While last week’s fundamental move swamped many COT-based signals there are still some viable trades, reports Andy Waldock.

It was quite a week in the markets. The Dow Jones futures dropped roughly 14%, more than 4,000 points! This type of volatility reveals two inherent issues we face when using the Commitment of Traders (COT) data. First, the data is a week old. Typically, the time lag isn't too difficult to overcome. We remind ourselves that we're focusing on the big picture of the interaction between commercial traders and speculators to determine fair value. When the markets get crazy, we need to monitor the action between these players more closely, which we are unable to accomplish with weekly data.

The second issue we face comes from using a pattern-based reversal setup. We track the markets for speculatively overbought or oversold prices conflicting with the commercial traders' forecast. Once we've identified a configuration, we wait for the market to reverse in commercial traders' forecasted direction.

Once we get the reversal, we enter the market in line with the commercial forecast and place a protective stop-loss order at the most recent extreme price. Typically, we expect to hold a position for two to five weeks, depending on market action. However, when volatility spikes, as it has this past week, it creates two problems with our methodology. First, the swing high or low becomes too far away to offer much protection. Secondly, when a large percentage of the forecasted move occurs during the week the signal is generated, it is likely to leave little on the table for the weeks to come.

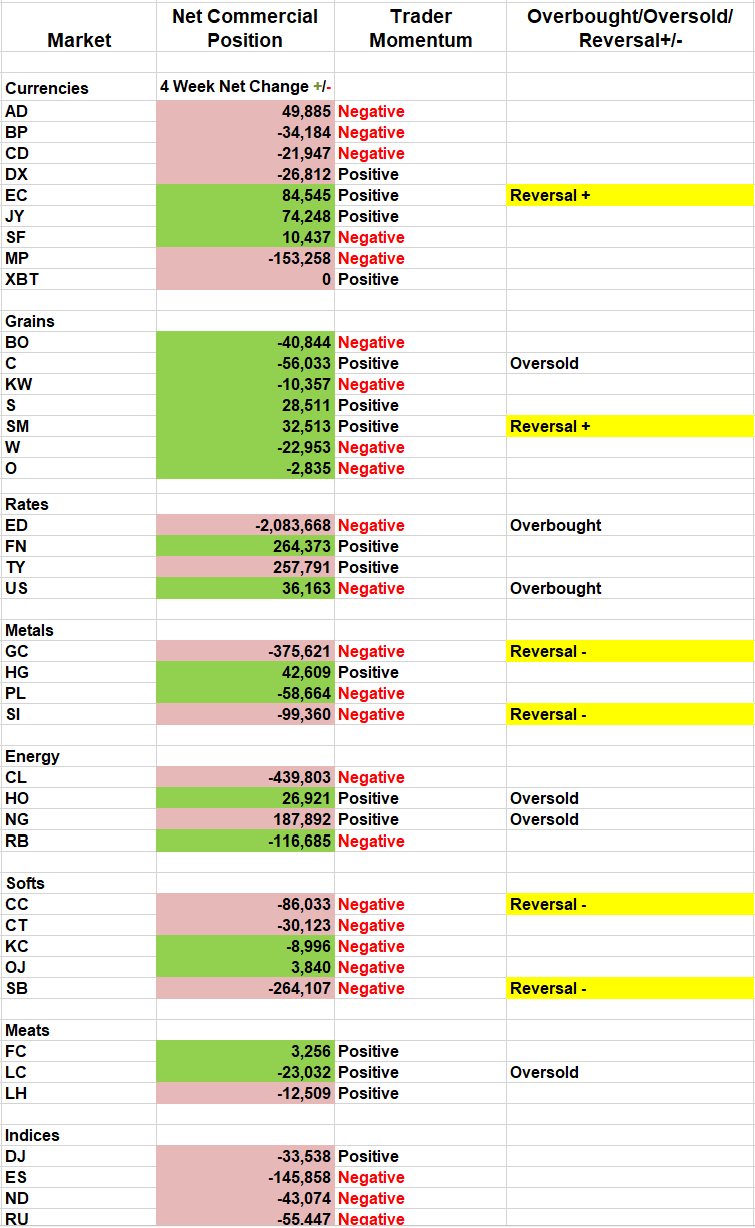

We'll walk this example through the silver market for further illustration. The silver market had built up considerable resistance around $19 per ounce. In fact, the commercial traders had built up their largest short position since April of 2017 (see table below). Clearly, silver miners were anxious to sell their forward production at $19 per ounce. Conversely, the large speculators were long 3:1, and the small speculators were long at nearly 5:1 as the market made one more attempt above $19. Obviously, the miners were correct, and prices fell by more than $2.50 per ounce last week.

Last week's COT letter noted that commercial momentum was negative, and the market was overbought. This satisfied our requirements for the setup. This week's letter shows that we're anticipating a reversal lower. The first problem is that our protective stop needs to be at last week's high. Last week's high is more than $12,500 away. That is too much risk. Secondly, silver fell by approximately 14% last week. It is unreasonable to extrapolate the previous week's action into the two- to five-bar move these setups usually forecast. Simply stated, the risk to reward ratio is no longer in our favor.

Many markets fit the scenario outlined above, but there is one signal on this week's list that seems reasonable. Let's look at the soybean market. May soybeans have fallen below $9 per bushel yet only fell nominally on the week. Soybean buyers have seen this as the critical level. They stepped up on December's decline, as well as the August and May declines last year. We have every reason to believe this continues and builds into an early spring bid.

The soybean meal market has been driven to oversold levels even as commercial traders increase the size and pace of their buying below $300 per ton. Last week, the soybean processors' net position grew to its largest size in more than a year (see table above) on a jump in purchases more than two standard deviations above their expected actions. This generated a higher close in soybean meal for the week and triggered a long entry with a protective sell stop placed at last week's low of $290.70 per ton, a risk of approximately $1,500 per contract. This is a much more manageable trade and keeps the risk to reward ratio in our favor.

View past letters on our site for free. Subscribe to follow along and receive stop levels plus additional commentary. Here is what Andy had to say about seasonality and the COT Report at the TradersEXPO New York. Visit Andy Waldock Trading to learn more. Register and see our daily and weekly signals archive for entries and stop loss levels sent to our subscribers.