Stocks gave up some ground on Monday, and they’re giving up more in the early going here. The same goes for crude oil. But long-term Treasuries are rising, gold is extending its recent breakout, and Bitcoin is closing in on a new record.

Starting with the last of those assets, the benchmark cryptocurrency briefly topped $68,000 in the last 24 hours, extending its year-to-date rally to more than 61%. That put it within a thousand dollars of its all-time high just under $69,000, set back in November 2021.

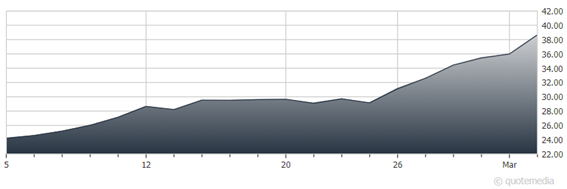

Helping push it along? Enormous inflows into the 10 spot Bitcoin ETFs that launched here in the US back in mid-January. Those funds now have nearly $50 billion in assets. BlackRock’s iShares Bitcoin Trust (IBIT) just topped $10 billion alone, an astonishing number considering only 4% of the 3,000-plus US-traded ETFs are that large.

iShares Bitcoin Trust (IBIT)

Retailing giant Target (TGT) is trying to convince investors it’s back on track after a series of stumbles. Its just-released Q4 numbers are helping the company’s case. Sales, gross profit margin, and earnings all rose year-over-year, topping estimates and sending the stock sharply higher in the early going. Still, TGT shares remain roughly $100 below their mid-2021 peak.

China’s premier Li Qiang declared the country is targeting 5% economic growth in 2024 at the annual National People’s Congress. The problem? That’s probably too ambitious given the challenges facing the world’s second-largest economy. They include a deepening real estate crisis, falling wages, slumping consumer spending growth, and deflationary pressures. China’s CSI 300 Index has shed more than 20% of its value in the last two years.