have specific dividend growth policies, which offer investors assurances that the company will take under consideration the targeted dividend hike when creating its annual budgets and plans.

Dividend Kings manage to enhance their annual dividend payouts year-after-year, which is more than just an indication that these companies have sufficient earnings and cash flow to support the growing payouts. The decades of rising dividend distribution signal that these companies are dynamic and adapt well to changing market conditions.

Effectively navigating the boom-bust business cycle, financial crises, financial bear markets and other obstacles that occur over decades also indicate that these companies are able to withstand challenging market conditions.

Any company that manages to navigate effectively multiple financial storms and rough markets, while managing to enhance its annual dividends every year, is well-managed and investors can expect sound long-term asset appreciation, as well as a steadily rising dividend income.

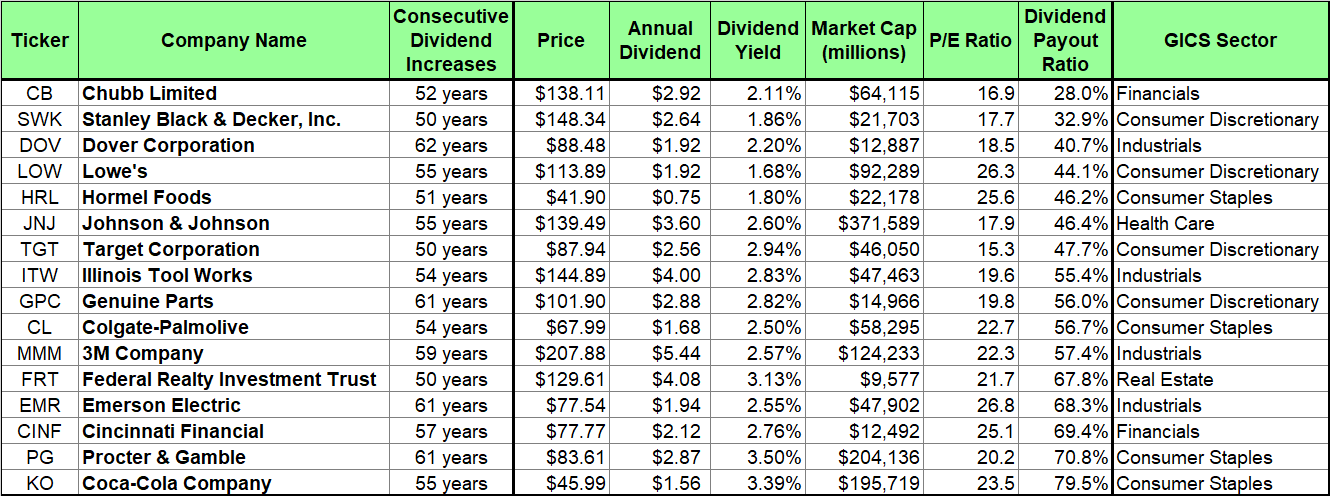

The 16 companies currently designated as Dividend kings come from six different market sectors — consumer discretionary (4), consumer staples (4), financials (2), healthcare (1), industrials (4) and real estate (1).

The table below provides a full list of the current Dividend Kings and few additional measures, such as share prices – as of closing on September 17, 2018 – annual dividend amounts, dividend yield, dividend payout ratio, etc.