There is a myth that markets were healthy and strong prior to the Coronavirus pandemic and will simply return when it’s over. Mike Larson provides a reality check here.

To figure out where we’re going, you have to understand where we came from.

Many on Wall Street and in Washington still don’t grasp that concept. But as an investor, you don’t have to make that same mistake. And I’m going to do my best today to help you avoid doing so.

Let’s start with the conventional market narrative: That everything was “fine” until the Coronavirus struck. The economy was great. Growth was strong. The credit and stock markets were healthy. There were no bubbles anywhere. It was one big trip down Easy Street.

Federal Reserve Chairman Jay Powell recently reiterated that line of thinking when announcing another round of bailout programs. He said: “We entered this turbulent period on a strong economic footing, and that should help support the recovery ... In the meantime, we are using our tools to help build a bridge from the solid economic foundation on which we entered this crisis to a position of regained economic strength on the other side.”

Then there are the usual Wall Street types like Fundstrat research head Tom Lee and JPMorgan strategist Marko Kolanovic. The former recently said he’s looking for a V-shaped recovery to S&P 500 3,450 by year end, while the latter thinks we’re headed right back to record highs for the S&P in early 2021.

The unifying thread here? Again, that nothing was fundamentally wrong with the economy or the markets before the virus outbreak began.

But that’s just wrong. Dead wrong. There was evidence all over the place that the credit cycle was turning, and that many asset markets were starting to leak oil, long before the virus turmoil struck in February. All you had to do was pay attention!

Economic Indicators

Interest rates peaked and started falling in Q4 2018. The yield curve started flattening by the second-biggest margin in the last four, pre-recession cycles in 2018. Then it spent almost half a year in inverted territory in Q2 and Q3 2019.

Defensive, pre-recession stocks like utilities? They started outperforming in Q1 2018, while offensive, early-cycle sectors like financials, transports, and small caps started underperforming dramatically.

“Chaos Insurance” investments like gold and mining shares? They started outperforming the averages later that year.

Our proprietary Weiss Ratings BUY/SELL Ratio? The one that gauges breadth and the underlying health of the market topped out in early 2018.

In short, Pollyanna policymakers and perma-bulls on Wall Street can say whatever they want. They can claim everything was fine before the outbreak, that we’ll just get right back to rip-roaring action in stocks soon, and that you should be aggressive with your investments as a result.

But that’s not a scenario I’d recommend betting on as an investor. Especially when you take into account that advice has been dead wrong for a few years now!

Source: Weiss Ratings, April 14, 2020

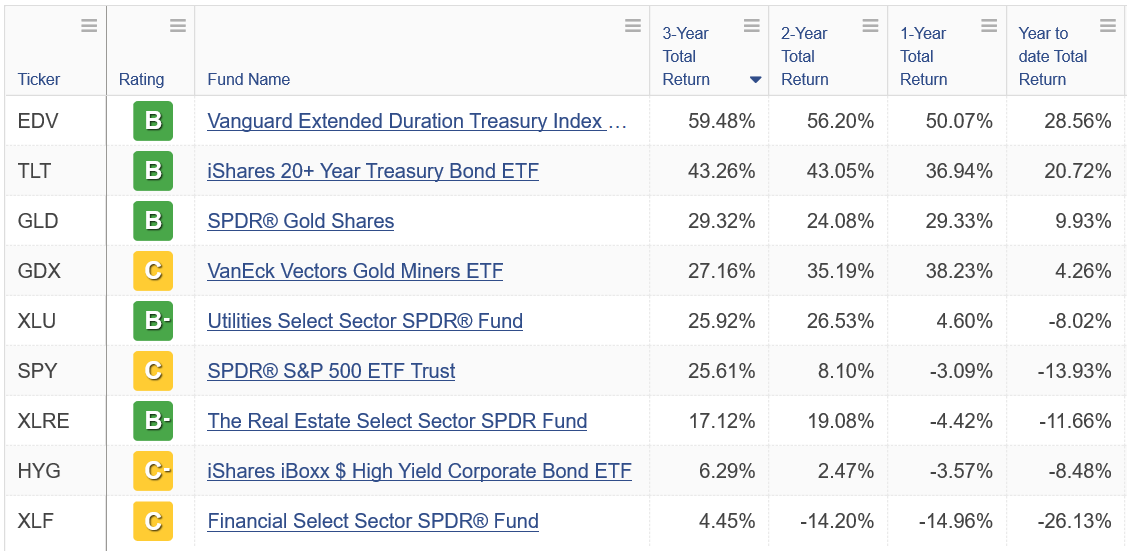

Just look at the data in my updated “Boring ETF screener.” If you had just bought plain vanilla U.S. Treasuries, as tracked by the iShares 20+ Year Treasury Bond ETF (TLT), you would’ve crushed the SPDR S&P 500 ETF Trust (SPY) 43% to 26% in the last three years.

If you had just bought the SPDR Gold Shares (GLD), you would have generated triple the return of the SPY over the last two years.

If you had bought the Utilities Select Sector SPDR Fund (XLU), you would have made about 5% in the last year even after the recent selloff. That compares to a 15% loss for a lousy sector ETF like the Financial Select Sector SPDR Fund (XLF).

None of us can go back in time and retroactively position for those gains. But that’s not the point of this exercise. It’s to show that a large performance gap was already building up before the virus hit. The outbreak has only (dramatically) amplified and accelerated that process.

That, in turn, has huge implications for this likely bear market rally – and the market outlook for the rest of 2020 and beyond. If our problems were truly all related to the virus, then all it would take is policy measures calibrated to combat its shorter-term effects to get us past them. The efforts so far by the Federal Reserve, Congress and the Treasury Department are designed mostly to do that.

But if I’m right and much more deep-seated, cycle-and-bubble-related problems are the real, underlying threats, then those policy measures won’t succeed over the long term. They’ll do what they’ve done already: Temporarily prop up asset prices and fuel a short-term relief rally. But they’ll ultimately fail to fix the markets or the economy longer term.

So, what’s the best course of action as an investor? Same as it has been for some time now.

Stay safe. Stay defensive. Own more gold, cash, and Treasuries than you used to. Sell junky bonds and bond funds. Don’t chase rallies for more than a short-term trade.

And finally, stay extremely selective and patient until bubble-era excesses have been more fully wrung out. Washington and Wall Street may not have recognized those problems before the recent turmoil, and they may still not be recognizing them after. But you don’t have to make that same mistake!

You can find some broad, big-picture guidance on how to do so here.

Or for more specific guidance and actionable recommendations, consider signing up for my Safe Money Report service. Subscribe to Weiss ratings' Safe Money Report here…