Despite the negative shock in crude, oil ETFs rebound; but SPY rebound stalls, reports Marvin Appel.

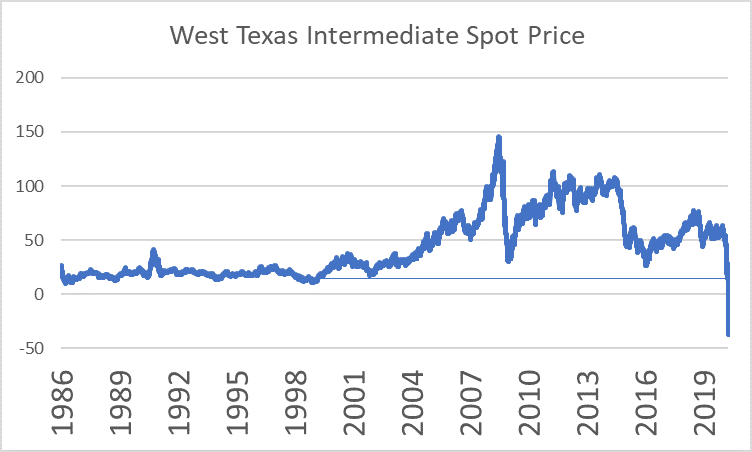

U.S. crude oil prices briefly turned negative on Monday, meaning that producers literally couldn’t give it away. That unusual situation has since rectified itself with a jump in oil prices today, but no matter how you look at it, oil prices remain very depressed and at their lowest levels since 1998 (see chart below).

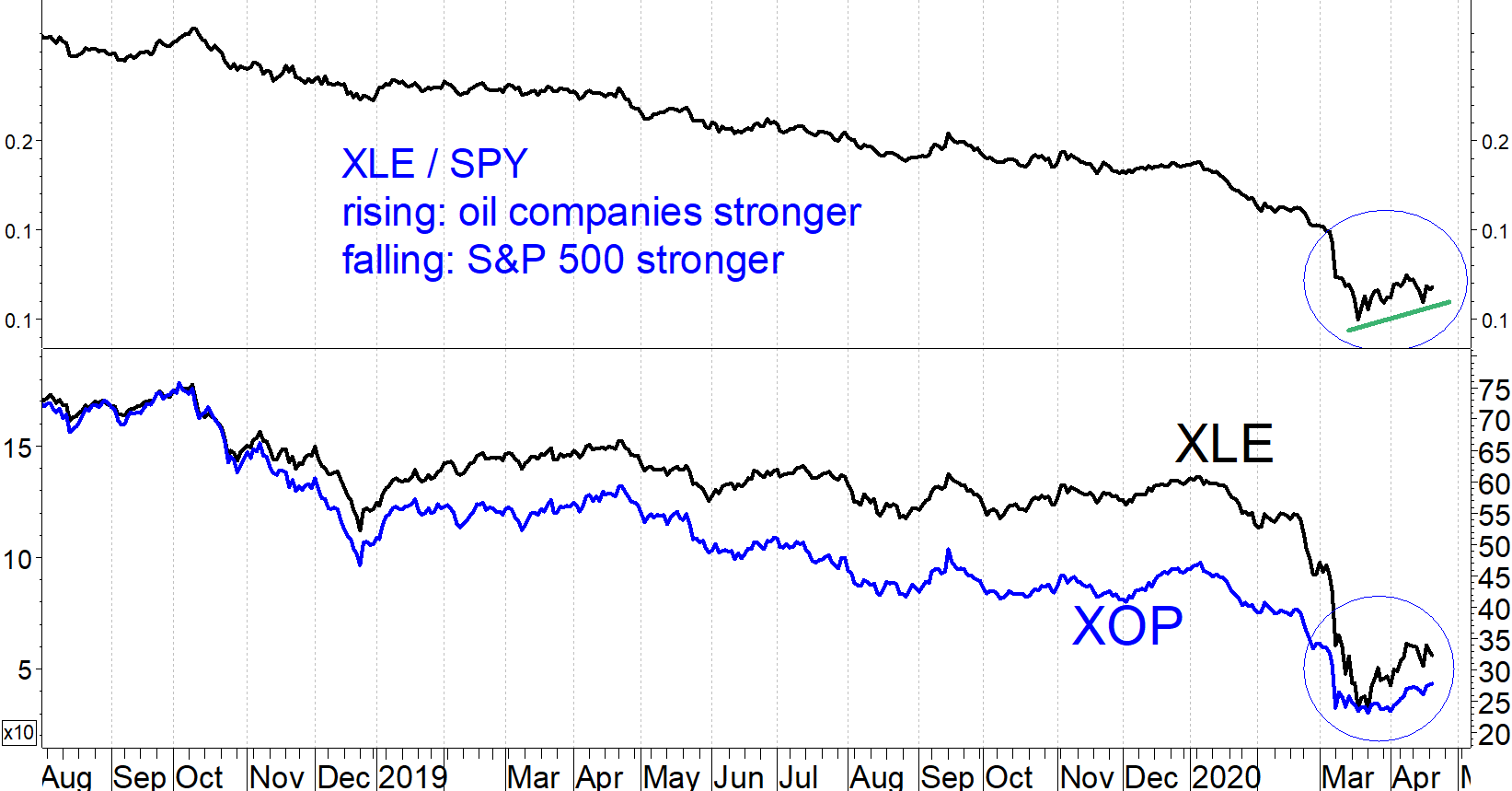

Fortunately, other areas of the stock market don’t seem overly concerned. Oil stocks themselves have already seen significant declines in 2020 but are not much worse for the wear this week. For example, the charts of the Energy Sector SPDR (XLE) and SPDR Oil and Gas Exploration and Production ETF (XOP) don’t show much shock about this week’s tumble in crude oil prices as both are in uptrends since March 23 (see chart below).

In fact, since the March 23 market low, XLE has outperformed the S&P 500 Index (circled in the top half of the chart to the left). On the other hand, high yield bonds are showing the strain of lower oil prices.

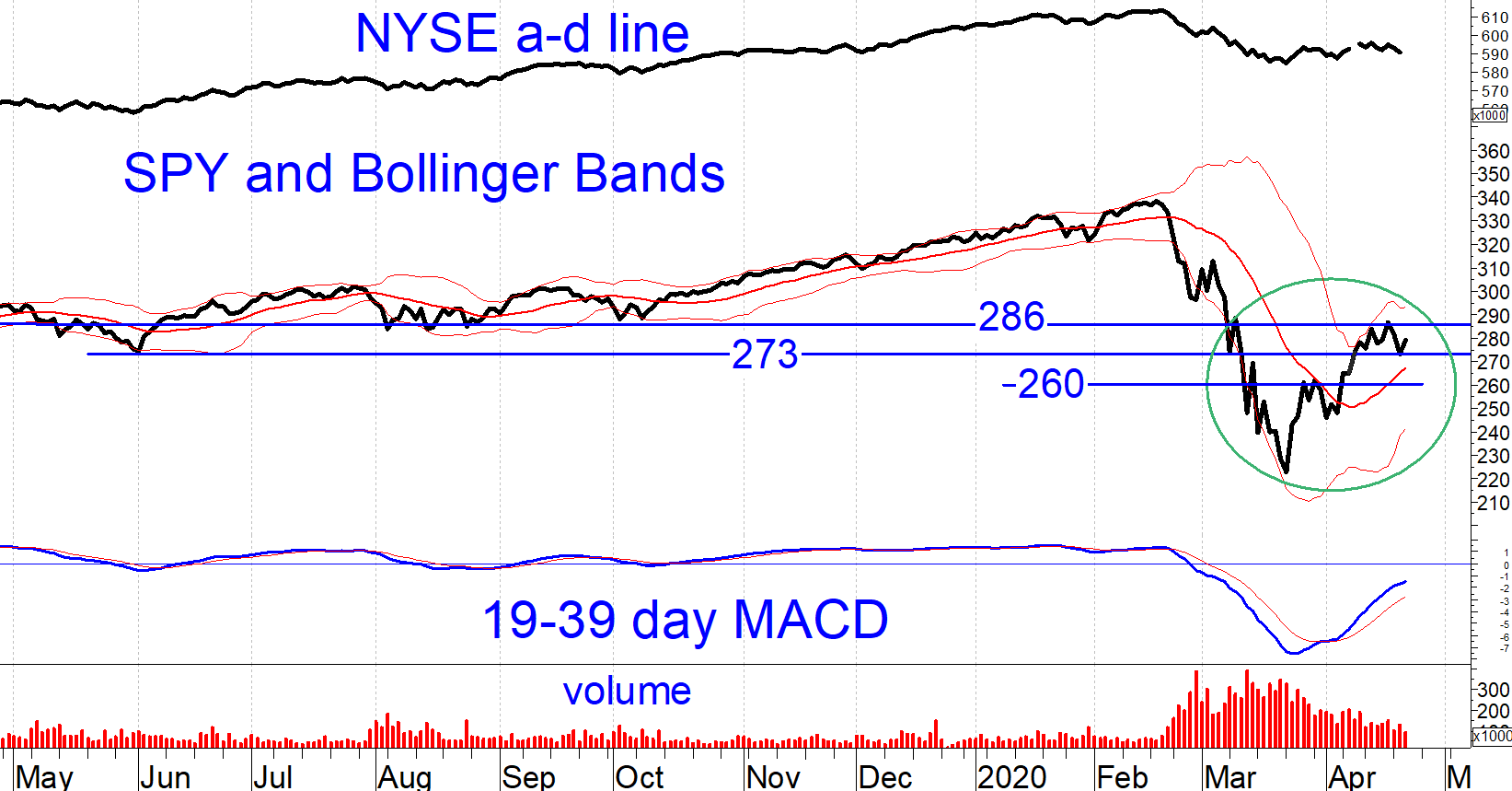

The broader stock market can’t seem to make up its mind. We saw the S&P 500 Index drop 3% on Tuesday, only to recapture three quarters of those losses on Wednesday. The S&P 500 SPDR (SPY) rallied further than I had expected, gaining almost 29% between March 23 and April 17. That is the largest bear market rally since the Great Depression.

This week that rally paused, stalled at the 286 resistance area defined by the August-October 2019 lows. For now, it appears that SPY will remain in a range of 260-286. The middle Bollinger band (now at 265) could be informative: is SPY spends most of the time between the middle and upper Bollinger band then the intermediate term uptrend that began on March 23 remains in effect.

However, I find it hard to dismiss the major hit to the economy that has occurred. Rather, I expect stocks to retest their March lows at some point in the next several months, either the March 31 low of 246 or the March 23 low of 223 (see chart below). This would be analogous to the March 2009 retest (a new low actually) of the November 2008 low or of the March 2003 retest of the October 2002 low. Although there continue to be favorable developments regarding the Coronavirus pandemic, we are far from out of the woods medically or economically. Caution remains warranted.

For those who want to take advantage of potential shorter term trading opportunities, covered call writing remains attractive. With the Cboe Volatility Index (VIX) above 40, one-month near-the-money SPY calls offer more than 10 points in time value (almost 4%), more than three times what has been normal in recent years.

Since 273 and 260 are potential support areas in the near term, traders could look to open covered call positions in SPY in the event of a pullback to 273; the premium you take in would cover most or all of the potential risk down to 260.

Again, however, there is nothing wrong with holding significant cash waiting for the economic situation to settle down. Doing that for our clients helps me sleep at night.