The E-mini S&P 500 futures, like all financial markets, is waiting for Wednesday’s Federal Open Markets Committee (FOMC) announcement, writes AL Brooks

The E-mini S&P 500 futures, like all financial markets, is waiting for Wednesday’s Federal Open Markets Committee (FOMC) announcement. While the June rally has been strong, it still has not yet broken above the May all-time high. Wednesday’s report could lead to a breakout or a reversal down.

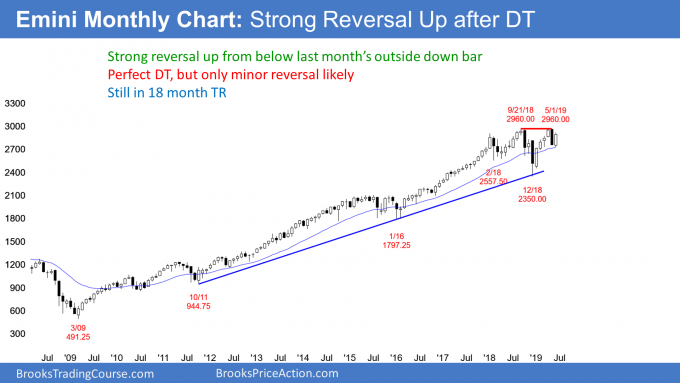

The monthly E-mini S&P 500 futures chart had an outside down bar in May. There is also a double top with the May and September highs. Therefore, May was a sell signal bar. When June traded below the May low, it triggered the monthly sell signal. However, the E-mini immediately reversed up strongly.

June so far is a big bull trend bar and it has reversed much of the May selloff. If June breaks above the May high, it will be a second consecutive outside bar. When an outside up bar follows an outside down bar, it is a reliable buy signal bar for the next month.

There is plenty of time remaining in June to accomplish this. Wednesday’s FOMC announcement is especially important because there is more uncertainty than usual about what the Fed will do. This means the report is a potential catalyst for a surprisingly big move up or down.

For example, a strong rally could break above the May high. That would create consecutive outside bars and make a new all-time high likely within a month.

Alternatively, the report could lead to a reversal back down to below the May low. If so, the E-mini will probably trade sideways to down for another month or two.

Weekly E-mini Chart Analysis

The weekly E-mini S&P 500 chart had a big outside up bar two weeks ago. While that is a buy signal bar in a bull trend, I wrote last week that there were problems with the setup. When a buy signal bar is especially big, the stop is far below. That increased risk makes many bulls wait for a pullback to buy (see chart).