What a great few days at MoneyShow San Francisco! The show was larger than it had been in several years and I got to speak in front of hundreds of investors, writes Mike Turner Wednesday.

What did surprise me was this. I spoke with an investor who was almost distraught. Here we are in the middle of the longest-lasting bull market in history and he hadn’t participated in any of the huge move higher. Why, I asked? The 2008 bear market had spooked him so much, he didn’t trust the markets.

For ten years he’d been on the sidelines. The S&P (SPX) has moved from the 666 level to almost 2900 and he’s kicking himself for missing out on this huge move higher.

So, I asked him, why aren’t you getting back into the market now? It still has the possibility of moving higher for quite a while. After all, nobody knows when the market is going to start moving lower. His response said it all.

“I can’t afford to lose half my money again.”

He’s right, he can’t afford to lose half his money again. That’s why he needs to look at the Market Directional approach to investing. Sure it’s possible to lose money on a trade, but it’s almost impossible to lose 50% in an ETF that tracks the major indices.

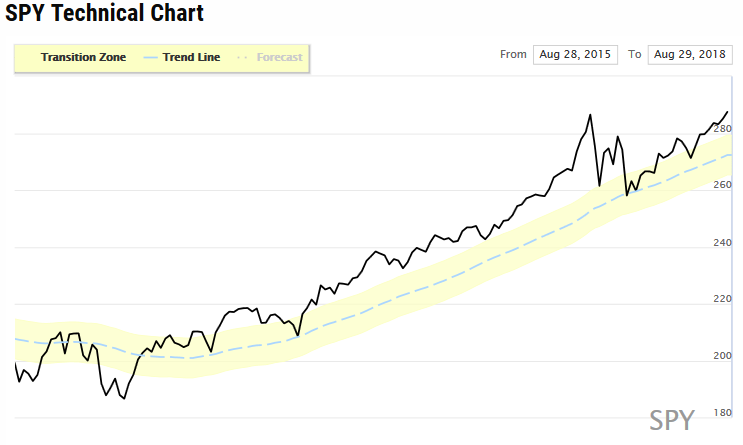

Here’s the chart for SPY, the ETF that tracks the S&P 500. SPY continues to be a slow and steady mover to the upside. Yes, at some point in time, SPY will reverse itself and start moving lower. But it’s still moving higher right now.

How will I know when SPY has reversed course?

That’s what the Expected Move (EM) is for.

The weekly EM for SPY is $7.01 (last week the EM was $6.81).The current stop is set at $279.36.

Remember, I don’t guess with any of my trades. It’s possible that the trades can move against me, but I know exactly what my exit strategy is before I get into a trade. This is all part of measuring where the market is and not trying to guess where it might or might not be headed.

Measuring where the market is, and not guessing what might happen with the markets, is something my investor friend should consider. He won’t make up for missing almost 10 years of a strong bull market, but he shouldn’t have to worry about losing another 50% of his investments.

Again, it was nice seeing you all this past week at the MoneyShow San Francisco. During the first week of October, I’ll be participating in the MoneyShow in Dallas. I hope you can make it.

The MoneyShow Dallas– October 3-5

Stop guessing and start measuring,

If you’re interested in learning more about how I manage money using the Market-Directional Investing methodology, you can read more here.

Watch Mike Turner and Mark Skousen in a video: The economics professor vs. the mathematician. The great debate on buy-and-hold vs. market timing. Here.

Recorded: MoneyShow San Francisco, August 24, 2018.

Duration: 1:06:57.