Marvin Appel explains why U.S. Dollar weakness is a sign emerging markets are ready to soar.

In the mid-June report, I projected that fundamental forces including the aggressiveness of our own Federal Reserve compared to other central banks plus technical analysis both pointed to the likelihood of a decline in the U.S. dollar. That has come to pass.

The chart below shows the Invesco DB US Dollar Index Bullish Fund (UUP) since its 2007 inception (weekly). UUP had retested its high in the 27 area by the time of the stock market peak in February. Now UUP is more than 5% lower. The next area of potential support is in the 23-24 area, 6% to 10% below where UUP is trading now. The moving average convergence/divergence (MACD) indicator is oversold but has a way to go before reaching the extremes seen in 2009, 2011 or 2017.

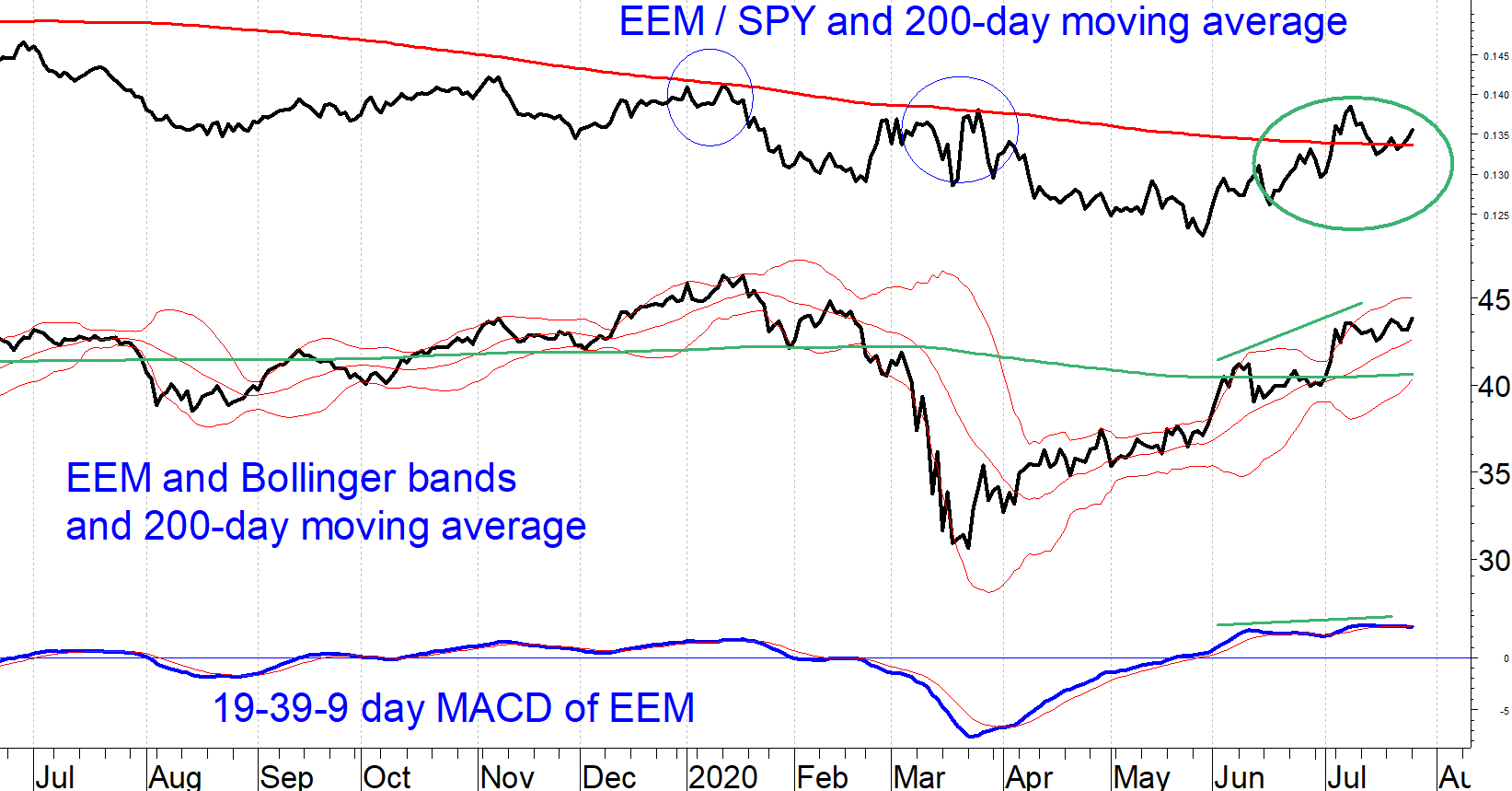

Weakness in the dollar spells potential opportunity in foreign stocks. Emerging markets look attractive now. Since the relative strength low of the iShares MSCI Emerging Markets ETF (EEM) compared to the SPDR S&P 500 ETF Trust (SPY) on May 28, EEM has gained more than 18% while SPY is up 7%. This is the best run of outperformance by emerging market stocks since early 2019 and is likely strong enough to shift our longer-term relative strength model to favor EEM over SPY.

The chart below shows the strong uptrend in EEM since March 23 and the strong outperformance relative to SPY since May 28. Unlike the case with SPY, MACD confirms the new price highs that EEM has made in July.

Implications—Time to overweight emerging markets

Our tactical model indicates that the EEM is likely to outperform SPY in the months to come if historical patterns hold true. Note that this change in our EEM/SPY model is not an equity buy signal. It is meant only to guide your asset allocation. If you follow the model you should shift some of your equity allocation from SPY to EEM.

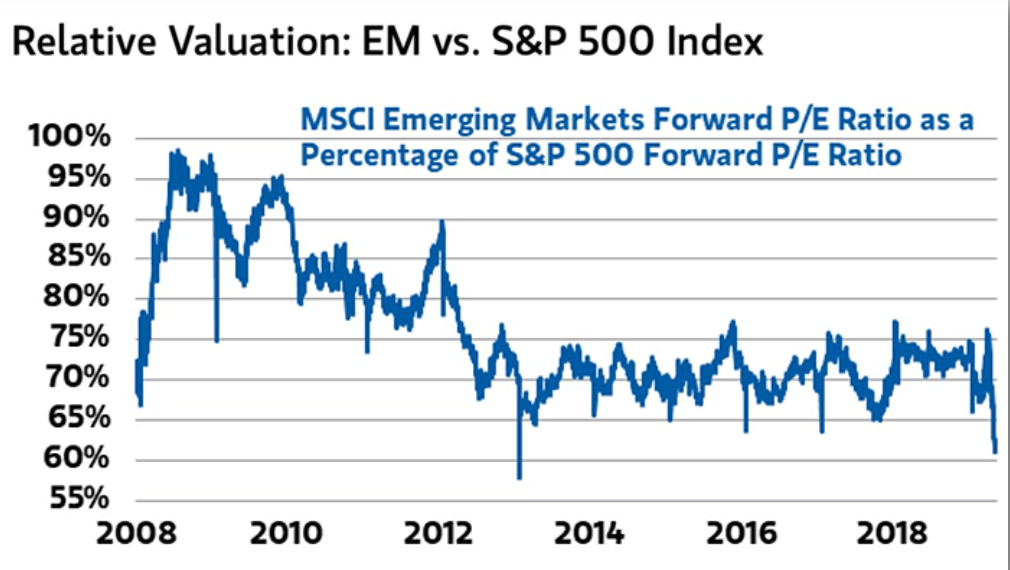

Emerging market valuations are favorable relative to S&P 500 valuations, as you can see in the chart below (which contains data as of April 20, 2020). However, the valuation advantage of emerging markets stocks is not new; the chart shows that the relationship between EEM and SPY valuations has been moving sideways for seven years, during which EEM lagged SPY.

Source: Isabelnet.com

The bottom line: This is a good time to increase the share of your equity exposure that you allocate to emerging markets.