Gold rally on U.S. dollar weakness adds 120k new longs in three weeks, reports Andy Waldock.

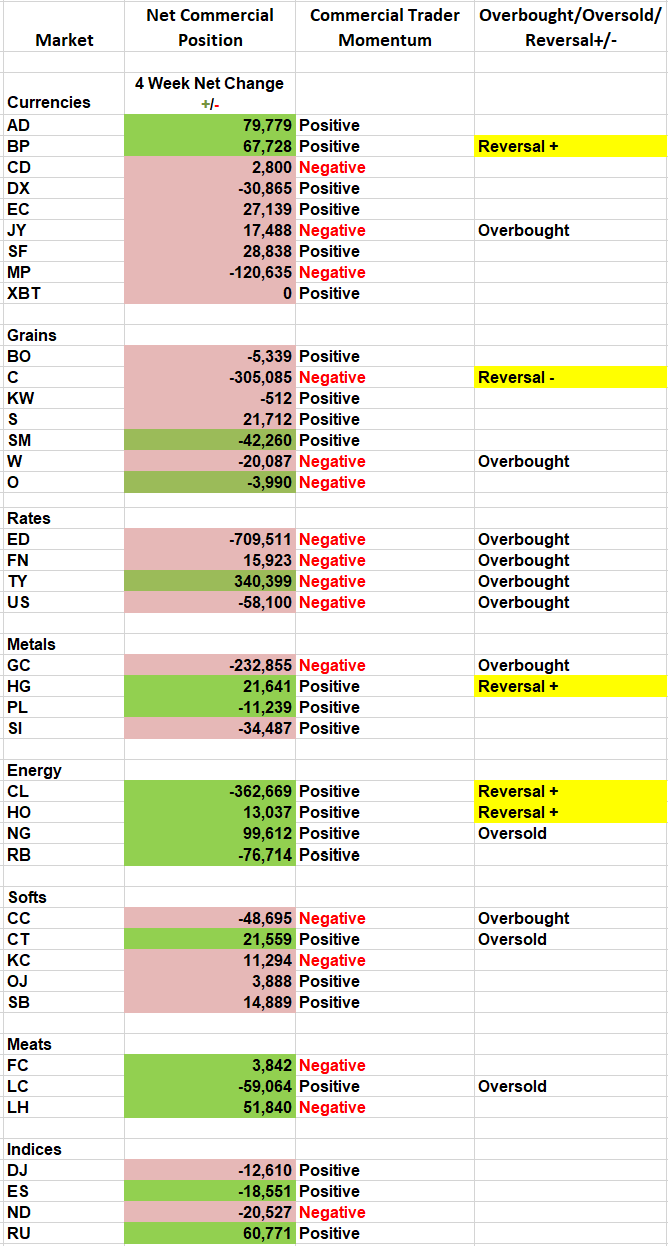

Last week’s massive moves in numerous markets in response to the Federal Reserve’s Open Market Committee’s (FOMC) more dovish response, has create some opportunities in numerous markets in the Commitments of Traders report (see table).

Gold

Last week’s rally in the gold market emboldened the large speculators to increase their positions to nearly 4:1 on the long side. Large specs added 120k new long positions over the last three weeks. This is the most bullish position in gold the speculators have attained since March of 2018. Gold made the high for 2018 at $1,370 in January then, failed miserably after a second speculative charge to $1,350 in April. Long-term back-adjusted charts show considerable resistance in the $1,410 to $1,425 area.

The gold miners have taken a different approach to this rally. They’ve locked in future deliveries at a pace not seen since July of 2016 when the August contract peaked at $1,377.

Finally, much of last week’s rally was due to weakness in the U.S. Dollar Index. We’ve been forecasting a weaker dollar and, the U.S. Dollar Index futures could fall another three handles. However, we think the timelier trade will be betting against an overbought gold market in the short-term as speculative buying runs out, and miners’ forward selling takes hold. Stay tuned for trading signals.

Commodity-based exchange traded fund traders can look at inverse funds like the DB Gold Short ETN (DGZ) or a leveraged fund like the ProShares UltraShort Gold (GLL)

Coffee

The coffee market’s brief rally has led to considerable producer selling. Forward selling by growers has pushed their net position a new low for the last 12 months. This eclipsed their total selling from last June when coffee prices were more than one-third higher. Producers’ willingness to lock in forward sales, now at lower prices, suggests the market could fall much further.

Corn

Corn traders are weighing the consequences of the latest start in history against declining demand. Corn prices have rallied by a third since the mid-May low.

We had this to say on April 22, ahead of the weather concerns and direct threats to our commodity trade with Mexico.

“The corn market has been stuck in roughly a 10% range as it grinds lower. The speculative total position has doubled in size on the short side within a $.20 range. This feels a bit ambitious on the speculators’ behalf, and we’re left wondering where additional selling might be found. Therefore, while I expect the corn market to make new lows, I believe they will be short-lived. Look for a buying opportunity ahead of the typical mid-May low and hold on for weather-related planting concern rally.”

Speculative traders have purchased nearly 480k contracts in the last six weeks. This covered their short position and shifted the speculative net position from short 1.56:1 on May 3 to now long, 2.3:1, six weeks later. Meanwhile, the commercial corn producers have just taken their net short to a new 52-week low. The last time we saw positions flip this violently both in magnitude and volume was June – July of 2015.

Those who’ve contracted for future delivery still feel pretty certain in their abilities. I’m not sure if this will come from their fields or, they’ve made arrangement to fulfill their obligations from another source. Either way, we’ll side with those who have their hands in the ground and look for short selling opportunities, accordingly.

Listen to Andy talk about seasonality and the COT Report at the recent TradersEXPO New York.

Visit Andy Waldock Trading to learn more. Register and see our daily and weekly signals archive for entries and stop loss levels sent to our subscribers.