For those new to trading, new to me, or my methodology, I think the following ground rules will help you to understand my philosophy towards trading and the markets, writes Dave Landry. Look for more Trading Lessons every Friday on MoneyShow.com.

And, I think for those of you who find yourself plotting the 15th oscillator, attempting to implement some arcane price bar counting technique, being fleeced by a guru, confusing the issue with facts by interjecting news or fundamentals into your trades, trading during less-than-ideal conditions, picking top tops/bottoms, and generally just trying to outsmart the markets will also benefit.

1. Technical analysis leads the way.

If a market is going from A to C and A < B < C, then it must pass through B on its way to C. There are no hard and fast rules like this when it comes to fundamental analysis. “…the fundamental factors suggest what ought to happen in the market, while the technical factors suggest what actually is happening in the market.” --R.W. Schabacker, Stock Market Profits.

2. Considering #1, all news and all fundamentals are ignored.

Price and only price leads the way. “Remember: All of the financial theories and all of the fundamentals will never be any better than what the trend of the market will allow.” --Greg Morris, Investing With The Trend.

3. The trend is your friend.

Trade only in the direction of the established trend.

As you gain knowledge, you can then also look to trade emerging trends.

Regardless of the methodology, all successful trades must capture a trend. So, why not start with a trend to begin with? I know I can be a little tongue in cheek with my uptrend, downtrend, and sideways arrows, but you'd be surprised how many people fight trends, trying to outsmart the market. Always start by asking yourself, “Self, is the market in an obvious uptrend, downtrend, or is it just going sideways?”

Yes, above is my action business card. It serves as a constant reminder of what I stand for.

4. It’s not my way or the highway.

There are many ways to trade. Yes, I am biased, especially when it comes to methodologies that I know will work until they don’t. If you are already a successful trader, then use only what your feel will improve your own trading. If you are not currently successful, then consider the methodology since it is a simple and straightforward approach.

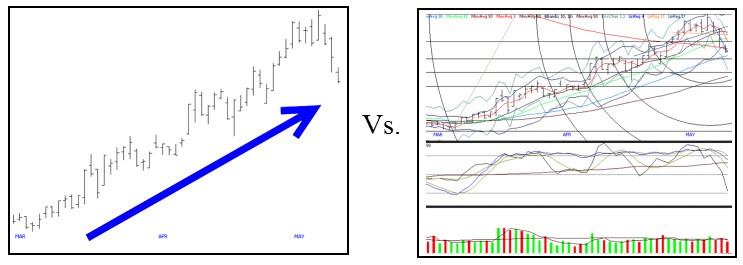

5. Keep it simple.

Other than the occasional moving average, no indicators are used.

Again, the only way to profit from a trade is to capture a trend. So, focus on that. Draw your arrows.

Use simple concepts such as persistency--drawing a line through as many bars as possible and net net price change--is the market higher? Lower? Or about the same as it was?

Once you look at the blank chart and ask yourself these questions, then and only then, add in a moving average or two.

6. Only the short-term can be predicted when it comes to markets.

When it comes to markets, only the short-term can be predicted with any degree of accuracy.

Unfortunately, you just don’t make enough trading the short-term. And, eventually, something bad will happen. This will make it difficult to survive both mentally and monetarily.

Longer-term trends are nearly impossible to predict (statistically, there’s over a 70% chance that you’ll be wrong), but that’s where the money is. The good news is that you can have your cake and eat it too.

You can trade for short-term gains but stick with a portion of the position just in case a longer-term trend materializes.

7. Money and position management are key.

You must position yourself for both shorter-term and longer-term gains.

No matter how great a trade might look, there is always a risk of loss. Therefore, stops must be used.

8. A good offense is often your best defense.

Although a good defense is crucial, a good offense is often your best defense.

Pick the best and leave the rest. Do not take mediocre trades and/or try to make something happen in less than ideal conditions. “Don’t invent trades.” --Peter Mauthe.

9. The methodology is repeatable.

There are a lot of disingenuous gurus out there, leading you to believe that they have the magical system and all you have to do is give them a sizable portion of your hard-earned cash and they will give it to you.

True, some of these gurus have done some amazing things. And, you can’t take that away from them. However, being in the right place at the right time and parlaying a small account is one thing. Repeating these feats is another. If they truly could turn $10,000 into $10 million, why wouldn’t they just rinse and repeat? I know I would!

Although it’s hard to sell reality, I take the high road when it comes to my educational business. I once told my youngest that I could make a lot more money if I sold out, thinking that would be a good virtuous lesson. She then replied: “Sell out!” LOL

Getting back to my methodology: There are no secret formulas. Execution is not extremely crucial. With some experience, you should be able to recognize trends/emerging trends and the patterns to get on board them.

I’m proud to say that I’ve helped a lot of people throughout my career. Most seem to have to go off to chase rainbows and empty promises before they get it.

10. Embracing your emotions is key.

As I preach, I use the word embrace and not eliminate because you cannot eliminate your emotions. It’s part of our physiological makeup. If you had no emotions, unless you're in a padded cell, you'd be dead within a week.

So how do you embrace your emotions? You do this by understanding the methodology, trading at a reasonable size, planning your trades, and only trading the best. “Obsess before you get into a trade, not afterwards.” --Dave Landry.

References and additional reading:

- 1. The ABC concrete rule is a reoccurring theme here at DaveLandry.com. Watch the first four videos (free) of Trading Full Circle.

- 2. Again, watch the first four Trading Full Circle videos for a lot more on why Technical Analysis and only Technical Analysis.

- 3. Read: 13 Things That You Must Know About Trend.

- 4. I’m hinting at anthill type strategies such as reversion to the mean trading and selling naked options. These methods can work for long periods of time. Unfortunately, though, I can all but guarantee that they it will end badly. And, yes, I've “been there, done that, and got the T-shirt!”

- 5. See Trading Full Circle. Come to the Weekly Chart Shows.

- 6. See Trading Full Circle.

- 7. Again, this is covered in detail in Trading Full Circle.

- 8. See the Stock Selection Course. Right now (until July 1, 2018), I’m including one year free to my Core Trading Service so you can learn then theory and then see it in practice. Also, I’m including 1-year to the new members area (from the launch date) and immediate sneak peek access.

- 9. Repeatably is a reoccurring theme here at DaveLandry.com. Yes, your guru might have done something impressive at some point. Quoting Janet, just ask them, “What have you done for me lately?”

- 10. See the Trading Psychology Micro Course (a sub-set of Trading Full Circle). Embracing, not eliminating, emotions comes from the research of Shull and Damasio.

Ground Rules: The original source came from a series of articles that I wrote for Traders magazine several years ago. Below is an updated and expanded version.

Dave Landry’s Trading Full Circle course videos and newsletter here