In every bear, there is an intense bullish phase. Those of you who remember 2008 will recall big time one-day to two-day bounces. But as soon as they materialized, they quickly vanished, writes Jeff Greenblatt Wednesday. This is a bearish year.

On Tuesday, markets were initially lower on news Trump speculated on the idea of putting a 10% tariff on Apple (AAPL) products, specifically Chinese made iPhones. By the end of the same day, markets jumped on the hope there will be a truce between the U.S. and China when negotiations start again this weekend.

You can’t have it both ways.

Bear markets are fueled by the slope of hope.

On Wednesday Fed Chairman Powell spoke in New York and basically said interest rates were neutral, meaning they are “neither speeding up nor slowing down growth.” According to a CNBC article, Robert Pavlik, chief investment strategist at SlateStone Wealth, said these comments were “exactly what the market was expecting to hear.” This is different from comments in October where the Fed said rates were a “long way from neutral.”

On the surface, that appears great. Houston, we have a problem.

Typically, the Fed is behind the curve. This time is no different. This is a higher interest rate environment and has been for a while. On another front, GDP came in at an expected 3.5%.

The problem and reality of the situations is this is telling us what has already happened, not what is going to happen in the future. Even the Fed knows they are behind the curve.

In yet another early Wednesday morning column, CNBC said the Fed warned that a “particularly large” plunge in market prices could materialize if certain risk events happened. They talked about how trade tensions, corporate debt and geopolitical uncertainty could hurt the market down the road.

Let me put it to you this way. The Fed is telling us interest rates are neither harming nor helping the economy at this point but they likely intend to slow down the rate hikes. But the truth of the matter is the economy already will slow down. At the low, the Dow (DJI) was already down over 10%. The Nasdaq (NDX) was down over 16% from the high. The stock market is a leading indicator to the economy historically by about 6-9 months.

Market participants are hoping there will be a trade truce. They are hoping the economy will stay at current levels. That’s why they either pushed the Buy button this week or let up on their short positions. In the end run, neither of these conditions will sustain. We just discussed the economy, based on past observation, its not likely a truce with the Chinese when it comes to economic issues will sustain either.

Then again, there are at least a half dozen other issues the market is not looking at or getting complacent again and prefers not to look at. Trump is looking at anti-trust action against the technocrat companies. Nobody was talking about that today. Did that problem go away?

That one issue alone has the ability to sink the FAANG stocks further which will take the market down another level. Fear of regulation is precisely what popped the Nasdaq bubble in 2000.

When these conditions don’t materialize, markets tend to slide back down that slope of hope. Then again, surprises come to the downside in a bear.

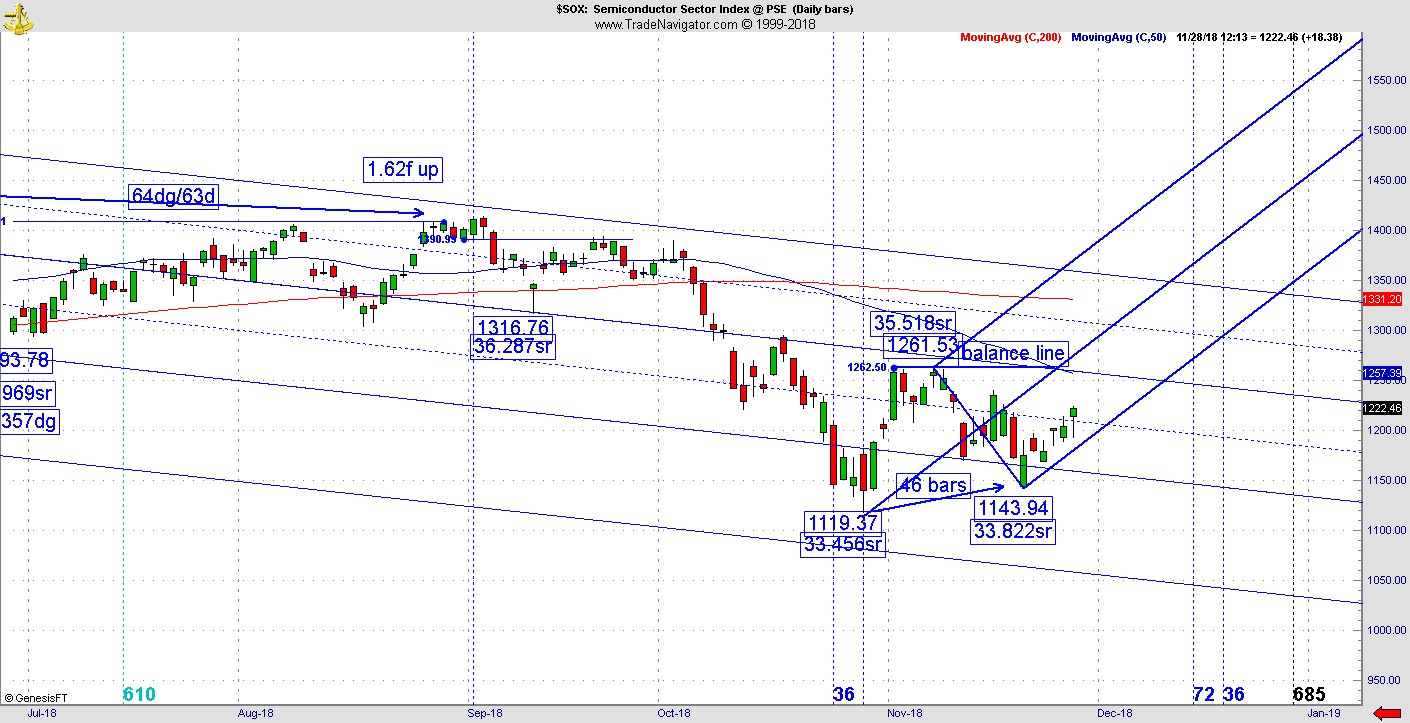

But for now, happy days are here again. Markets are complacent because if they can’t be complacent during the holidays, when exactly are they supposed to be complacent? Briefly, here is a chart of the PHLX Semiconductor Sector Index (SOX) as it is a good representation visually of what is going on right now. There are a lot of annotations on this chart (in other time frames) but for right now, all you need to do is pay attention to the bold blue channel moving higher which is the navigation for this sequence.

A couple of weeks ago Eliades said the market is entering its most bullish point in the presidential cycle. His worry and mine is the fact this is the first time the bullish presidential cycle is encountering opposing forces which could be bigger.

We’ve discussed the generational 80-year turning cycle. By now everyone realizes we are in a season of quickening where strange and historical events tend to materialize on a regular basis.

For my part, this is a bearish year. In other bearish years, the Santa rally got interrupted by bearish sequences that can last as long as a week. This is what we could be facing right through to Christmas. I still believe there are too many potential risks which could materialize at any time going forward to call for a bottom in the market.

Subscribe to Lucas Wave International newsletter here

Related: Santa Claus rally: Myth, magic or money, commentary by Jake Bernstein.