Equity and now corporate bond markets are being protected by the Fed, trade accordingly, notes Jeff Greenblatt.

Once again, the knight in shining armor Federal Reserve declared they would begin purchasing corporate bonds. This is already on top of purchasing exchange traded funds (ETFs) and everything else. The latest from Fed Chair Powell is they will move away from ETFs and concentrate on corporate bonds.

In any event, they’ve become the most powerful institution on the planet. They’ve become the buyer and seller of last and first resort. It’s simply breathtaking to see exactly what they have done. Do you remember when former Texas Governor Rick Perry said the Fed’s actions were treasonous? How about Ron and Rand Paul’s efforts to make the Fed more transparent by auditing them.

It’s never going to happen. For those who read G. Edward Griffin’s landmark book called The Creature from Jekyll Island, you already knew that. Now the Fed’s power is greater than ever. They’ve kept the market up since the seasonal change point in March. Can you believe three months has passed? Once again, it's time for a fresh seasonal change point as the calendar turns into summer. On the other side of the coin there is social unrest unlike anything America has seen in modern times.

My goal is not to provide social commentary but to tell you financial markets are allergic to social unrest. So, the Fed is the immovable object while cultural issues are the irresistible force. The irresistible force is usually driven by the mood of the crowd and history has shown us there will usually be unintended consequences.

So, of two choices, I always choose the third. Have you heard China, India, North Korea, Israel and Turkey could be on the cusp of regional wars? China and India already have casualties. It was none other than that elder statesman Dennis Rodman who told Piers Morgan concerning the mystery of Kim Jong Un, “I do have communications with North Korea, but I can say this, though: If you see his sister on TV, running the country, now you know something is wrong, that’s all I can tell you.” Sure enough, Kim Yo Jong took responsibility for blowing up a liaison office on the South Korean border.

The leader of Israel Bibi Netanyahu is on record as wanting to annex new territory in the West Bank and Turkey stated they will mobilize the Islamic world if such an event materializes. Why the hurry Mr. Netanyahu? He could be handicapping the U.S. election and may have already concluded President Trump will lose in November so if he is ever going to act, now is the time.

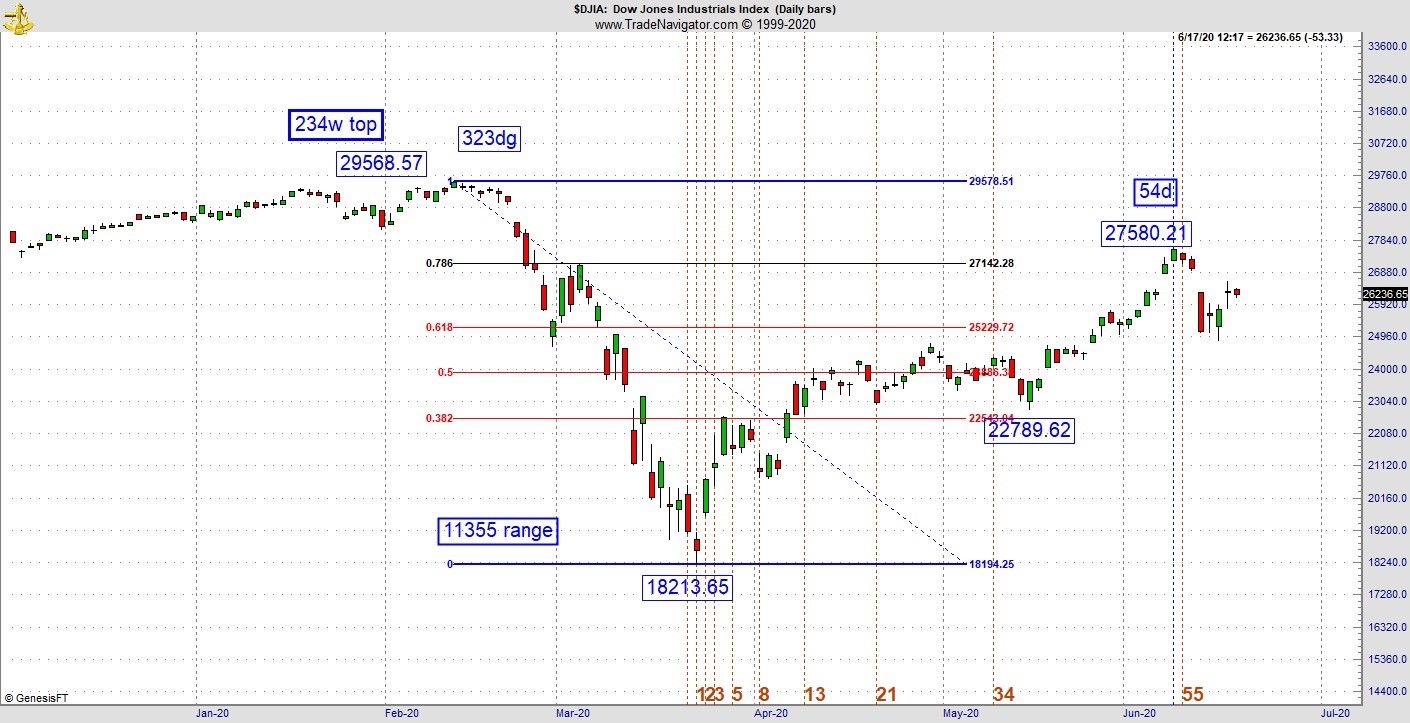

With all this going on, it's fair to say there is enough uncertainty to stall this amazing rally, even as it is completely Fed instigated. From recent posts we know the U.S. Dollar Index lost nearly 8% since the high in March but the anticipated bounce is underway. We also know the Dow had a range on the bear drop of 11355 and stalled at 54 days up.

Today I’m handicapping the drop and we see a decent Kairos reading on the intraday chart since the recent high and gap down. The recent drop is 2737.03 while the pushback is 1767.85. This secondary pivot works at a Kairos vibration of 66-30-minute bars which lines up with the 1767 (see chart below). Thus far it has gone sideways but started fading into the close. This is one of the most precise methods of selling a rally or buying a dip.

The reality of the situation has the action struggling to retake the gap down. As you can see there is also a gap up into that high.

Perhaps nothing better describes the overall situation then a chart that is trapped between two gap points. Even if we get the drop here, the next level of support for the Dow would be the May low which is about 3600 points south of here (see chart below). What I’m watching for is the activity around this seasonal change point which hits over the weekend. The market could accelerate one way or the other any time from Friday through next Tuesday.

In normal times, it would be impossible to be bullish in a market like this. Pundits like to tell us the market is climbing a wall of worry. This is not a wall of worry, it’s the plunge protection team on steroids. If you understand it, odds are low you’ll get hurt financially. This is a trading paradise. There are incredible intraday opportunities materializing on a regular basis. Those who bought this market should realize its more luck then skill but deserve credit for hanging on. The reality is one shouldn’t fight the power of the Fed and if that has been your basis for holding on, you’ve been rewarded for understanding how the game works.

Finally, in addition to the potential for regional wars breaking out, there is new fear of another wave of the virus. It will be very interesting to see if and how the Fed will be able to overcome this next sequence of events. It’s my view we’ll see some air come out of the balloon as the calendar pursues September which is the traditional graveyard for stocks.

If you want more information, go to: Lucaswaveinternational.com and sign up for the free newsletter.