About Donald

Donald's Videos

In this presentation, Donald Dony will reveal two simple methods to outperform the Toronto Stock Exchange using the iShares S&P/TSX 60 (XIU). The first method enhances a time-tested strategy of moving average crossover. The second method uses the XIU and sectors. Donald will reveal a straightforward technique focused on buying only the sector ETFs outperforming the XIU.

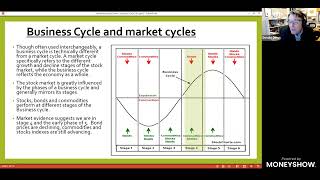

Donald will go through some key economic (GDP peaking, interest rates rising, unemployment) and market events (sector strength and weakness in certain industry groups) that are occurring at this time. He will also highlight events that normally take place in the next phase.

Newsletter Contributions

Technical Speculator

Straight forward, independent financial review of major world equity markets, commodities and currencies.

Learn More