Here is an options trade to watch following Administration’s plan on uranium, notes Jay Soloff.

Financial markets tend to be cyclical in nature, which means you almost never count out an asset for the long-run. Sure, there may not be a market for lead paint anymore, but lead as a commodity goes through the same trends as most other investment vehicles.

Speaking of commodities, they tend to be even more cyclical than assets like stocks and bonds. One year there may be an abundant wheat crop, and the next year a drought may ruin a huge portion of the yield. For most commodities, whether they are agricultural, metals, or energy, this tends to hold true.

(This even holds true for onions. One of the first tradable commodity futures was in onions, but they were outlawed due to manipulation by major onion suppliers—some say traders— in the early days of futures trading. That moratorium is still in effect to this day; onions, officially are not commodity.)

One commodity that hasn't been in the news for quite some time is uranium. As you know, uranium is the primary fuel source for nuclear reactors, which used to be a very important fuel source. Highly visible accidents have dampened demand for nuclear power, and uranium prices have suffered as a result.

But, as noted above, almost everything in the financial markets moves in cycles. Just this week, the U.S. administration is proposing a $150 million uranium reserve as part of its new budget. As you’d expect, this has been very bullish for uranium.

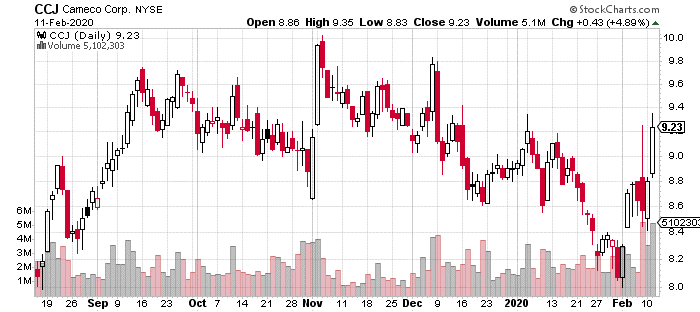

In fact, Cameco Corp. (CCJ), the world’s largest uranium producer, was up 5% the day the strategic reserve plan was announced (see chart below). Now, we don’t know if this line item in the new budget will make it past Congress, but even the possibility of it has been a boon for uranium stocks.

There has been quite a bit of options activity in CCJ to go along with the reserve news. On the day the news broke, CCJ options traded 10x their normal amount. Moreover, the vast majority of the activity was bullish.

One particular trade that caught my eye was a large number of calls being rolled to a later month. With the stock at around $9.25, a trader closed 20,000 March 8 calls for around $1.22. At the same time, 20,000 calls were purchased in June for 45¢.

The trader collected about $2.4 million from the call sale and spent $900,000 on new calls in June. The breakeven point for the June calls is 45¢. Now, we don’t know what the trader initially paid for those March 8 calls, but we can assume a chunk of the $1.5 million left over is profits.

Meanwhile, the trader still has plenty of skin in the game with the 20,000 June calls. This roll trade was likely a way to take some profits off the table while also buying about three months extra time. Presumably, this person or fund is still bullish on CCJ; otherwise, they would have closed the whole trade instead of rolling it out.

If CCJ still has upside after the big move this week, and this big roll trade suggests that’s the case, there’s still plenty of time to get into CCJ calls for cheap. Those June 10 calls only cost about 50¢, or you could buy March 10 calls for just 15¢ if you think the stock is going a lot higher sooner rather than later.

Jay Soloff is the Options Portfolio Manager at Investors Alley. He is the editor for Options Profit Engine, an investment advisory bringing you professional options trading strategies, with all the bells and whistles of Wall Street, but simplified so all you have to do is enter the trades with your broker.