Jeff Greenblatt explores the impact of the historic crude oil move on markets.

I paid $1.79 for a gallon of gas at Walmart while at the same time a barrel of oil was selling for nothing. While we know there are 42 gallons in a barrel of oil, according to the U.S. Energy Department, petroleum refineries can produce about 20 gallons of motor gasoline from one barrel. It seemed like a bad deal. By that math I should have been paying about 9¢ per gallon and later in the day retailers should’ve been paying the consumer to fill up.

That’s the problem.

I overpaid and was glad to do it. On Monday afternoon, consumers were donating to their local gas station to keep them in business. Since then, I’ve listened to people from all walks of life discuss Monday’s historic day in crude oil. Some of the smartest oil people in the world aren’t sure what to make of it. With a glut of oil, one would think it would be easy to keep getting this ‘corona discount.’ But I’m not so sure. By now everyone knows the people still holding the front month May contract had to pay a big premium to rollover into June and late in the day they were willing to pay any price to get out of having to fill their swimming pool with oil.

Talk about supply chain disruptions, did anyone figure out they might hoard the oil the same way consumers do with toilet paper until the market stabilizes? Is it possible to have oil supply chain interruptions during the greatest supply in history?

I don’t see how anyone could stay in business with a barrel of oil trading less than the cost of a gallon. People are rightly concerned about the inverted yield curve, but we’ve never seen anything like this.

Peter Schiff was more colorful in describing the problem. Since oil was trading at nothing, it was the equivalent of garbage. You do have to pay the garbage man to come and take it away, don’t you? By the end of the day, the May contract was back near the origination point from Monday morning and the June contract picked up the next day not far from that. As of early Wednesday, it was around $14 a barrel. You must wonder how Fed Chair Powell pulled this little rabbit out of his hat.

The real concern is what comes next. Holders of the June contract must be a little nervous as it doesn’t yet appear demand is picking up anytime soon. Last week we talked about unintended consequences of shutting down the global economy. How about a glut of oil destroying the petrodollar relationship? The U.S. Dollar is not backed by anything other than the power of the Federal Reserve. The Fed’s relationship to the dollar is dependent on the fact countries around the world must convert their own currencies to Greenbacks to buy oil. What if foreign entities come to the same conclusion as Schiff, that oil is garbage? That would mean the U.S. dollar is the same. How long would it be before the U.S. dollar takes a more meaningful leap off that 144-month high we’ve talking about?

In 2019 the conversation was we knew there were problems. Think of everything we’ve gone through since the 2018 correction. We were lucky to get out of them all unscathed. Now whatever we were worried about is here and nothing could be ruled off the table anymore. If the greatest power the world has ever known can be flattened in less than 60 days, anything is possible. Including a major war in the Middle East.

I’m very concerned there could be supply chain disruptions in crude oil. Should we be concerned? After all, nobody is driving anyway. Nobody, except the truckers that bring food and toilet paper to your local market. Tyson announced they were closing a meat and pork processing plant in Iowa; they are not the only one.

Thus far the market has behaved incredibly well through this sequence of events. On Monday, markets had a chance to get crushed. Yeah, they were down but not like what happened last month. But they’ve been up on the hope the global economy would open soon. May 1 is a very pivotal day. A lot of people, politicians included, are looking to that day to get guidance about what will happen in May. There is a good chance the market already peaked from the March low. Sentiment is likely to shift one way or another by then. It does not appear the oil market would be able to withstand another episode, which is being called a ‘once in a lifetime’ event. If it were to happen again, next time it could be accompanied by food shortages and the market probably won’t react so tame again.

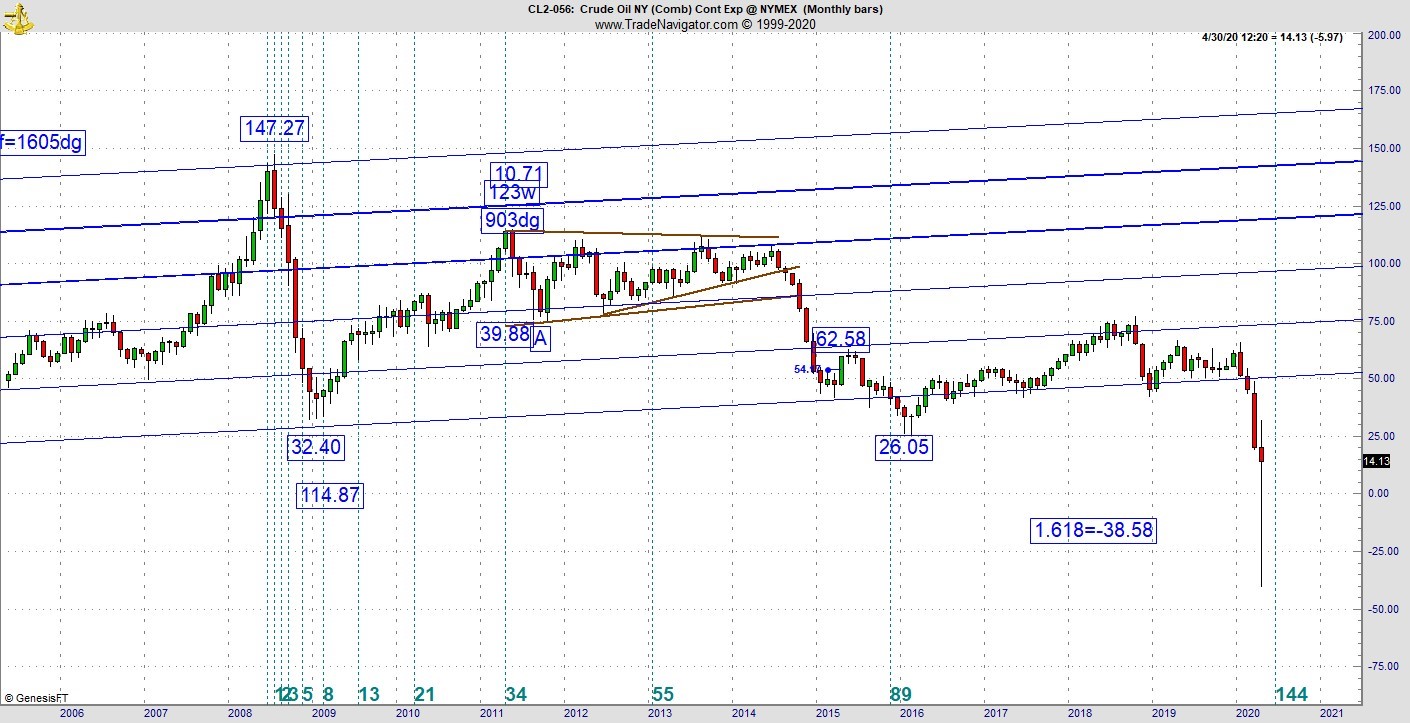

Let’s look at the long-term oil chart going back to the top in 2008 (see below). The drop to the $32.40 low has a range of $114.87. Now take 1.618 of that and the sum is $185.85. Now subtract that from $147.27 and the pattern comes to the -38 handle. The low is in a -$40 handle. Odds favor a once in a lifetime event, but you never know.

As far as trading these markets are concerned, it also appears we have entered a new phase. If you are trading intraday, you’ll know exactly what I mean. We know the Fed has given trillions to the banks to prop the market up. Lately markets have dropped during the day, but they haven’t gotten out of hand.

On the other side of the coin, there are also points in the day where it looks like markets can stage rallies like we’ve seen the past three weeks. Those aren’t happening either which can be frustrating to both sides. Unless something historic or catastrophic happens, we could be setting up to stay in a trading range that could last for a while. How long that “while” could be is unknown at this point but one indication is how much the quarantine restrictions will be lifted by May 1.

If you want more information, go to: Lucaswaveinternational.com and sign up for the free newsletter.