It now makes sense to start building small to intermediate size long positions in legacy tech stocks and other areas of the market which are either extremely oversold or are showing signs of excellent relative strength, writes Dr. Joe Duarte Sunday. Consider options.

I’ve got my fingers crossed as the market’s technical indicators suggest that we may have a tradable bottom in place. And the initial market response was positive to the trade truce between the U.S. and China, which bears out my improving outlook, in the short term.

In fact, the party seemed to start early as U.S. stocks delivered a nice rally to end November on an up note after the Federal Reserve made it clear that interest rate increases may slow down or pause after the expected December 2018 rate increase.

Of course, we have to trade day by day, and anything could change instantly. Thus, as the old country song by Johnny Lee, “Looking for Love in all the Wrong Places” notes, we may all end up “playing a fool’s game hopin’ to win and telling those sweet lies and losing again,” at the slightest hint that something is not panning out quite right.

One thing is much clearer at the moment. If the Federal Reserve actually stops raising interest rates after December and the China trade situation actually sorts itself out, 2019 may actually be a decent year for stocks.

Hopeful signs in key indicator appeared prior to the good news

The NYSE Advance Decline line (NYAD) has been the most accurate indicator of the market’s trend since the presidential election in 2016. In September, NYAD, correctly predicted the October swoon, and now, barring a reversal to the down side the indicator is suggesting that a tradable bottom may be in place.

Specifically, NYAD did not make a new low when the markets, especially the Nasdaq 100 Index (NDX) made new lows recently, which is a positive divergence likely reversing the negative divergence the line displayed in September. Furthermore, RSI and ROC have reversed their down side trajectories confirming that the odds of the down trend having been arrested are above the 50-50 mark. A complete confirmation of the trend reversal would be signaled if the ROC rises above the zero line and NYAD can make a clean breakout above its 200-day moving average and there are no reversals below those two key chart points.

W bottoms are everywhere

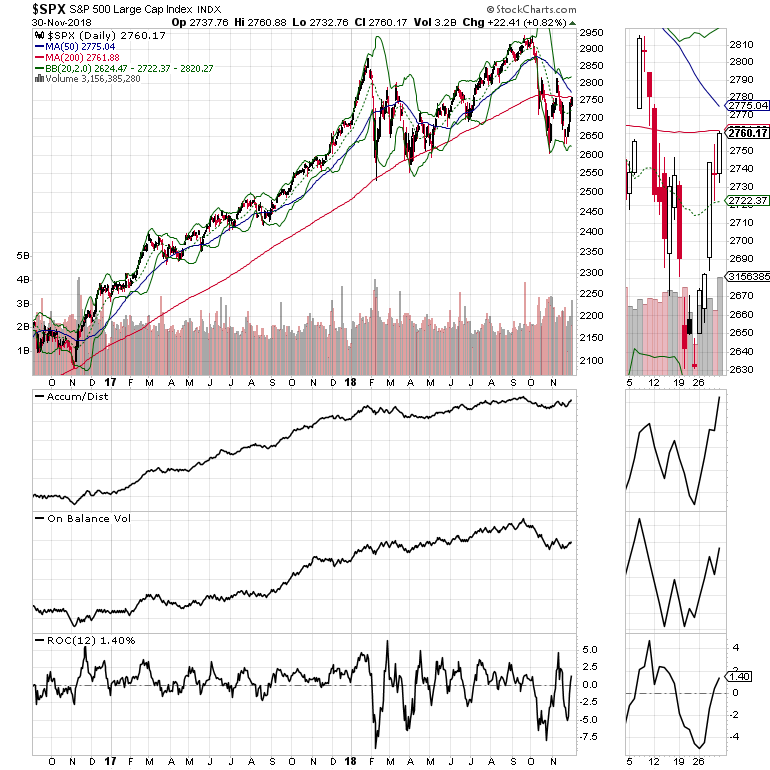

The S & P 500 (SPX) seems to be in the final stages of a W bottom and is now poised to break back above its 200-day moving average, a factor that would be reassuring to those betting on higher prices for stocks over the intermediate term.

A positive development was the increase in volume and the improvement in breadth on the last two trading days of the week that ended on Nov. 30. Also encouraging is the reversal in the Accumulation Distribution,

On Balance Volume (OBV) and the Rate of Change (ROC) indicators for the index which show that money is moving back into the market.

Even the Nasdaq 100 showed signs of life at the end of the week as money seemed to be moving back into select tech names such as Iridium (IRDM) and Texas Instruments (TXN). Iridium recently gave an upbeat conference call after its earnings, and Texas Instruments is as well run a technology as there is.

Of course, there was a bounce in the FANG Stocks Index (FNGU), which helped, but overall it was the chip stocks and the software stocks such as Microsoft (MSFT) which saw the biggest money flows, a fact that suggests that there may be a leadership shift in the works for technology vs. Apple (AAPL).

Related: A strange thing happened. Microsoft passed Apple in market cap, reports The Guardian.

So far so good

The Federal Reserve may have seen the light. The U.S. China trade standoff seems to have called a truce. Of course, there is still plenty to worry about as the fallout from the U.S. midterms and the ongoing saga with the Mueller investigation can still deliver interesting surprises.

Nevertheless, it’s now prudent to trim any short positions left in portfolios and to shift the burden of proof to the bears in this market. As a result, it now makes sense to start building small to intermediate size long positions in legacy tech stocks and other areas of the market which are either extremely oversold or are showing signs of excellent relative strength. It’s also a great time to consider options in these same areas of the market.

All bets are off, though, if there is anything falls short of expectations with the trade talks between the U.S. and the Fed decides to resume their rate hikes. In that case, we may all have to start looking for love on the short side once again.

Disclosure: I own TXN and IRDM as of this writing.

Joe Duarte has been an active trader and widely recognized stock market analyst since 1987. He is author of Trading Options for Dummies, rated a TOP Options Book for 2018 by Benzinga.com - now in its third edition, The Everything Investing in your 20s and 30s and six other trading books.

To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week, visit us here.