Its too soon to say this massive sell-off is over, but it is not too soon to make plans for profiting from the aftermath, reports Joe Duarte.

In this market, there are three prime directives: capital preservation, preparation for the end of the correction and the deployment of cash into worthy stocks when the right time comes; whether it’s in three days or six months.

Although the present is daunting, and the worst may still be ahead, investors should consider the possibility that at some point the Coronavirus correction will end, that the seeds of the next rally – the Federal Reserve flooding the market with money via its recent rate cut and continuing QE may have already been planted - and that when the dust clears there will likely be a multitude of historical bargains to be had in the stocks of companies whose brands and business niches have been decimated by the recent selling spree.

Furthermore, if there are any positive surprises in the not too distant future, such as a quicker than expected vaccine or successful treatment for the virus, see Gilead Sciences (GILD) below, the odds of the bearish case disintegrating almost instantly are significantly better than even.

This is a Serious Situation

I don’t want to sound like, Chicken Little, Pollyanna or Goldie Locks, but there is no wrong in assessing the moment through clear eyes, nor in looking at the glass being half full, as history is full of examples of markets turning just as the end seemed near.

Of course, it’s obvious that the current situation is serious, and no one knows when things will improve. In fact, everything now is predictably unpredictable as we are in the midst of a cage fight between chaos and complexity. Paradoxically, chaos is a complete and unpredictable mess while complexity is a highly organized, rules based process within which systems function optimally based on the constant interaction and the feedback loop between the active agents in the system and the environment.

As a result, it’s important to understand the dominant features of the environment as well as the agents engaged in the daily activity of the system. Currently on the agent side we have the components of the complex adaptive system known as MEL, the Markets, the Economy, and Life (people’s financial decisions). On the environment side we have the Coronavirus.

That said, from an epidemiological point of view, it is reasonable to expect that what happened in China will be reproduced in the rest of the world and that the effects may be more dramatic as the virus grows exponentially for what could be an extended period of time. What that means is that as long as the viral footprint is increasing it will exert its chaotic influence on people’s lives, on businesses, and on political institutions such as the Federal Reserve, Congress, the White House and the entire U.S. and global healthcare, financial, and government systems. This, of course means that quarantines, business closures, and unfortunately increasing death tolls will likely be present for a while.

Moreover, the news will certainly be grim in many places and there are likely to be a great deal of permanent changes that emerge in all global systems, including MEL as the world adapts to a new reality. Specifically, alliances will shift, supply chains will be remade, and the likelihood of new pockets of leadership in high places in both governments and corporations will develop and which will reshape global events for the foreseeable future.

As investors, it is important to recognize that change is unfolding, and that adaptation will be the key to success. Thus, vigilance and agility will be the keys to survival. Here are several key points to consider:

- Stay patient

- Keep high levels of cash in reserve

- Develop and adjust your shopping list as events unfold

- Be prepared to deploy capital into your shopping list based on market conditions

- Be selective: Only deploy cash in the best possible trading opportunities

- Trade Small lots

- Use well placed sell stops (maximum draw down of 5-6%)

- Prepare for more volatility and the potential for any rally to be a false start

- Consider options where appropriate to minimize risk and to maximize profits but don’t overpay for contracts just to gamble and hope.

Finally, as I discuss below, if there is a positive announcement regarding a treatment or a vaccine for the Coronavirus the bearish case will likely crumble; perhaps instantly.

Gilead Sciences: Bright Light or False Hope

Shares of Gilead Sciences (GILD) a global biotech leader in combating viral diseases broke out convincingly on March 6, 2020 as the market is hoping that the company reports positive results on its ongoing phase 3 trials of its antiviral drug remdesivir. Clinical trials of remdesivir in the treatment of Coronavirus are being conducted in China by the Chinese government while global trial, including patients in the U.S. is being conducted by Gilead (see today’s post on GILD for more details).

Bond Yields and Market Breadth Collapse Simultaneously

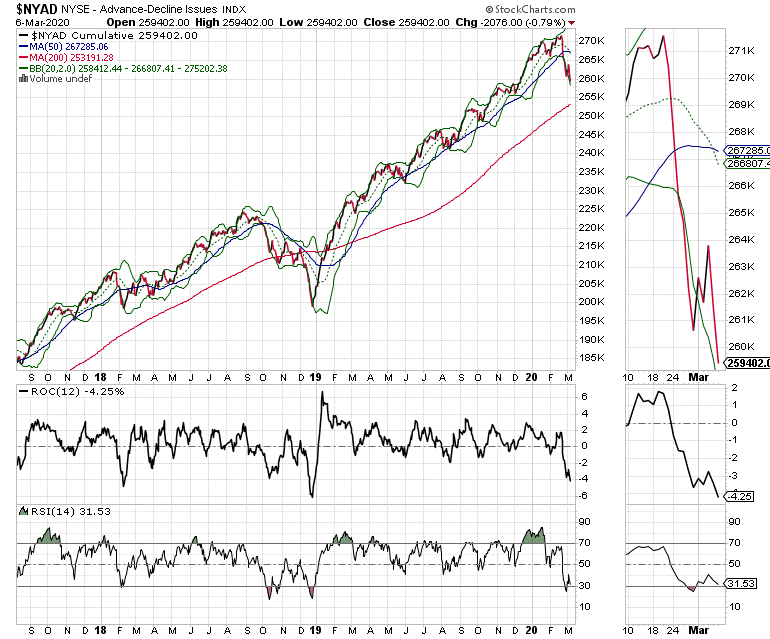

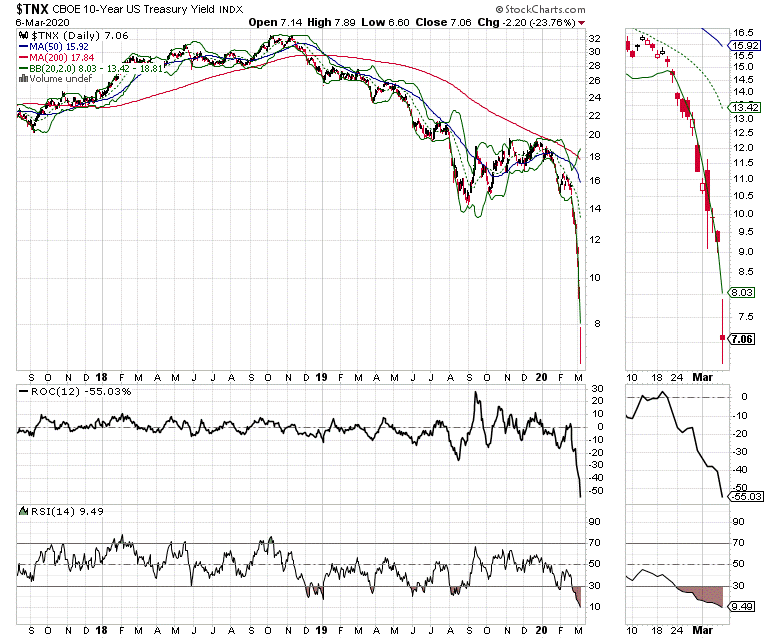

The U.S. 10-year Treasury note yield (TNX) and the New York Stock Exchange Advance Decline line (NYAD) are both in collapse mode as investors price in the potential for a significant global economic slowing and a subsequent decline in corporate earnings. The effects of this dramatic decline in yields on the mortgage and housing markets should be carefully monitored.

Indeed, the declines in both key benchmarks are impressive, they may still both fall further, although the declines seem to be overdone in the short term. Of the two, TNX is the most extended as measured by the extent it has traded outside of its lower Bollinger Band. On the other hand, NYAD still has room to fall, perhaps as low as its 200-day moving average.

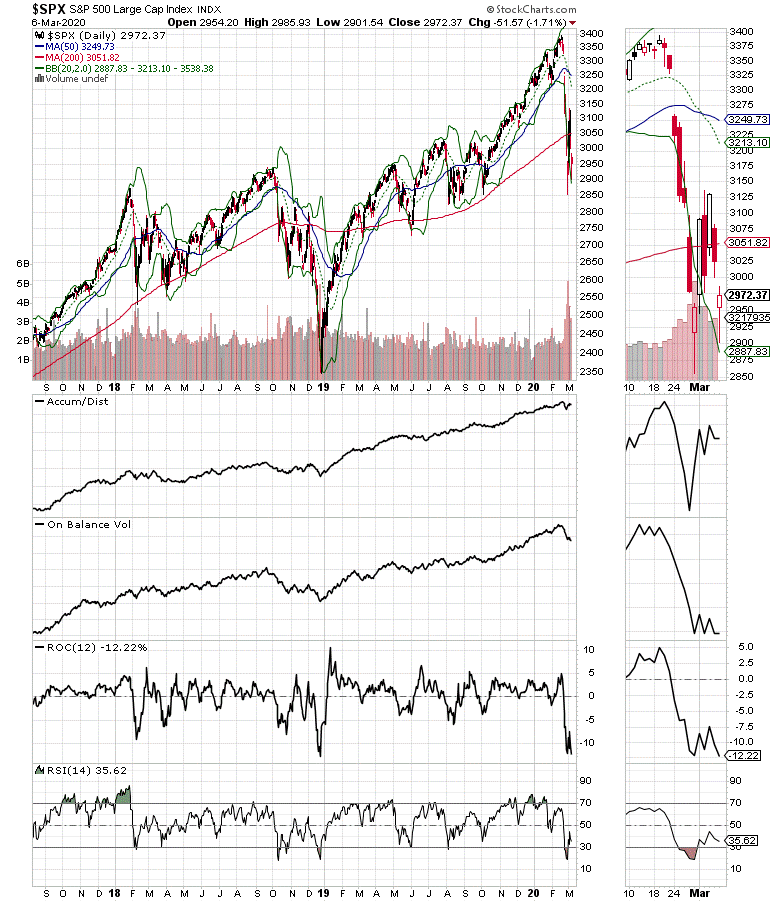

Meanwhile, the S&P 500 (SPX) has broken below its 200-day moving average, a very bearish sign, which if not reversed will signal the possibility of a bear market.

Finally, the Nasdaq 100 (NDX) index is not far from breaking below its 200-day moving average, which if it occurs would confirm the possible arrival of a bearish trend.

It’s Always Darkest before the Dawn

The current market is extremely challenging. As a result, it makes sense to keep up with developments, make a shopping list, follow a sound trading plan and stay patient. This market will eventually bottom and there will be many bargains to consider. All we can do is hope to stay healthy, stay awake and avoid foolish trading mistakes.

Disclosure: I own GILD as of this writing.

Joe Duarte is author of Trading Options for Dummies, and The Everything Guide to Investing in your 20s & 30s at Amazon. To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit here. I’ll have more for subscribers in this week’s Portfolio Summary. For a 30-day Free trial subscription go here. For more direction on managing the GILD trade, go here.

For a full review of how Complexity and Chaos work in the financial markets, how I predicted the current trading environment well before it started, and how to survive and thrive in it, check out my Orlando Money Show presentation: “ Trading at the Edge of Chaos