When used correctly margin can be your best friend, but when used incorrectly it can be a disaster. Leverage is a double-edged sword and it can work for you, as well as against you. This is why I want to show you the responsible way to trade on margin, explains Markus Heitkoetter of Rockwell Trading.

What is Margin?

First off, what the heck is margin? Well, when opening a trading account, you can open a cash account or a margin account. What is the difference between the two? With a cash account, if you put $10,000 in, it means that you have $10,000 in buying power, meaning that you can buy stocks and options for $10,000.

Now, when you have a margin account, the difference is when you’re putting $10,000 in cash in there, the broker will actually lend you another $10,000. So in total, you’re getting $20,000 in buying power.

Buying Power: Stock vs Options

When it comes to buying power, there are two things that you need to know. First, there is buying power for options, and buying power for options is always non-leveraged. So, if you put $10,000 in cash, even in a margin account, it means that you have $10,000 in buying power for options. I’ll explain to you in a moment why that is.

And then we also have buying power for stocks, and this is where margin kicks in. So, $10,000 in cash will give you $20,000 in buying power for buying stocks.

There’s also something called portfolio margin, and we will talk about this in just a moment. First I want to show you exactly what it means here to have the buying power for options and to have the buying power for stocks.

How to Use Margin the Right Way

I want to give you a very specific example for Apple (AAPL), and we first want to look at what happens if you want to sell, while trading The Wheel. So let’s just say that you want to sell the 125 put for Apple. What does that mean? It means that if you’re selling the put, you might be forced to buy Apple at $125 a share, and for each put option that you’re selling, you would have to buy 100 shares of Apple. This means that you would have to bring $12,500 to the table per contract, right?

Now here’s the deal. When you’re selling options, the broker is already giving you a discount. So let’s see how much the broker is charging us if we want to sell a 125 put for Apple.

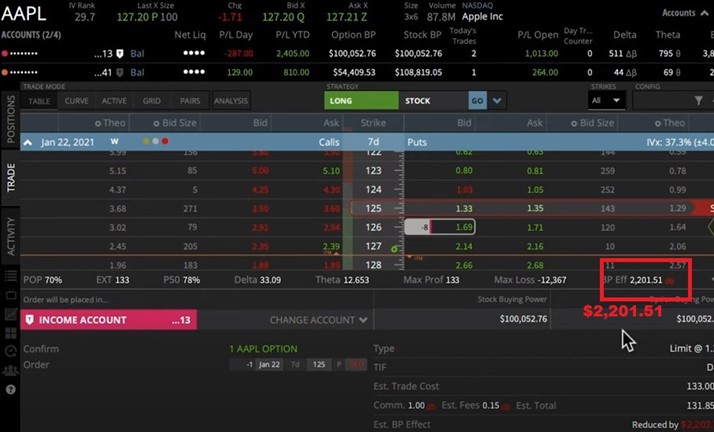

For Apple I’m just choosing next week’s expiration, because at this point, the expiration and the price don’t matter right now. All I want to show you is how much buying power is needed if I were to sell 1 put. So, as you can see, the buying power that will be reduced from your options is $2,202 (rounding up from $2,201.51).

As you can see, if you are buying Apple at 125, you would have to bring $12,500 to the table, but here the broker is only charging you $2,202. Now again, we want to assume a $10,000 account because this is what many people are starting with.

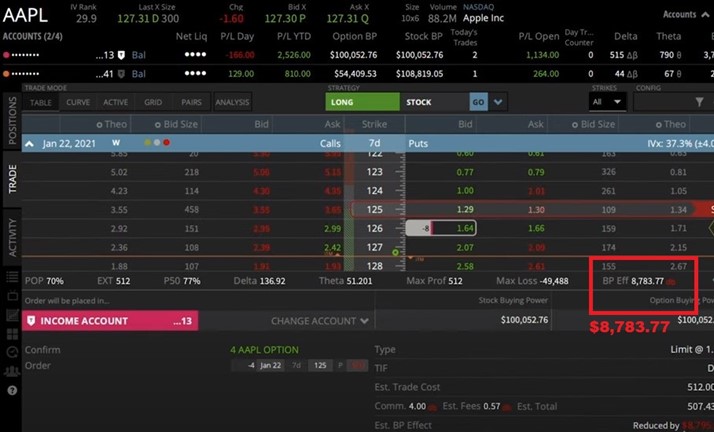

On a $10,000 account, theoretically, you could sell 4 of these options. If we are doing this, and edit our order to sell 4, we see that the broker will charge you $8,783. So on a $10,000 account, at first it seems that you have enough margin for this. Wrong! Don’t do that!

This is where we talk about the responsible way and the irresponsible way to do this. When you do this, this would be irresponsible. Here is what I think you should do. Remember, on a $10,000 account you’re actually getting $20,000 in buying power for buying stocks.

You have $20,000 for buying stocks, so if you are selling one option, and you would get assigned, then you would have to buy stocks for $12,500 and you still have $7,500 left, right? This is why you should only sell one option, even though your broker will only charge you $2,205, because if you’re assigned you would have to bring $12,500 to the table.

The good news is you have that, because the broker gave you $20,000 in buying power. This here is the right way to do this, and the right way means that you’re not over-leveraging yourself.

How to Use Margin the Wrong Way

Here’s what would have happened if you would have sold 4 options and got assigned. In this case, you would have to bring to the table 4 times $12,500, this is $50,000, but you only have $20,000 in buying power.

There’s a difference. If you take the $50,000 minus the $20,000 that you have in buying power you are $30,000 short, and these $30,000 become a so-called margin call. These are the dreaded margin calls that you sometimes hear traders talk about.

A margin call means that right now you have to wire the broker $30,000, which you probably don’t have, right? If you don’t do this, he will sell 300 of your shares.

You’re still technically fine if you have less than the $20,000. He probably sells a little bit less because he wants to make sure that you are just overcoming this shortage.

Portfolio Margin

There’s also portfolio margin. What the heck is the portfolio margin? Well, the portfolio margin is for bigger accounts, and when I say bigger accounts, it really depends on the broker. You see, some brokers request at least $100,000 in your account. Others request that you have at least $150,000 in your account, and some even request that you have $175,000 in your account.

It really depends on your broker. However, if you have the required minimum in the account, you can apply for portfolio margin. Why would someone be interested in doing this? Well, portfolio margin basically means, and again, it depends on the broker, that you are getting a 5:1 or a 6:1 leverage. It means that if you have let’s say $200,000 cash in an account, it becomes a million dollars in buying power. Depending on the broker, it could even become $1,250,000 in buying power.

So now you have a lot of buying power, and again, you have to use this responsibly. Just because the broker is giving it to you, you shouldn’t use it all. With this the same principles apply for me as if I were using a 2:1 margin account. I personally use this “excess buying power” when things go wrong, when I need to save a trade that is in trouble. This is when I have to fly a rescue mission.

Summary

First of all, it is super important that you understand what margin is, what buying power is, and then that you also understand that your broker is only charging you a small amount when you are selling options.

Don’t overleverage yourself, when you do this you’re getting the dreaded margin call. When you are getting the dreaded margin call you have to wire money into the account, pretty much right away, the broker usually gives you 24 hours.

Some brokers might be generous and give you 48 hours, but usually, it is within 24 hours. If you don’t wire the shortage to your broker, he will sell your shares until the margin requirement is met. So you lose full control and you don’t want to do this.

Learn more about Markus Heitkoetter at Rockwell Trading.