Andy Waldock breaks down this week’s CFTC COT data.

Trade wars remain the dominant theme in the commodity markets. Both technical and fundamental strategies will struggle as long as the two largest global economies continue to argue.

There are two ways to approach the current situation. First, one can remain on the sidelines. The only necessary participants in the commodity markets are the true hedgers. If your business doesn’t produce or, process one of the commodities we follow, there is no reason to place capital at risk in uncertain times. Second, traders who choose to invest in the commodity markets due to the tremendous opportunities created by recent market dislocations should shorten their holding periods, significantly.

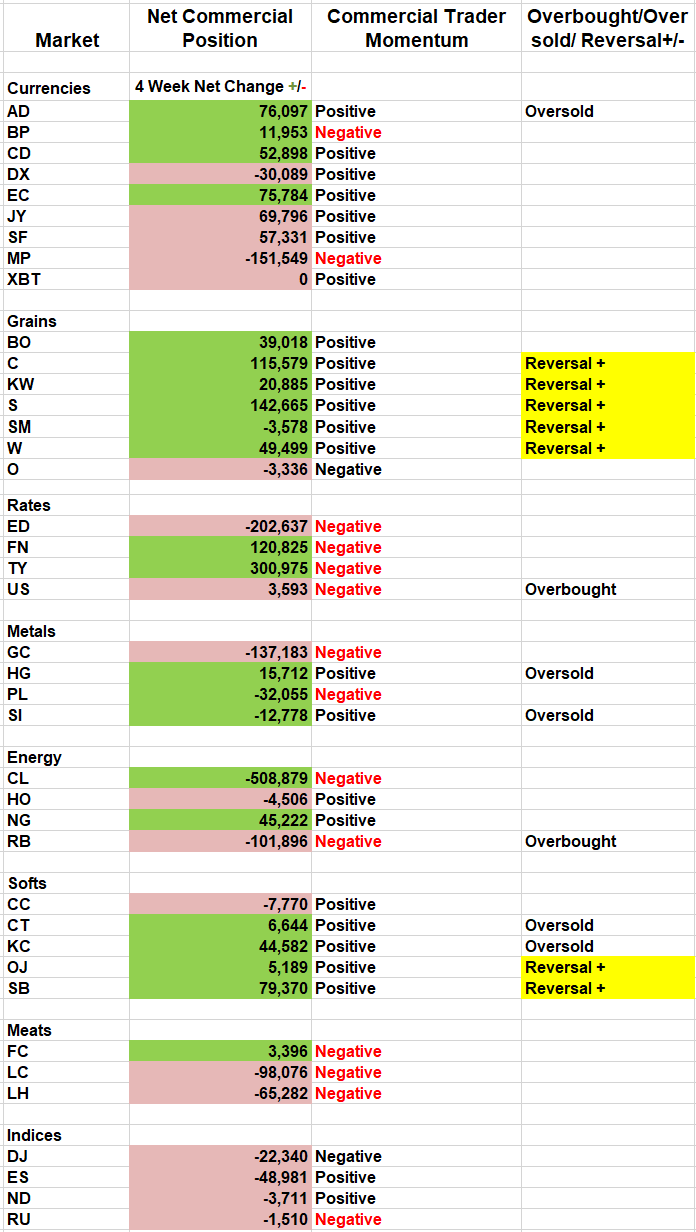

The buy signals generated in the grain markets last week are a good example. Our daily subscribers were issued buy signals in corn and wheat for last Monday’s trade, and soybeans on Tuesday. The markets’ subsequent jumps higher have allowed us to raise the protective stops to breakeven or, better. Substantial pessimism has built up sizeable speculative short positions in the grain markets. Last week was the first step towards forcing to offset their positions. However, if the market cannot breach last week’s highs quickly on positive news, then, I fear the lows for the move have not been made.

Last week’s report suggested oversold conditions in grains, which has been confirmed. Nearly the entire grain complex is signaling a bullish reversal in this week’s COT report.

Open Positions

Crude Oil/Natural Gas Spread: Depending on your entries, the crude oil should have a small profit, and the natural gas should be up approximately $1,500. Iran is about the fifth largest global crude oil producer. The recent expansion and enforcement of current sanctions are taking hold of the markets. The Iranian oil export sanctions are serving to prop up global prices.

Further escalation of this conflict will only push prices higher. Offset the short side of the crude oil spread and raise the protective sell stop for natural gas to $2.51, $2.70 to $2.75 is a good target for the coming week. If all goes well, this strategy should produce approximately $5 per spread.

Currencies: The Euro followed an inside bar with an outside bar while consolidating near the lows. Meanwhile, the Swiss franc ran higher, testing parity with the U.S. dollar. The euro currency doesn’t give us any room to raise the stop loss order. However, we can increase the Swiss franc sell stop to .9985 and significantly reduce our exposure.

Silver: The silver market’s imbalance continues to shift towards a reversal, higher. Last week, we employed a buy stop as an entry technique to get us long if the market moved higher. The market did not move higher, and our entry order was not filled. We’ll continue to watch the silver market for long entry opportunities.

Please visit WaldockTrading.com for our brokerage and trade advisory services.

Hear Andy talk about seasonality and the COT at the TradersEXPO New York