Let’s move to CryptoCorner, where bitcoin (BTC-USD) continues to power higher, most likely catching a bunch of future players naked short ducking to cover, writes Nell Sloane Tuesday in her weekly crypto trader notebook.

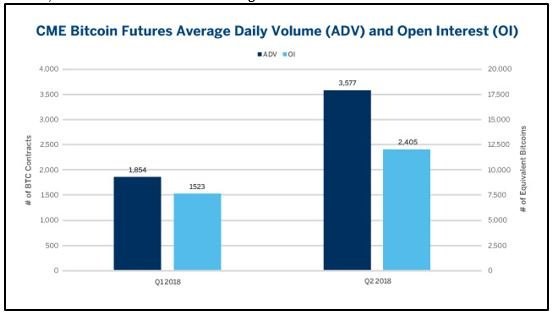

Speaking of futures, the CME Group posted their latest Q2 numbers, here are the highlights:

- ADV reached 3,577 contracts, +93% versus Q1; equal to ~$140M notional or 17,885 equivalent bitcoins.

- OI, up every month since December, surpasses 2,400 contracts, +58% versus Q1.

- Bid-ask spread has continued to tighten since March, narrowing from 10 ticks to under 2 ticks.

- Over 1,500 active accounts are trading.

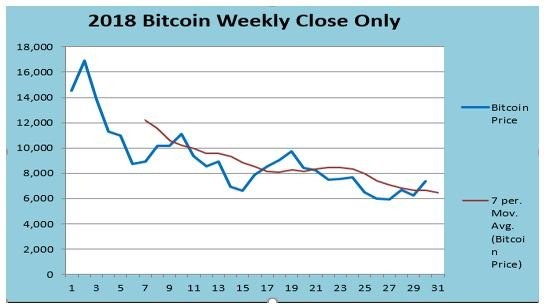

The weekly bitcoin chart posted a nice close above our simple 7 period moving average, shown here, utilizing weekly close only:

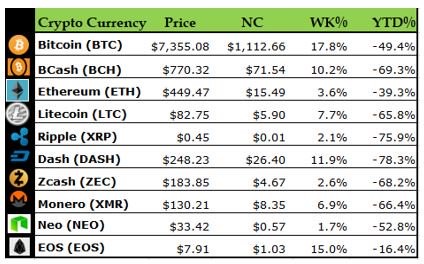

Here are the weekly crypto settles for Friday, July 20:

When we look at our CryptoCorner Index we can see that the index had a nice week up 14.6%, settling the week at $2799.22 up $409.62.

This week move puts it solidly above the weekly closing trendline and may spell more trouble for any naked future short sellers.

We really haven’t seen the futures sellers resolve since they came into being, but this move may be just the beginning if indeed complacent sellers are running rampant. Considering the growth of BTC trading at the CME, this should be interesting.

**

We also noted some new large entrants in the BTC complex on the Bitcoin Richlist.

- 10885 BTC valued at $80 million

- 14837 BTC valued at $113 million

- 48500 BTC valued at $371 million

- A chunky 85947 BTC valued at $659 million.

So, it’s fair to say, some heavy hitters have stepped in and put their foot in the sand!

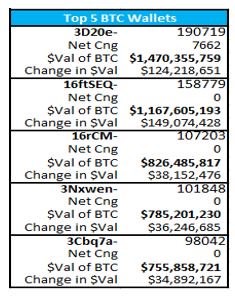

As far as the top 5 wallets, they are still the same:

Bloomberg: Keep an eye on what bitcoin miners are doing during this rally.

OK, that does it, sorry for the long letter, but there was a lot to cover this week, actually too much for a strange July that is seeing a cooler Midwest, a dryer southwest and wetter Eastern seaboard!

We suppose like the markets, a little something for everyone! So, keep your senses sharp and your mind open, for we never know when opportunity may strike, usually and more often than not, when we least expect it too.

Cheers!

Nell

Subscribe to Nell Sloane's free Unique Insights and CryptoCorner newsletters here