Stocks are flat in the early going, while gold and silver are spiking. Treasuries and the dollar are up slightly, though crude oil is now giving up its early-morning gains.

After attacking ships and land bases for weeks with missiles and drones, Middle Eastern militants managed to take the lives of American soldiers Sunday. A drone strike on an outpost called Tower 22 in northeastern Jordan killed three service members and wounded another 34. The attack reportedly struck living quarters there, something that accounted for the high casualty count.

President Biden has vowed to strike back at the Iranian-backed militia that claimed responsibility for the attack, a group calling itself the “Axis of Resistance.” That could lead to the Israeli-Hamas conflict spilling over in the region, especially if the US hits Iran directly. Officials say there have been more than 160 attacks on US troops in Syria, Iraq, and Jordan since Hamas struck Israel on Oct. 7.

Gold and silver are rallying as “safe haven” plays on the news. But after rising above $79 a barrel yesterday evening, US crude oil futures are now trading slightly in the red.

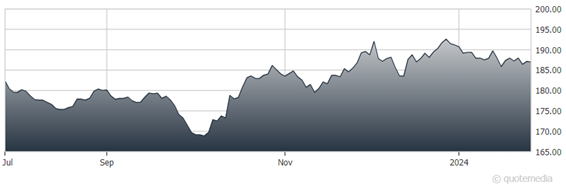

SPDR Gold Shares (GLD)

In Asia, the troubled mega-developer China Evergrande Group will be forced to liquidate rather than restructure. A Hong Kong court ordered the move for the company that used to be China’s biggest property developer. It comes as China’s real estate sector continues to slump, with new homes sales dropping another 6% in 2023 to a seven-year low.

Finally, Amazon (AMZN) walked away from its proposed takeover of iRobot after European Union antitrust regulators vowed to block it. The online retailer had agreed to buy the Roomba vacuum maker for $1.4 billion. But it chose to pay a $94 million breakup fee and abandon the transaction rather than lock horns with the EU in an appeals process that could last years.