Markets are at important historical inflection point, reports Jeff Greenblatt.

Those of you who’ve been following this post the past few years should recall I made several references to Lord Rothschild’s view the market had a 1937 feel to it; 1937 was a year those with eyes to see looked at the tea leaves and didn’t like what they saw. As far as I was concerned, I believed a top could’ve formed back in 2018 yet all we got was a fourth quarter correction that eventually recovered.

1939 was an ominous year. The world started facing up to the evil challenge of Nazi Germany. Now roughly 80 years later, the fourth turning is upon us. It's high time for another war/revolutionary cycle. The first six months of the year have been tough, many are wondering what the second half has in store. In the very least, there will be a historic Presidential election.

Reliable sources are suggesting the drums of war could be beating sooner as opposed to later. What does that mean to financial markets? In the very least, an updated view of our U.S. Dollar Index chart (below) shows continuation of what we’ve been discussing these past weeks.

+

+

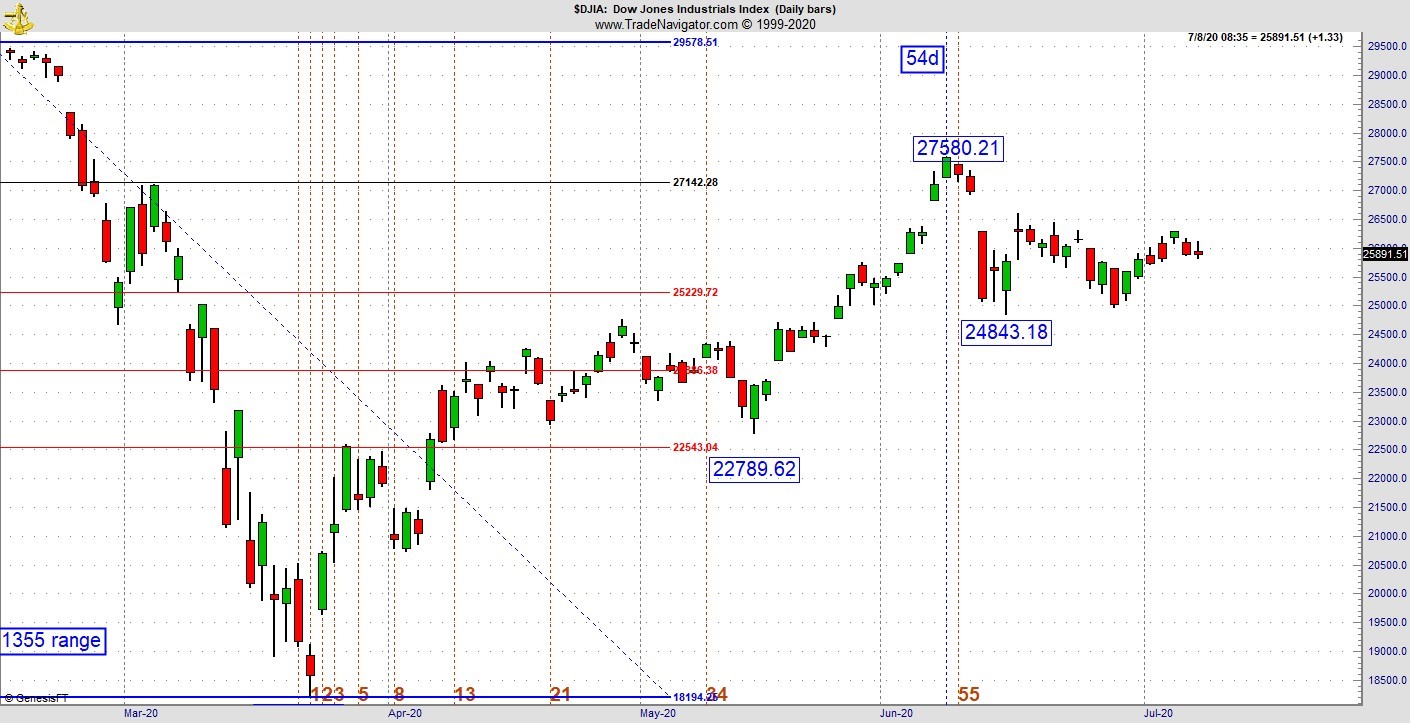

The Greenback held the downward sloping trend channel. The Kairos readings have stayed true to form. The challenge for traders and investors is deciding risk levels in a market filled potential minefields yet stays up because the Fed has become the ultimate backstop of last resort. The Dow Jones Index has settled into a trading range, which is not unusual for this time of year. Concerning the chart, this is a retest of the gap down on June 11 (see below). A failure here will erode half the gains from the move up from March. This is not a prediction but the logical conclusion for bears to either kick it into gear or give up for now.

The major news story of the week is the arrest of Ghislaine Maxwell and you may be wondering what on earth this would have to do with financial markets. On the surface, not much. But one must look deeper to connect the dots. It was Dave Hodges of the Commonsense Show who first reported Chinese warships were surrounding Taiwan and was confirmed on Sunday by Indian state media this was indeed the case. The West has done little to save Hong Kong. Geopolitical watchers are connecting the dots and believe Taiwan could be next. As far as Maxwell is concerned, Hodges also reported Chinese intelligence has a list of all those in the Epstein, Maxwell pedophile compromise network. Imagine the national security issues this could create. I’m not even going to speculate what could happen, but chances are good financial markets would plummet on any real confrontation over Taiwan.

World War II started because of the West’s appeasement of Hitler. He realized his enemies were weak. First, he gobbled up Austria then Neville Chamberlain handed him Czechoslovakia. Right now, China enacted a new national security law for Hong Kong, the West did nothing. China must view the chaos in the West as a sign of weakness. They could be banking on further appeasement concerning Taiwan. History could indeed be repeating itself.

As far as trading is concerned, this is one of the most challenging times in history. All many of us want to do is make a few bucks. To do that, one must have a particularly good method. You must know what your edge is. We’ve discussed chasing moves because we are afraid the train is leaving the station without us. That strategy rarely works as many breakouts either fail or retest and shake many out of their positions.

How do you transform yourself away from one who pulls the trigger when the move is more psychologically comfortable but a trap? Always remember he/she who gets in first ultimately has more staying power. If you chase and it comes back on you, that’s a recipe for being a deer in the headlights. In working with traders from all over the world for a dozen years I’ve noticed traders are more likely to roll the dice as opposed to treating each trade like a business venture.

When starting a business or any serious investment, one does a lot of due diligence. Traders don’t do that for a variety of reasons. First, many don’t exercise impulse control. One must overcome the emotional impulse to enter trades that are not in our best interests. If you seriously audit trades 20 at a time, you are likely to find a few where you can’t even explain to yourself why you were in it.

econdly, if you are using lagging indicators like MACD, stochastics and others, your faith is misplaced. Winning traders have trained their minds to understand the market at a deeper level and have also learned to control impulses. Instead of looking at the market like a robot, the best traders will understand trading is a zero-sum game. When you start to look at the patterns for the potential mistakes of others, that’s when you begin to tune into why some market moves are based on upward or downward pressure.

How to get there? There is a price to pay. Spending a season on a simulator gives developing traders an opportunity to not only test a method but also learn more about themselves. If you spend a month or two on a simulator you will learn a lot about the kinds of setups you are attracted to for the good and bad. You’ll have a chance to see how you psychologically deal with different market conditions from one day to the next. You’ll also have a chance to adjust without eroding the bankroll. Many successful traders blow at least two bankrolls before they finally succeed if they succeed. Working on a simulator allows one to hone their craft and at the same time transform from trading in the psychologically more comfortable places on the chart and get closer to the point where the risk/reward ratio is greatest. This is when we develop the brain to correctly identify opportunity for what it really is.

Larry Bird used to shoot a thousand shots every morning. He may or may not have realized that by developing the proper hand/eye coordination what he was really doing was developing the correct neuropaths in his brain. When the game was on the line, his brain kicked into gear because it already made that shot many times.

Obviously, trading on a simulator isn’t the same as using real money. However, it is the closest thing traders have for practice. When you recognize trading opportunities correctly, the brain is growing new neuropaths to repeat that process over and over.

If you want more information, go to: Lucaswaveinternational.com and sign up for the free newsletter.