Jeff Greenblatt highlights perilous times and its impact on U.S. Dollar.

No doubt about it, these are perilous times. Everything I’ve discussed in this space over the past couple of years is now coming to fruition. The question I ask myself everyday is how do I keep a cool head to trade successfully during the chaos?

To be frank, there are days when the news is overbearing that it is hard to trade. Even in good times, if you are going through an emotional crisis such as a divorce or death in the family, it’s probably best to take time off from trading. Some will advise its best to turn off the news altogether. I think there must be a balance to knowing what is going on and keeping enough peace to be able trade successfully. Professional athletes must be able to tune out situations that could affect their performance. Last week was an example of how even professional athletes have been impacted by news events and they almost sabotaged their livelihoods.

You know yourself and what you can handle. If the heat gets too hot, you need a break from the kitchen. If a news event makes you too emotional, either take a break from the news, or trading. The reason we are talking about this is being overly emotional makes one stupid and traders can’t afford emotional mistakes. In these times, there’s a fine line and a constant balancing act.

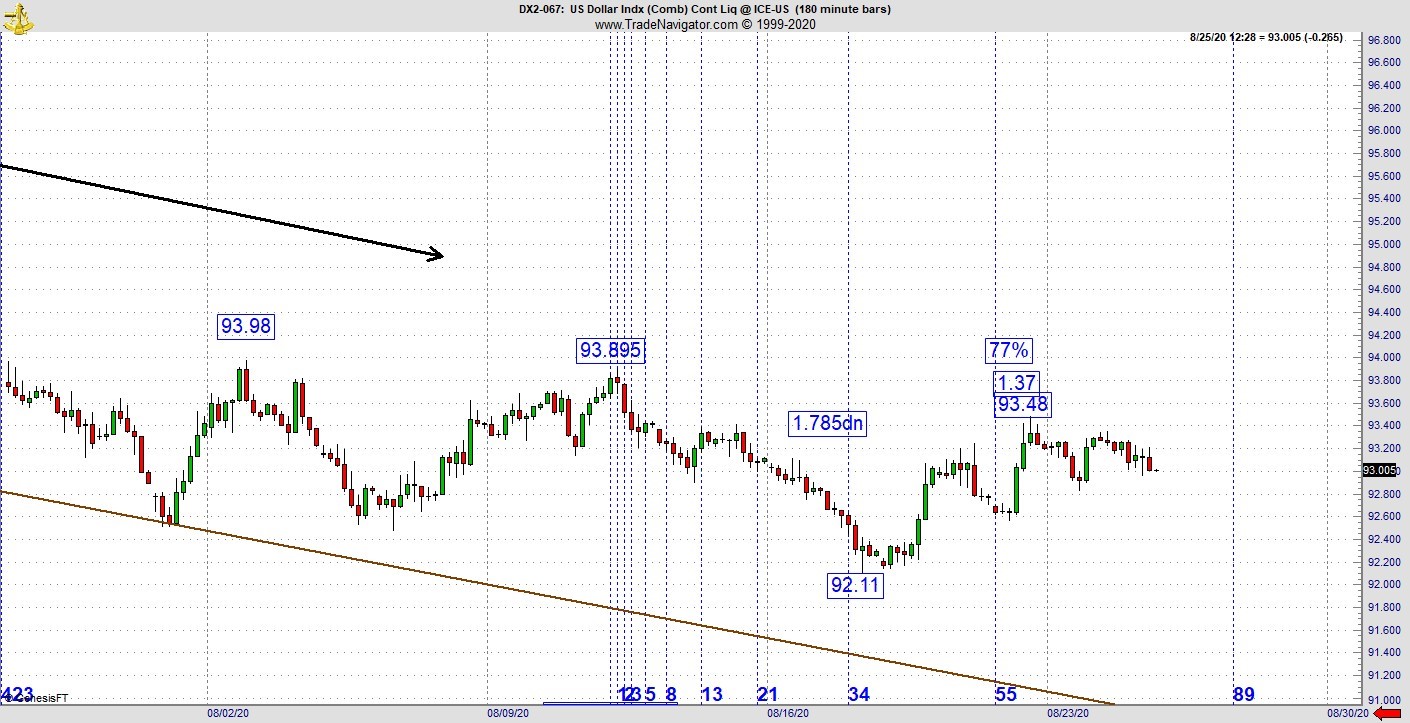

Of course, it helps to have a superior methodology, so you know what your edge is. W.D. Gann taught on price and time squaring 100 years ago. Nothing else comes close in terms of technical precision. We’ve been watching the U.S. Dollar Index closely. I’ve called out the most recent major symmetry and the action that has followed. Since the high pivot which was a 6.64-point difference in 64 days, the bearish action has been mitigated (see chart below). To be sure, there has been two new lower lows, but the action has turned from down to sideways. That still doesn’t mean there will be a major rally. In a better market, there would be a bear rally but to this point it hasn’t materialized. That’s not to say it won’t as over the years I’ve seen the dollar act like an oil tanker. It takes a lot to get it to reverse. The fact is the 64 vibrational setups has not led to a major drop, that could be bullish.

Ultimately, its going a lot lower. Why? Simply put, everything I’ve told you. The situation in Portland has the country on the edge of civil war. In Los Angeles, the county has terminated the parking lot lease of a church not adhering to social distancing restrictions. I bring this up because social mood is clearing sinking while the market sets new highs. Because the Federal Reserve has seen fit to prop up the stock market at all cost, I believe the greenback has now become a much better indication of the sinking social mood. If you are day trading, I’m sure you’ve found there have been days where it appeared like the market should drop but it didn’t.

Clearly, a hidden hand like the plunge protection team is at work. It appears they let it drop occasionally just to let a little air out of the bubble. Make no mistake, with tens of millions unemployed and New York becoming a ghost town, this is the biggest of the bubbles we’ve experienced since the 1990s. It’s completely artificial.

Finally, I want to show you how to combat all this insanity. Here’s another great example of how the Gann calendar recently worked on cocoa with before and after charts. At first you see the pivot forming as a result of a 42dg move on the Gann calendar clustering with a 41% retracement. This works because the distance from the 107dg day to 149dg on Aug. 21, so the Gann calendar lines up with the retracement value. Then you see the incredible leg up since that low. I’ve shown you other examples such as the Dow which continues higher based on its own Gann calendar relationships.

The stock market may be higher but eventually there will be another black swan event which will sink the indices, its not a matter of if but when. If I could tell you what that would be, I would but it’s beyond all our job descriptions. What I can tell you is election is likely to be a very emotional event which will likely impact all markets. Don’t trade when overly emotional but at the same time realize there will continue to be outstanding opportunities you should capitalize on if you know what your edge is and when it appears.

If you want more information, go to: Lucaswaveinternational.com and sign up for the free newsletter.