Raghav Mehta

Fidelity Canada

About Raghav

Raghav Mehta is responsible for communicating Fidelity Canada’s ETF product strategy, research, market insights, industry trends, and portfolio construction ideas for equities, fixed incomes, and alternative ETFs to clients, prospects, and industry experts across Canada. Mr. Mehta started his career trading bonds as a fixed-income trader. He worked in the global fixed-income sales & trading group at Scotiabank within Capital Markets. Mr. Mehta recently joined Fidelity Canada from SunGard, where he spent the last five years as a strategist in institutional sales and cross-asset trading. Before that role, he spent five years at Scotia and RBC Capital Markets as a fixed-income professional and global credit analyst. Mr. Mehta is focused on helping advisors, institutional clients, and investors understand how they could incorporate exchange-traded funds into their investment portfolios. He has his business degree from U of T and is a CFA charter holder.

Raghav's Videos

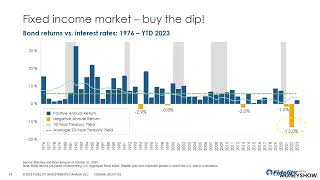

Raghav Mehta CFA, ETF strategist at Fidelity Investments Canada discusses upcoming opportunities in fixed income. With central banks nearing the end of rate hike cycles, bond investors had faced a challenging and volatile environment. With yields near decade highs, there are now various sectors of the bond market that investors should consider when building a well-diversified portfolio.

Raghav Mehta, ETF Strategist at Fidelity Investments Canada discusses the upcoming opportunities in fixed income. With global central banks embarking on simultaneous rate hike cycles, bond investors faced a challenging and volatile environment. With two consecutive years of negative returns for major bond indices and yields near decade highs, there are now various sectors of the bond market that investors should consider when building a well-diversified portfolio.