A conflict between the Dow Jones Index and the transportation subsector may indicate risk for bulls, notes Marvin Appel.

The S&P 500 and Dow Jones Industrial Average touched record highs this month but have been moving overall sideways since in the past two weeks. The question is whether stocks will break out to new highs or will continue to stall and perhaps pull back.

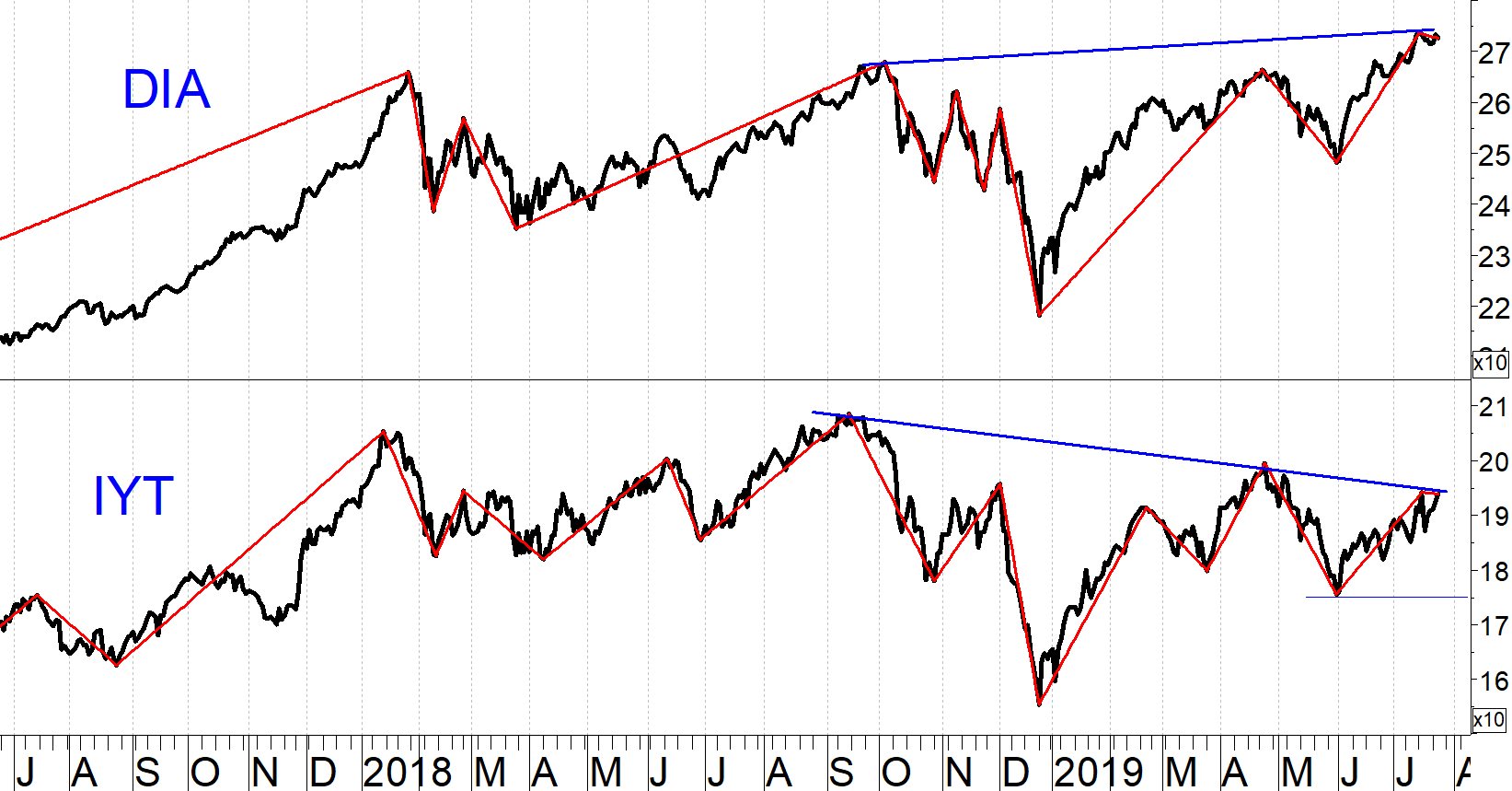

One venerated approach to discerning market trends is the Dow Theory. It states that conditions are bullish when both the Dow Jones Industrial Average and the Dow Jones Transportation Average are in uptrends. An uptrend is a succession of at least two higher lows and higher highs, while a downtrend is a succession of at least two lower highs and lower lows. There is no universal definition of how large a move must separate consecutive highs or lows. As Supreme Court Justice Potter Stewart said of pornography, “you know it when you see it.” I generally use 6% to10% as the minimum significant size of a market move between adjacent highs and lows.

The chart below shows the SPDR Dow Jones Industrial Average ETF (DIA) and the iShares Transportation Average ETF (IYT) that track the Industrials and Transports, respectively. Both ended 2018 in downtrends (bear market condition), but both are now in uptrends. That should be bullish according to Dow Theory. The Industrials are close to their highs, while the Transports are well off of their Sept. 2018 peak. If IYT closes below 175.59, that would define a downtrend. However, for now Dow Theory remains neutral-bullish: Bullish because both IYT and DIA are in uptrends but with a caveat because IYT did not confirm the new high in DIA and may, in fact, begin a new downtrend if IYT pulls back by 9%.

Implications

The U.S. stock market appears more bullish than bearish at this juncture, but it appears to me that the fast money in equities will be behind us for the next several months. This is a good time to take profits, and a risky time to increase your equity exposure.

Sign up here for a free three-month subscription to Dr. Marvin Appel’s Systems and Forecasts newsletter, published every other week with hotline access to the most current commentary. No further obligation.