Even though most attention is currently focused on technology and biotech stocks, investors should not overlook quieter shares as part of a long-term portfolio, states Marvin Appel of Signalert Asset Management.

One easy way to gain exposure to large-cap stocks with below-average volatility is with the PowerShares S&P 500 Low Volatility ETF (SPLV).

This ETF has the 100 stocks in the S&P 500 with the lowest daily volatility over the past year, with each stock weighted inversely to its volatility. The ETF is rebalanced quarterly. Roughly half of SPLV is in healthcare and consumer staples. Compared to the S&P 500 (SPX), industrials are also overweighted in SPLV. Technology is significantly underweighted in SPLV, and consumer discretionary is also a significant underweight.

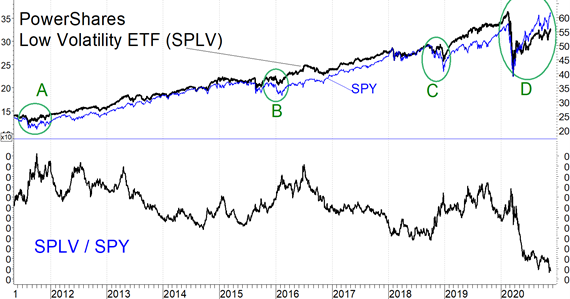

SPLV was launched in 2011. From then until early this year, SPLV and SPY had similar overall returns while SPLV had 20% less daily volatility and almost one third lower drawdown (12.5% for SPLV versus 19.3% for SPY between 5/11/11-2/13/20). The chart below of SPLV and SPY shows how SPY (in blue) suffered larger losses in the market corrections of 2011, 2015, and 2018 (circled A, B and C).

However, in 2020 SPLV has performed relatively poorly. It matched (actually slightly exceeded) the 34% drawdown in SPY and is still down year-to-date. (Circle D in the chart.) The underperformance of SPLV in 2020 has resulted in its greatest performance gap versus SPY since its 2011 inception, demonstrated by the SPLV/SPY ratio in the chart.

Implications

Lower-volatility stocks as a group have historically had superior risk-adjusted performance compared to SPY. With the prospect that a coronavirus vaccine will be widely available by the middle of 2021, I am hopeful that the dislocations that the pandemic have caused will correct themselves in the coming months. That outlook means that we should see the behavior of financial assets revert toward the mean, which would provide a tailwind for low-volatility stocks. I recommend SPLV as a long-term holding and as a tactical purchase until its relative strength catches back up with SPY.

To learn more about Marvin Appel, please visit Signal Alert Asset Management.