Last week, Mike Turner of Turner Capital Investments focused on the aging of America being a two-edged sword. Yes, your money has to last longer, but there‘s also more time to build a nest egg even if you’re starting late.

There’s another area that’s of concern to both those looking to retire or already in retirement. It’s something the government is going to tell you is under control. It’s something that affects your lifestyle on a 24/7 basis, but you can’t see it.

Inflation.

The potential for inflation, both the overall cost of living and, especially, medical inflation, is great and could hurt many portfolios no matter how well they’re constructed. Inflation acts as a virtual tax on your money, constantly eating away at your purchasing power.

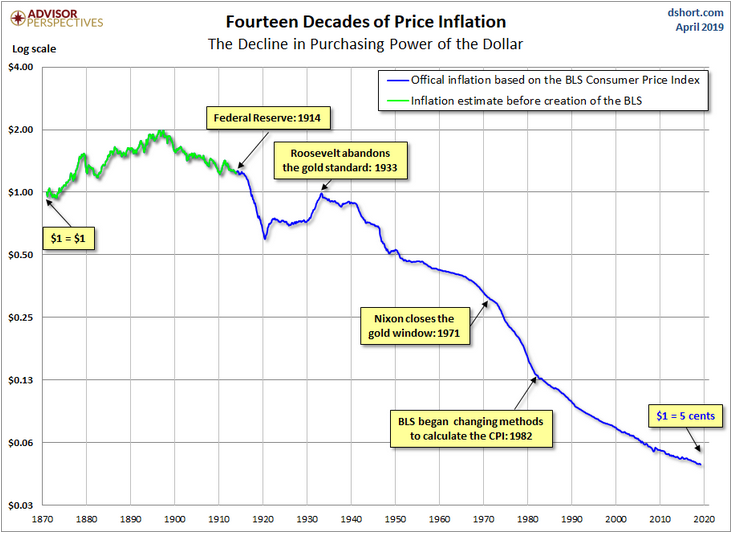

Here’s a chart showing the current purchasing power “value” of a dollar today compared to 1870. As you can see, today’s dollar is worth about a nickel compared to almost 150 years ago.

Medical inflation is even worse. A medical expense that cost $1000 in the year 2000 now costs $1880…. and climbing. Each year, even with Medicare, you’re paying more for your health care. And God forbid you have a medical emergency or need a period of extended care.

Do you have a plan in place to overcome this inflation?

There’s an intelligent way you can structure your portfolio to overcome this inflation and the expenses that are eating away at your portfolio’s buying power.

It’s called Market Directional Investing.

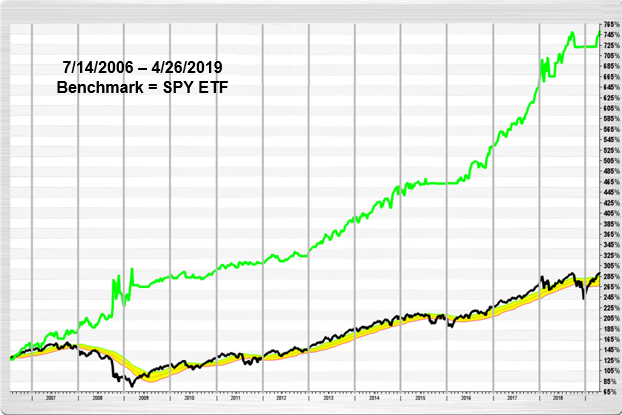

What if you could be long when the market is bullish and short if the market when the market is bearish? Rather than returns like the black line, you could potentially have returns similar to the green line.

Want to know how to do this? I’ll show you how and you don’t have to buy anything or subscribe to anything. This is an educational presentation and 100% free.

Think about it… The green line above, while 100% back-tested, is comprised of just two ETFs and by following the rules and methods that I’ll show you, this model back-tested to 40% per year, on average. That means money following this model would have, theoretically, doubled every two years. That is a strategy that can compete with any inflation concern. It is also a strategy that you can use for free. Learn how to put this strategy to work and see if doesn’t radically change your outlook for the future and the outlook for your retirement’s financial goals.

On Thursday evening, June 6th, I’ll be conducting an educational webinar (totally free) that shows how I know exactly when the market is in a bullish trend and when the market is in a bearish trend. And the system moves me to cash when the risk is too high.

To register for this presentation, click here.

As an added bonus, everyone who registers for this webinar will receive four weeks of my client newsletter. In the newsletter, I show you my updated charts (similar to the chart above) with all of the bullish and bearish signals that my system generated that weekend.

Again, click here to register. This presentation could significantly affect your retirement success.

Visit www.turnercapital.com or contact us at info@turnercapital.com.

TURNER CAPITAL INVESTMENTS, LLC

GROWING AND PROTECTING CLIENT CAPITAL IN BOTH BULL AND BEAR MARKETS