Gold is soaring and stocks are slumping amid ongoing chaos in Washington. Meanwhile, crude oil, interest rates, and the dollar are dipping...but Bitcoin and other cryptocurrencies are popping.

Well, it’s official. The federal government is (mostly) shut down. Republicans and Democrats in Congress couldn’t agree on a way to extend federal funding past midnight – and President Trump’s meeting on Monday failed to break the impasse. So, hundreds of thousands of workers will get furloughed and non-essential operations will cease until some kind of deal can be reached.

Meanwhile, the labor market was already struggling last month, if PRIVATE data from ADP is to be believed. This morning’s report from the payroll processor showed the economy shed 32,000 jobs in September – much worse than the gain of 50,000 jobs that economists were expecting. Official government data won’t be released Friday due to the shutdown.

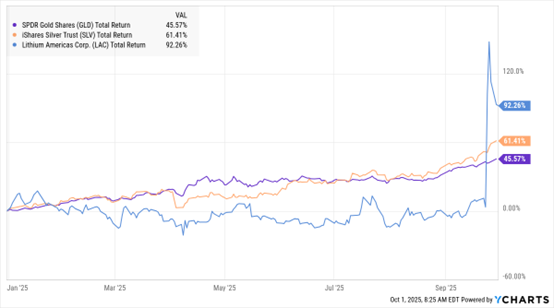

GLD, SLV, LAC (YTD % Change)

Data by YCharts

Investors may want to keep some perspective on the “Shutdown Drama” though. I wrote about why panicking is NOT the best option here. Other MoneyShow expert contributors have also chimed in on how past shutdowns – while disrupting people’s daily lives – have NOT had lasting, negative impacts on markets.

As for precious metals…WOW. Gold and silver just had the best quarter of performance in history, rising 17% and 29%, respectively. Both are rising again today as “chaos insurance” plays amid ongoing dysfunction and upheaval in Washington. Plus, if the shutdown were to drag on, it would likely weaken the economy at the margins and provide extra fuel for Federal Reserve interest rate cuts. And that would likely pressure the dollar...boosting the appeal of metals.

Speaking of the federal government, it IS moving forward with a plan to buy a chunk of Lithium Americas Corp. (LAC). The Vancouver, Canada-based company is developing the Western Hemisphere’s largest lithium mine – called Thacker Pass – in Nevada.

Uncle Sam will buy 5% of LAC and also 5% of the mining project. General Motors Co. (GM) is a partner in the Thacker Pass joint venture because lithium is a critical component in Electric Vehicle (EV) batteries. LAC shares soared another 36% on the news – after already rising 92% in 2025 through yesterday.