When markets really want to drop, there is no power on Earth capable of stopping it. Not even the Fed, writes Jeff Greenblatt.

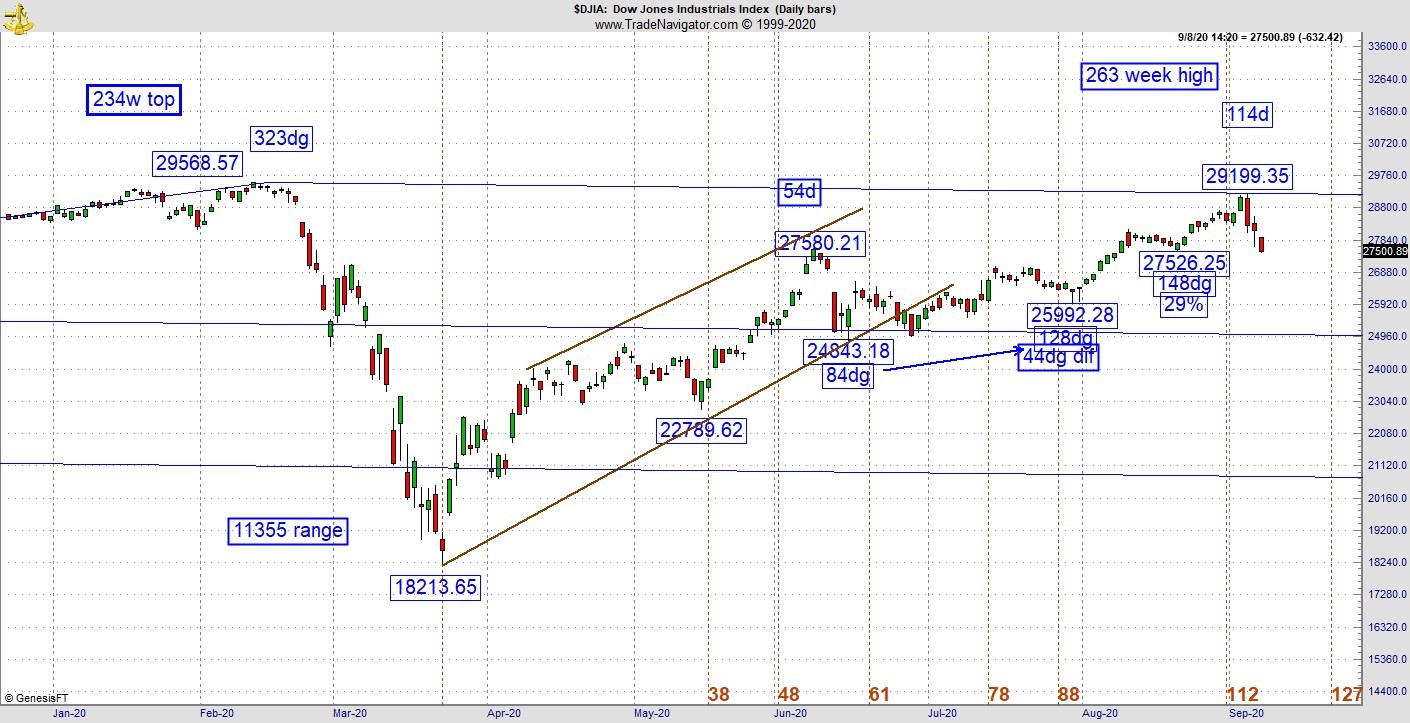

The long-awaited September swoon has begun. The Dow Jones Index has turned at 263 weeks from its low in 2015. For those of you who may not remember, the Dow bottomed nearly six months prior to the rest of the market which was in February 2016. Without setting a new high the Dow peaked earlier this year at 234 weeks (Fibonacci 233) from its bottom in 2015 and now looks like it wants to do it at the golden spiral back end of the 262-week window. As you look at the chart below, it doesn’t hurt there is a Kairos reading attached at 114 days up from a bottom at 18231.65.

Why is this happening now? My bottom-line answer is nature always takes its course and if there is a time of the year for markets to get hit, it’s always going to be September. But isn’t there a plunge protection team? Yes, there is but perhaps the powers that be see fit to let some air out of the bubble. Let’s put it another way, they seem to have a lot of control over propping up the market. They’ve done it this year at a record clip. But when markets really want to drop, there is no power on Earth capable of stopping it. Not even the Federal Reserve.

It shouldn’t surprise anyone the market is dropping. What is more of a surprise is they’ve been able to prop it all the way back up to the top of the range and in many cases beyond. This could be a case of nature taking its course and the Fed standing aside.

As many authors on this site have suggested, none of us have ever seen a market go up like this with the amount of problems plaguing the world and the economy. The closest comparison we have is 1942 where the United States was fighting both the Nazis and Imperial Japanese. We were on the ropes as Hitler’s army had already conquered most of Europe, was at the gates of Moscow and on the cusp of a victory in Egypt. Millions were dying in the concentration camps.

Why did that market turn? According to a Time magazine article in July 1942, the Germans had already maxed out their industrial capacity to produce armaments. As the Arsenal of Democracy, the United States was at roughly 25% to 30% of capacity. So, ask yourself how is it possible the market could be near highs with a country more divided now than at any time since the Civil War?

People are leaving major cities like New York and Los Angeles in record numbers. Most businesses except for the box stores seem to operate no better than 25% of capacity. The restaurant industry is on the ropes. The National Football League is about to start next week, and America will be treated to the spectacle of watching games in empty stadiums. We love sports because it is supposed to be a release from the stress of life. But for thousands of people who work at the stadiums or thrive because they have a business that is active during the game, it is a way to make a living and the losses are catastrophic.

I don’t see one reason the market should be anywhere near all-time highs with the exception of the Fed. One other author here suggested the market is like Wile E. Coyote. It’s already over the cliff but only starting to find out about it now. Let me be clear to suggest the real economy is worse now than it was either at the depths of the Great Depression or the wartime historic secondary bottom in 1942. We might not be there geopolitically at this point, but the situation is entirely different. This time we are not dealing with a foreign enemy although you could make a case for China. No, the enemy is us and we are tearing each other apart. As we hit the stretch run to the election, it’s bound to get a lot worse before it gets better.

Aside from the chart, there is another indication the market has started a correction. The action has picked up quite a bit. We might not be back in February when the Dow had many days of thousand-point losses and more, but risk has picked up. For those who trade intraday, we are once again seeing candles of 80-100 points on one-minute charts. Given August had some paint drying sequences, this is a wakeup call for traders to get it right.

You need a methodology you trust because by the time you figure out whether to take the trade or not, your stop loss might be twice the length you are accustomed to. Here’s a hint. Let’s say you know what you are doing. What you’ll find is in the instances that call for larger than usual stop loss points, you’ll also find those are the pivots that tend to bear fruit. This is truly a case of no pain, no gain. It’s something traders are going to have to deal with throughout this month. If you can’t stand the heat, you’ll have to get out of the kitchen. In any event, no trade will be better than a bad trade. For this next sequence, only trade what you would call your best-looking setups. If it’s questionable, pass. In a forgiving market, you might be able to get away with it but not now.

If you want more information, go to: Lucaswaveinternational.com and sign up for the free newsletter.