This is a follow-up cash-secured puts article to the one published last week where I detailed how I was selling deep OTM cash-secured puts on Apple Computer (AAPL) to generate weekly cash flow explains Alan Ellman of The Blue Collar Investor.

I was using strikes with deltas below -0.10%, approximating less than a 10% of ending in-the-money. My goal was to generate 0.4% five-day returns, 18%–19% annualized. This past week, I continued this approach but also was able to take advantage of exit strategy opportunities.

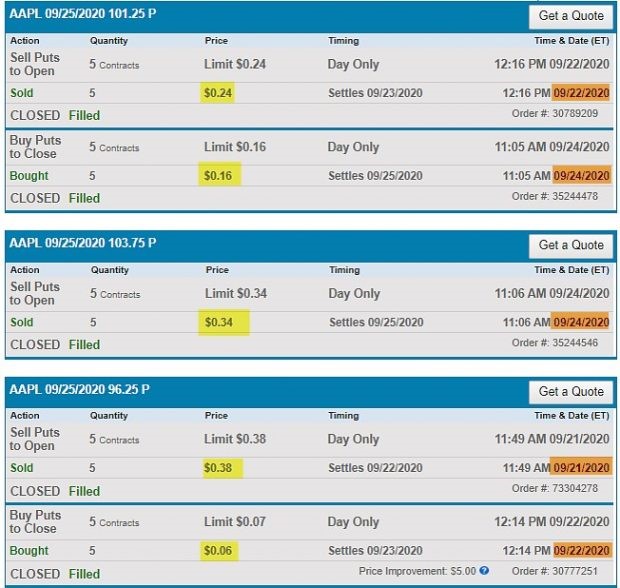

AAPL Trading Log from 9/21/2020 Through 9/25/2020 (Five contracts)

- 9/21/2020: AAPL trading at $106.60

- 9/21/2020: STO $96.25 put at $$0.38 per share

- 9/22/2020: BTC the $96.25 put at $0.06 (AAPL appreciated in price) per share

- 9/22/2020: STO the $101.25 put at $0.24 per share

- 9/24/2020: BTC the $101.25 put at $0.16 per share

- 9/24/2020: STO the $103.75 put at $0.34 per share

- 9/25/2020: BTC the $103.75 put at $0.02

***I took advantage of share appreciation such that I was able to generate additional time-value profit while still retaining options with deltas <-.10%.

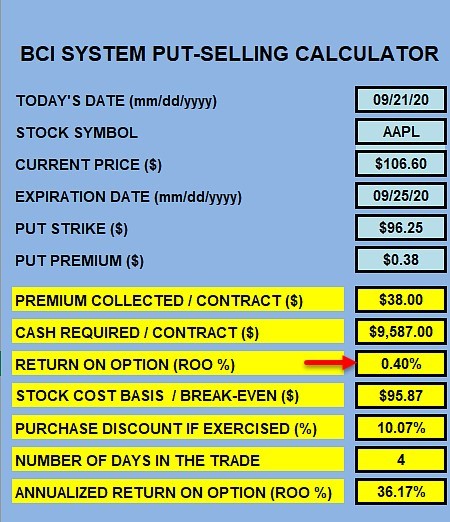

Initial Trade Structuring on 9/21/2020

AAPL Put Trade with the BCI Put Calculator

This meets our target of 0.4% five-day initial time-value return goal.

Brokerage Statement Showing Initial Trade with Exit Strategy Implementation

Brokerage Statement from 9/21/2020 – 9/25/2020

Four-Day Results

We will use a cost-basis of $103.41 per share ($51,705.00 for the five contracts) as this is the largest amount of cash required for all trades. Our option credits per share are $0.38, $0.24, and $0.34. Our option debits are $0.06 and $0.16 per share for a net option credit of $0.74 per share or $370.00 for the five contracts. On a cost-basis of $51,705.00, the four-day return is 0.72%, 34% for a 48-week (avoiding earnings weeks) annualized return.

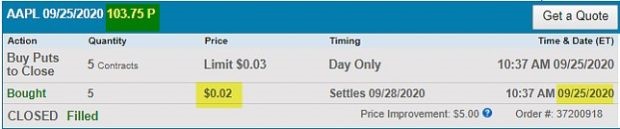

Final Trade of the Week: Five-Day Results

AAPL moved up early on expiration Friday driving down the ask price of the $103.75 put to $0.02. I closed all five contracts to lock in a final five-day profit of 0.70%, 33.4% annualized over 48 weeks. The screenshot shows this final trade of the week:

AAPL Put Final Trade of the Week

Discussion

Selling deep OTM cash-secured puts can generate significant annualized returns in a low-risk manner. Taking advantage of exit strategy opportunities will enhance returns to the highest possible levels. As always, we must be prepared with exit strategies if the trades turn against us.

Learn more about Alan Ellman on the Blue Collar Investor Website.