Why do 90% of traders lose money? You might have heard this, “90% of traders lose 90% of their money in the first 90 days of trading.” This is known as the 90/90/90 rule. I don’t even know if this is true, but it seems that a lot of traders are losing money, states Markus Heitkoetter of Rockwell Trading.

So today, we’re going to talk about what causes most traders to lose money. Then I’ll give you practical tips on how to avoid it so that you can be part of the few that actually make money with trading.

What Do You Need to Become a Successful Trader?

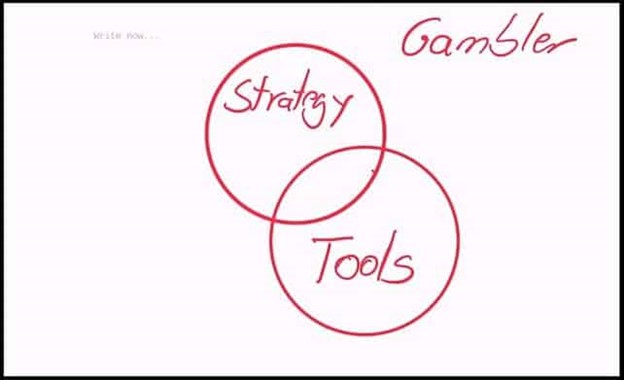

There are three things that you need to really become a successful trader. If you’re missing even one of these things, you already have a big problem.

The first thing, which is the most important thing that a trader needs, is a trading strategy.

Now, there are traders out there who are trading without a strategy, and the number one reason that I see traders fail is they don’t have a trading strategy.

A trading strategy tells you what to trade, when to enter, and when to exit. A trading strategy doesn’t have to be super complicated, but you need to know what to trade.

Here is what I see many traders doing since they don’t have a trading strategy. They are going for the flavor of the day. The flavor of the day might be something that Jim Cramer is saying, something that Cathie Wood, the famous, or infamous hedge fund manager of Ark Investments is saying, or maybe something that they read in the news.

This is the worst thing you can do. I’ve been talking a lot of people who are getting started in the market, and I ask them, “what are you trading right now?”

They usually just name the most popular stocks that are being traded. These are stocks like Tesla (TSLA), Apple (AAPL), Amazon (AMZN), and Netflix (NFLX). Then recently, with the Gamestop (GME) hype, a lot came up there.

If you’re not trading with a strategy, you’re not a trader, you’re a gambler.

The second important piece that you need as a trader is you need to have the right tools, and I can’t stress this enough.

Here’s the deal, if you want to compete in what they call the game of games, if you want to really make it as a trader, you need to have professional tools.

Think about it this way. If you only have a strategy without a tool, it’s like trying to win NASCAR riding on a llama. It doesn’t work this way. It’s super important that you have the right tools.

You can’t win a car race on a llama or on a donkey, you get the idea, right?

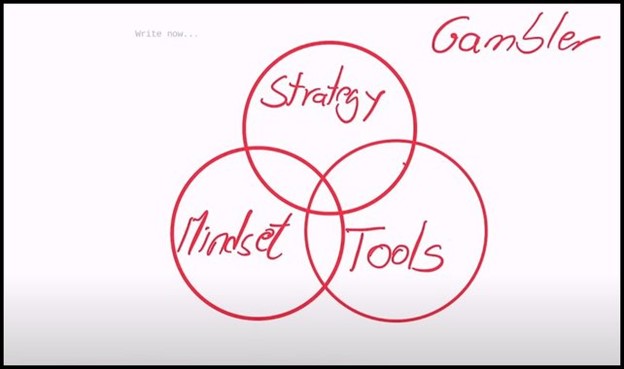

The third thing you need to be a successful trader is having the right mindset.

You can have the best strategy and the best tools, but if you don’t have the right mindset, you will lose money.

I see it all the time. Sometimes people think all they need is the right tool and they will be successful traders. Or they think all they need is a trading strategy and they will be a successful trader, but that’s not the case.

The reason why traders fail by not having the right mindset is because they let emotions get the best of them.

The two main emotions that we have as traders are greed and fear. We are greedy, we want to make money, and this is why we get into this game of trading in the first place. At least that’s why I started trading.

Then there’s also the fear, the fear of losing money, but you’ve got to be able to control these emotions.

One of the challenges, because of greed, traders will often trade too often, meaning that they are overtrading.

Have you ever been guilty of overtrading? It happened to me at the beginning of my trading career. I remember when I was still a young trader and new to the whole trading game somebody told me, “If you want to make it as a trader, you have to take at least 100 trades a day.”

This person was probably a broker because I tried this, and it is impossible. I traded on a one-minute chart trying to make 100 trades a day, and I found it just didn’t work this way.

Then there is revenge trading. Revenge trading is something that I did in the beginning. I thought after I took a loss it was time for me to make back the money that I lost.

Something important that you need to understand is that the market doesn’t owe you anything. Sometimes the markets give, and sometimes the markets take away.

This is why revenge trading is something that you need to avoid at all costs. The good news is, in the long run the market usually likes to give, at least to those who are serious.

You must understand that losses are part of our business as traders, and it is sometimes really easy to become overconfident.

However, whenever you think that you have the markets figured out, that’s when the market is going to throw you a curveball. There will be always surprises and situations that you have never encountered. Some call these black swan events.

Often what I see is that many traders who are new to trading simply focus on the wrong things. Most young or new traders focus mostly on the entry. They think if they can just time the entry, this is when they’ve figured it all out.

Well news flash, money is made and lost when you exit a trade. Timing the exits is almost more important than timing the entries.

Sometimes traders focus on just having a strategy with a high winning percentage, but this is another mistake. You don’t need a high winning percentage. In fact, you can make money with trading even if you’re wrong half of the time.

The magic happens when all three things are coming together. So how can you do this? I want to share with you what I’m doing.

First let’s talk about trading strategies.

Trading Strategies

First of all, what you need to understand is that there is no “best” trading strategy. It amuses me when people argue with me about this. People will ask me what will you do if this or that happens?

Well, this is where I’m not saying that you should trade my trading strategies. I show you what I personally do and how I’m making enough money to trade for income, to trade for a living, and let you make the decision if it’s right for you.

I can’t tell you if my strategies are right for you or not, but I can tell you there is no “best” trading strategy. Either a trading strategy is making money or it doesn’t, right?

I would never, ever criticize anyone who is making money with a trading strategy. Who am I to say you’re doing it wrong?

When it comes to the strategies I use, sometimes people ask me, “Why do you do it this way? Why don’t you do it the other way?” and I’ll be happy to explain to you why I do certain things.

It’s always interesting to see that some people feel that I need to become a better trader, and I appreciate your concern for me, but I’m actually doing pretty good.

A trading strategy must fit YOU. It must fit you in terms of capital requirements. There are some trading strategies that you can start with as little as $5,000, while others require more money. You need to make sure you have enough money.

The other thing might be time requirements. Some trading strategies require you to sit in front of the computer all day long. This is not for me, I personally like to watch the markets for 10 or 15 minutes before they open, and then for 30 minutes after they open. So personally, my own trading is usually just 45 minutes in the morning.

Now, fortunately, I don’t have a job, I have nothing else to do but watch the markets, this is why I do it. However, some of the trading strategies that I trade don’t require you to watch the markets at all.

So there are time requirements to consider, there are capital requirements to consider, and then also possible drawdowns you need to keep in mind.

Without risk, there’s no return. No risk, no reward. See, if you don’t want to take any risks at all, and make sure that you never, ever lose any money, then you should put your money into a savings account.

In a savings account your money will be safe, right? But it also earns only about a quarter percent right now. If you want to make more money with trading, then you have to risk some money.

There’s a fine line regarding the risk and rewards ratio. You need to be aware of the risk, and the more risks you’re willing to take, the higher the rewards will be.

Keep this in mind when you’re looking at a trading strategy: There are a few things where it might make sense for you to trade the strategy, or it might not make sense for you to trade the strategy.

The PowerX Strategy

There are two trading strategies that I like to trade, and the first strategy is the PowerX Strategy.

For the PowerX Strategy, there are a few criteria here according to whether or not it’s the “best” strategy.

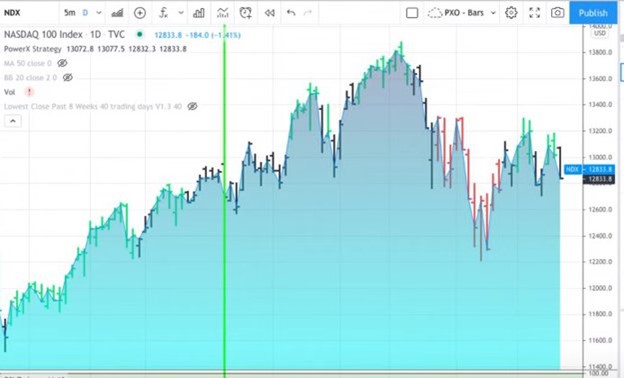

First of all, the PowerX Strategy is great for a trending market, and it doesn’t really matter if the market is trending up or down as long as it trends.

It does not perform well in a sideways or in a choppy market. This is what we are having right now, and this is why right now I am not trading the PowerX Strategy as much as I used to last year when we did have trending markets.

Now, trading with the PowerX Strategy requires a minimum of $5,000. If you have $5,000 to $10,000, that’s actually perfect to get started with this strategy. If you have less than this, I don’t think that this strategy is for you.

Honestly, I don’t know a trading strategy that you could trade with less than $5,000. This is where I’m not claiming that I have the best trading strategies. I have trading strategies that I personally have traded for many, many, many years that have stood the test of time and that are proven to make money, at least for me.

The PowerX Strategy is perfect for growing a small account, and here is why. With the PowerX Strategy you can apply money management, and money management is the turbo boost in your account. It can help you to take your trading to the next level.

In terms of time requirements, it takes around 15 minutes per day and you can do this while the markets are closed. If you have a demanding daytime job that doesn’t allow you to step away and look at the markets, then the PowerX Strategy is perfect for you.

Again, it does have some limitations, so it doesn’t work all the time. It’s important that you know when to use this strategy.

The Wheel Strategy

The other trading strategy that I like to trade is the Wheel Strategy. So the Wheel Strategy is perfect for a market that is going up, going sideways, even when it is choppy or when the market is slightly going down.

It is not good for a bear market where the market is going down.

You need to know when to apply what strategy. This is where, in the same way as you have multiple tools to fix the home, you need to have multiple trading strategies.

When you’re trading the Wheel Strategy, it’s an options trading strategy only. Here specifically, you are selling premium.

This is where you could have a large drawdown, which is possible if you’re stuck in a position as I am right now. I’m actually stuck in two positions.

Let me show you the two positions that I’m stuck in.

One of them is Apple, I bought it at 133. Right now it’s trading at 120, so I’m losing $13 per share that I own, and I own 800 shares. So the question is, are we in a bear market? No, we are not in a bear market right now. Not at all.

We are somewhat in correction territory, and correction territory is when a market is going from the top from the recent high to down more than 10%. That is how a correction is defined.

As you can see by looking at the Nasdaq, we’re clearly in a choppy market. Since the beginning of the year we have been grinding higher, coming back, going up, going sideways.

In fact, year to date, the Nasdaq is down .37%. So pretty much hasn’t moved since the beginning of the year, but we are not in a bear market.

You could have a large drawdown while you’re stuck in a position.

Let’s talk about the other position that I’m in.

The other position that I’m in is Lordstown Motors (RIDE), and RIDE is not doing well at all.

I’m flying a rescue mission here right now. I bought RIDE at 21.50, and right now it is trading at half of what I bought it for. Obviously, that’s not good at all, right?

What I need to do right now is work my breakeven all the way down by doing dollar-cost averaging.

I sold some more puts trying to bring down my cost basis from 21.50 to 18.70, then to 16. What I’m hoping for, and this is part of this strategy, is that I’m getting a quick bounce.

Now, absolute full disclaimer. What happened here with RIDE, to be honest, why I got into this is because I was getting greedy. I’ve been trading now for more than 20 years; even after this, I love money.

I saw a lot of premium on RIDE, and I got blinded by the premium. This could be the one trade out of close to 150 trades where I have to take a loss. It happens, losses are part of the business. Never let greed get into your way.

So you could have a large drawdown.

With this strategy you need a minimum of $10,000 in cash, and you have to put it into a margin account so that you get $20,000 in buying power. If you’re trading an IRA, you need at least $20,000 because in an IRA you don’t get any buying power.

Time requirements for this strategy is also about 15 to 30 minutes per day. I think the best time to trade this strategy is during the open, this means from 9:30 to 10:00 am Eastern Time.

If you have been following me for a while, then you know, I’m not standing here and telling you, “You have to trade this way. My trading strategies are the best.” I would never do this because they may, or may not fit your style, which is absolutely fine.

The Best Trading Tool, the PowerX Optimizer

However, if you choose to trade these trading strategies, this is where I believe that I have the best tool in the world. I’m absolutely biased, but the tool that I have here is the PowerX Optimizer.

I think that this is the absolute best tool for it because this software has been programmed for these two strategies specifically.

Now, if you look at any other tools, for example TradingView, it’s software with which you can do some backtesting and has a bunch of indicators built-in.

First of all, I feel this software is very complex to learn because you have multiple functions. And it basically allows you to trade any trading strategy whether you’re using a moving average strategy, a MACD strategy, or you’re using Bollinger bands.

But you see, especially with the PowerX Optimizer, it has been designed to support the PowerX and the Wheel Strategies.

This is where it shows you exactly the three things that you need to know when you have a strategy. It tells you exactly what to trade, it tells you exactly when to enter, and it tells you exactly when to exit.

I’m using this tool every day, and I wouldn’t want to trade without it. I want to be absolutely honest. If you would take PowerX Optimizer away from me, even though I know these two trading strategies inside out, it would be super difficult to find the best stocks to trade.

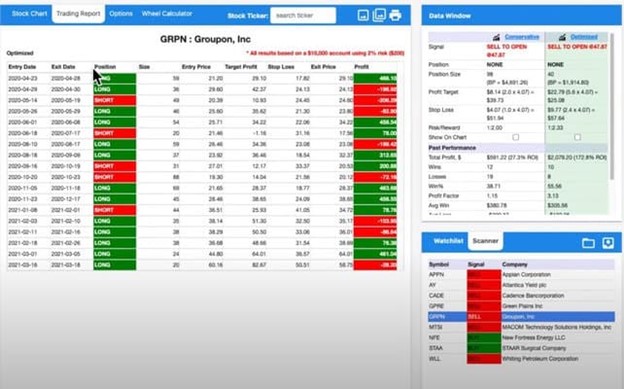

The other super important thing that PowerX Optimizer does is, it tells me what would have happened in the past if I had traded this particular stock group according to the rules of the PowerX Strategy.

This is important to me because it gives me more confidence. The trading report basically tells you if you had followed the rules of the PowerX Strategy, what would have happened over the past year if you had traded a stock.

If I look at the summary it shows me the ROI, how many winning trades and losing trades I would have had, what is the winning percentage, the profit factor, the average win and the average loss.

This here is based on a $10,000 account. If you have a $10,000 account, and your average loss is $122, you’ll be fine, right? You’re not wiping out your account.

What is important to me in a trading tool?

First of all, what I want to have is a powerful scanner, because a scanner tells me what to trade.

The second thing is I want to see what would have happened if I traded this stock with this strategy. This for me is super important.

Then, of course, I want to get all the important data for trading. This means I want to know how many stocks or options I should trade, when to enter, and when to exit.

These are the important things. This is, of course, combined with what can I expect from this trade. It’s so important that I also see the risk and reward ratio.

So here, for Groupon (GRPN) (pictured above), I can expect to risk a dollar trying to make $2.33. Now let me ask you, does this sound good? It sounds pretty good to me.

Learn more about Markus Heitkoetter at Rockwell Trading.