Julius Caesar failed to heed the famous warning to “beware the Ides of March” but investors have been served well when they have, notes Jeffrey Hirsch, seasonal timing expert and editor of Stock Trader's Almanac.

Tempestuous March markets tend to drive prices up early in the month and batter stocks at month end. Stock prices have a propensity to decline, sometimes rather precipitously, during the latter days of the month.

One sector that begins its seasonally favorable periods in March is utilities. Indeed, the utilities sector appears to be setting up for a new trade.

Last year Utilities had a great year, right up until early December. After reaching a peak in early December, Utilities quickly slide lower as interest rates began to move higher. From their peak in late November to the low in February, the sector shed 16.6%.

The sector is generally defensive in nature and does offer a relatively hefty dividend (3.55% as of February 27). This year could prove to be an interesting year for Utilities. If the 10-year Treasury yield does breakout above 3.04% and continue to climb, higher rates could pressure Utility shares.

However, if interest rates are rising because economic growth is accelerating, then the sector could benefit from the increased demand that could come from higher growth.

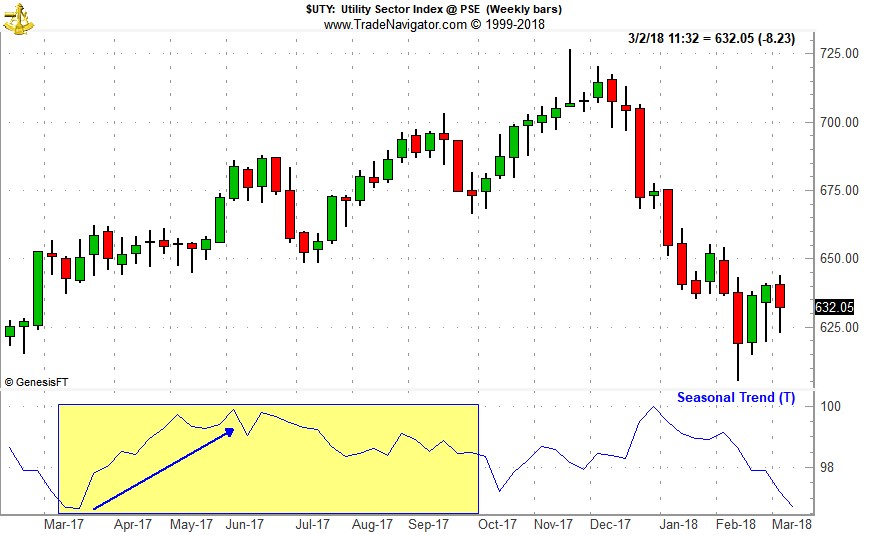

As can be seen in the following weekly bar chart of the Utility Sector Index (UTY), seasonal strength (lower pane, shaded in yellow) typically begins following an early March bottom and usually lasts through early October although the bulk of the move is typically done sometime in May or early June (blue arrow).

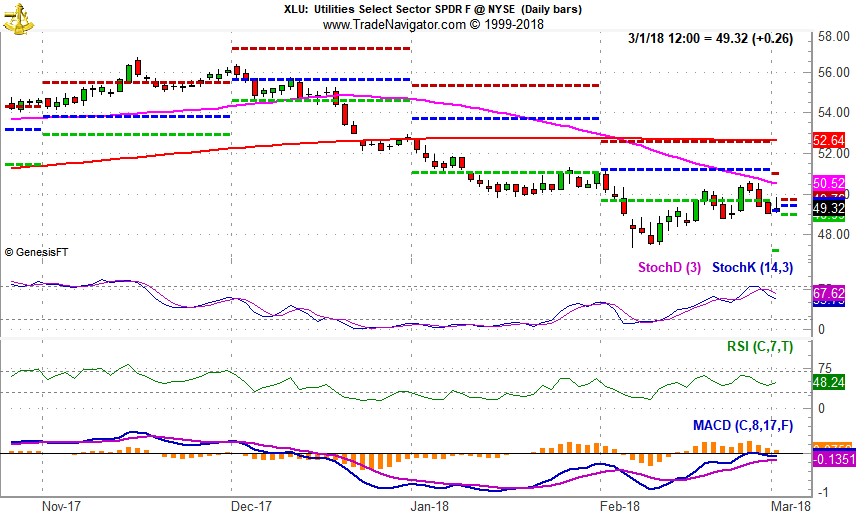

With nearly $7 billion in assets and ample average daily trading volume, SPDR Utilities (XLU) is a top choice to consider holding during Utilities seasonally favorable period.

It has a gross expense ratio of just 0.13%. Top five holdings include: NextEra Energy (NEE), Duke Energy (DUK), Dominion Energy (D), Southern Co. (SO) and Exelon Corp. (EXC).

XLU could be bought on dips below $49.20. This is just above its projected monthly support (green-dashed line in daily bar chart below).

Based upon its 15-year average return of 6.4% (excluding dividends and trading fees) during its favorable period mid-March to the beginning of October, an auto-sell price of $57.58 is set. If purchased an initial stop loss of $47.00 is suggested.